- Israel

- /

- Medical Equipment

- /

- TASE:MRHL

If You Like EPS Growth Then Check Out Merchavia Holdings and Investments (TLV:MRHL) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Merchavia Holdings and Investments (TLV:MRHL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Merchavia Holdings and Investments

Merchavia Holdings and Investments's Improving Profits

Over the last three years, Merchavia Holdings and Investments has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Merchavia Holdings and Investments's EPS shot from ₪0.043 to ₪0.071, over the last year. Year on year growth of 68% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

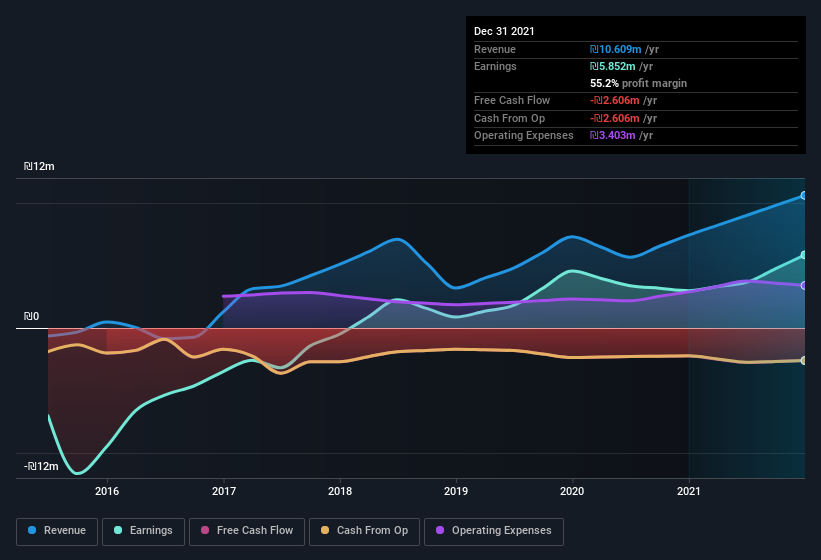

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Merchavia Holdings and Investments's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Merchavia Holdings and Investments shareholders can take confidence from the fact that EBIT margins are up from 60% to 67%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Merchavia Holdings and Investments isn't a huge company, given its market capitalization of ₪42m. That makes it extra important to check on its balance sheet strength.

Are Merchavia Holdings and Investments Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like Merchavia Holdings and Investments with market caps under ₪671m is about ₪1.3m.

Merchavia Holdings and Investments offered total compensation worth ₪716k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Merchavia Holdings and Investments To Your Watchlist?

Merchavia Holdings and Investments's earnings have taken off like any random crypto-currency did, back in 2017. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that Merchavia Holdings and Investments has the hallmarks of a quality business; and that would make it well worth watching. Still, you should learn about the 5 warning signs we've spotted with Merchavia Holdings and Investments (including 1 which is concerning) .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MRHL

Medium-low risk with mediocre balance sheet.

Market Insights

Community Narratives