Global markets have been navigating a complex landscape, with U.S. stocks experiencing volatility amid competitive pressures in the AI sector and mixed corporate earnings reports. In such an environment, investors often seek out opportunities that combine affordability with growth potential, which is where penny stocks come into play. While the term may seem outdated, these lower-priced stocks can offer significant opportunities when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,727 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sivers Semiconductors (OM:SIVE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sivers Semiconductors AB (publ) develops, manufactures, and sells chips, components, modules, and subsystems across North America, Europe, and Asia with a market cap of approximately SEK743.83 million.

Operations: The company generates revenue from two main segments: Wireless, contributing SEK158.18 million, and Photonics, adding SEK82.75 million.

Market Cap: SEK743.83M

Sivers Semiconductors, with a market cap of approximately SEK743.83 million, operates in the semiconductor sector with revenue streams from Wireless (SEK158.18 million) and Photonics (SEK82.75 million). Despite its unprofitability and volatile share price, recent strategic partnerships and contracts highlight potential growth avenues. Notably, Sivers secured significant contracts under the U.S. CHIPS Act for RF technology development with industry leaders like BAE Systems and Raytheon, alongside a major telecom chip development program valued at $5.4 million through 2026. These initiatives could bolster its financial position despite current challenges such as limited cash runway and negative equity returns.

- Click to explore a detailed breakdown of our findings in Sivers Semiconductors' financial health report.

- Gain insights into Sivers Semiconductors' future direction by reviewing our growth report.

Sino ICT Holdings (SEHK:365)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino ICT Holdings Limited is an investment holding company that manufactures and sells surface mount technology and semiconductor equipment in the People’s Republic of China and Hong Kong, with a market cap of HK$346.29 million.

Operations: The company generates revenue primarily from the production and sales of industrial products, amounting to HK$222.41 million.

Market Cap: HK$346.29M

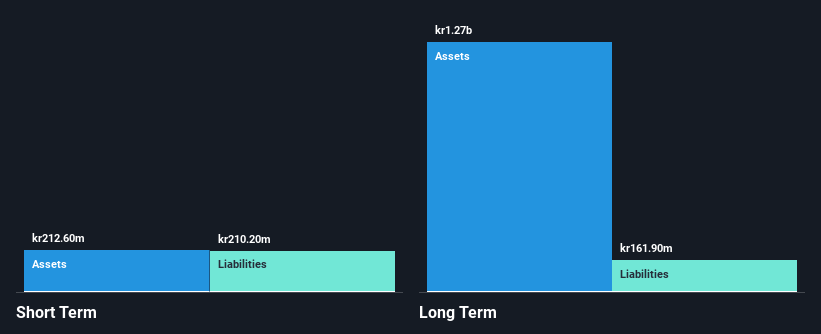

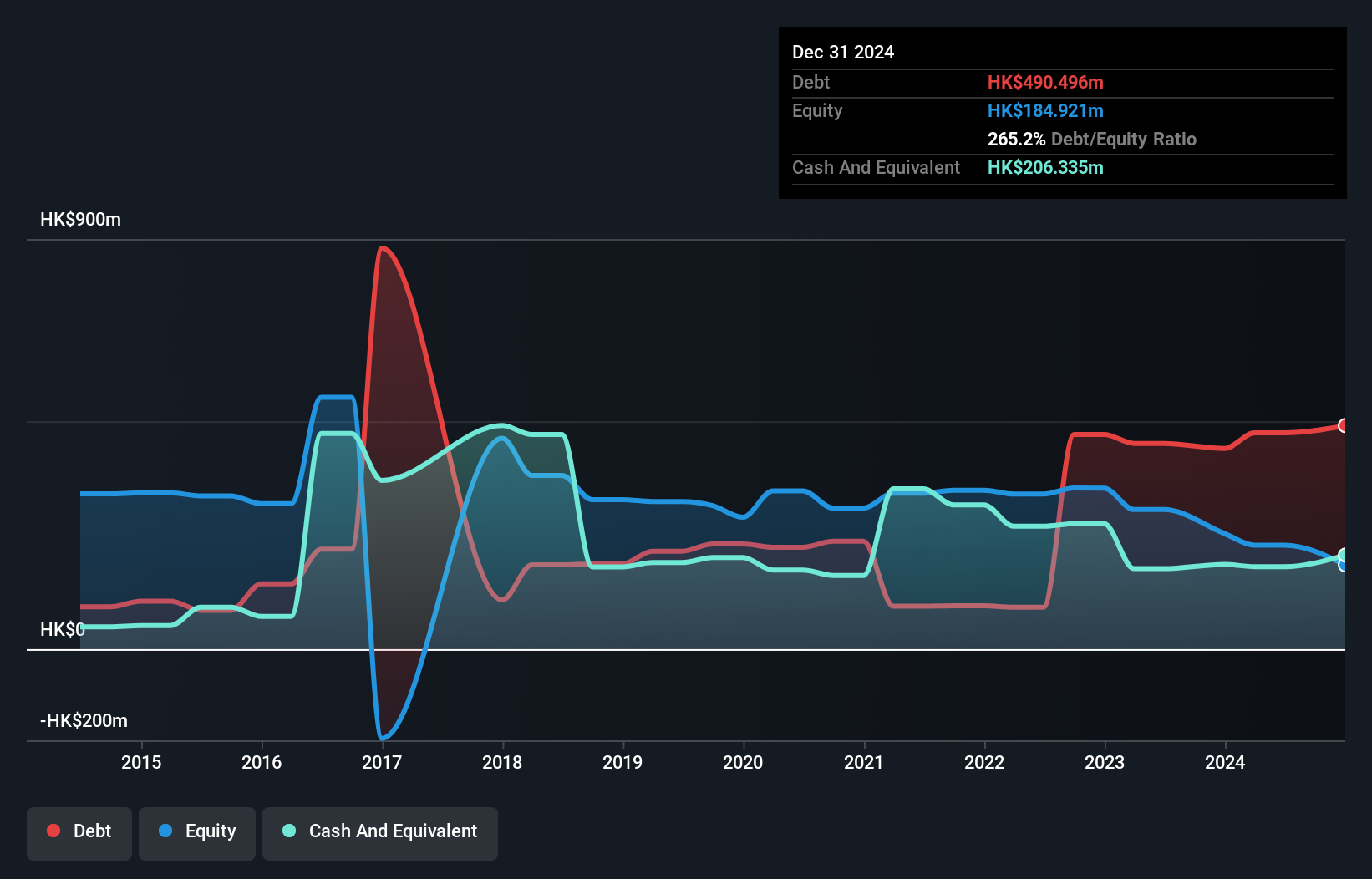

Sino ICT Holdings, with a market cap of HK$346.29 million, faces challenges as it remains unprofitable, with losses increasing by 21.3% annually over the past five years. Despite this, the company maintains a robust cash runway exceeding three years and has not diluted shareholders recently. Its short-term assets surpass both short-term and long-term liabilities, indicating some financial stability amidst high net debt to equity ratio at 128.8%. Recent board changes include Ms. Bai Yu's appointment as a non-executive director following Mr. Li Jinxian's resignation, potentially bringing fresh perspectives to its seasoned management team.

- Navigate through the intricacies of Sino ICT Holdings with our comprehensive balance sheet health report here.

- Explore historical data to track Sino ICT Holdings' performance over time in our past results report.

Pulsenmore (TASE:PULS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulsenmore Ltd. specializes in providing self-scan ultrasound devices for remote clinical diagnosis and screening, with a market cap of ₪206.01 million.

Operations: The company generates revenue from its X-Ray Equipment segment, totaling ₪8.11 million.

Market Cap: ₪206.01M

Pulsenmore Ltd., with a market cap of ₪206.01 million, is currently unprofitable and has seen increasing losses over the past five years at a rate of 39.6% annually. Despite this, the company is debt-free and maintains sufficient cash runway for more than a year based on current free cash flow trends. Its management team and board are considered experienced, with average tenures of 2.5 and 4.2 years respectively. While its short-term assets significantly exceed both short-term (₪11.8M) and long-term liabilities (₪32.9M), the share price remains highly volatile, reflecting investor uncertainty amidst limited revenue generation (₪8M).

- Get an in-depth perspective on Pulsenmore's performance by reading our balance sheet health report here.

- Understand Pulsenmore's track record by examining our performance history report.

Next Steps

- Access the full spectrum of 5,727 Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:365

Sino ICT Holdings

An investment holding company, manufactures and sells surface mount technology (SMT) and semiconductor equipment in the People’s Republic of China and Hong Kong.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives