Zanlakol (TASE:ZNKL) Margin Decline Reinforces Concerns Over Slowing Profit Growth

Reviewed by Simply Wall St

Zanlakol (TASE:ZNKL) just announced Q3 2025 results, reporting revenue of 136.7 million ILS and basic EPS of 0.812 ILS. Over recent periods, the company has seen revenue fluctuate from 142 million ILS in Q3 2024 to 126.4 million ILS in Q1 2025, with EPS ranging from a high of 1.157 ILS last year to more measured levels in 2025. While margins compressed compared to previous highs, investors will be weighing this softer profitability against a history of steady top-line performance.

See our full analysis for Zanlakol.Next, we are comparing Zanlakol's numbers to the current narratives followed by the market and the wider community to see which stories hold up and which ones face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Narrow as Growth Slows

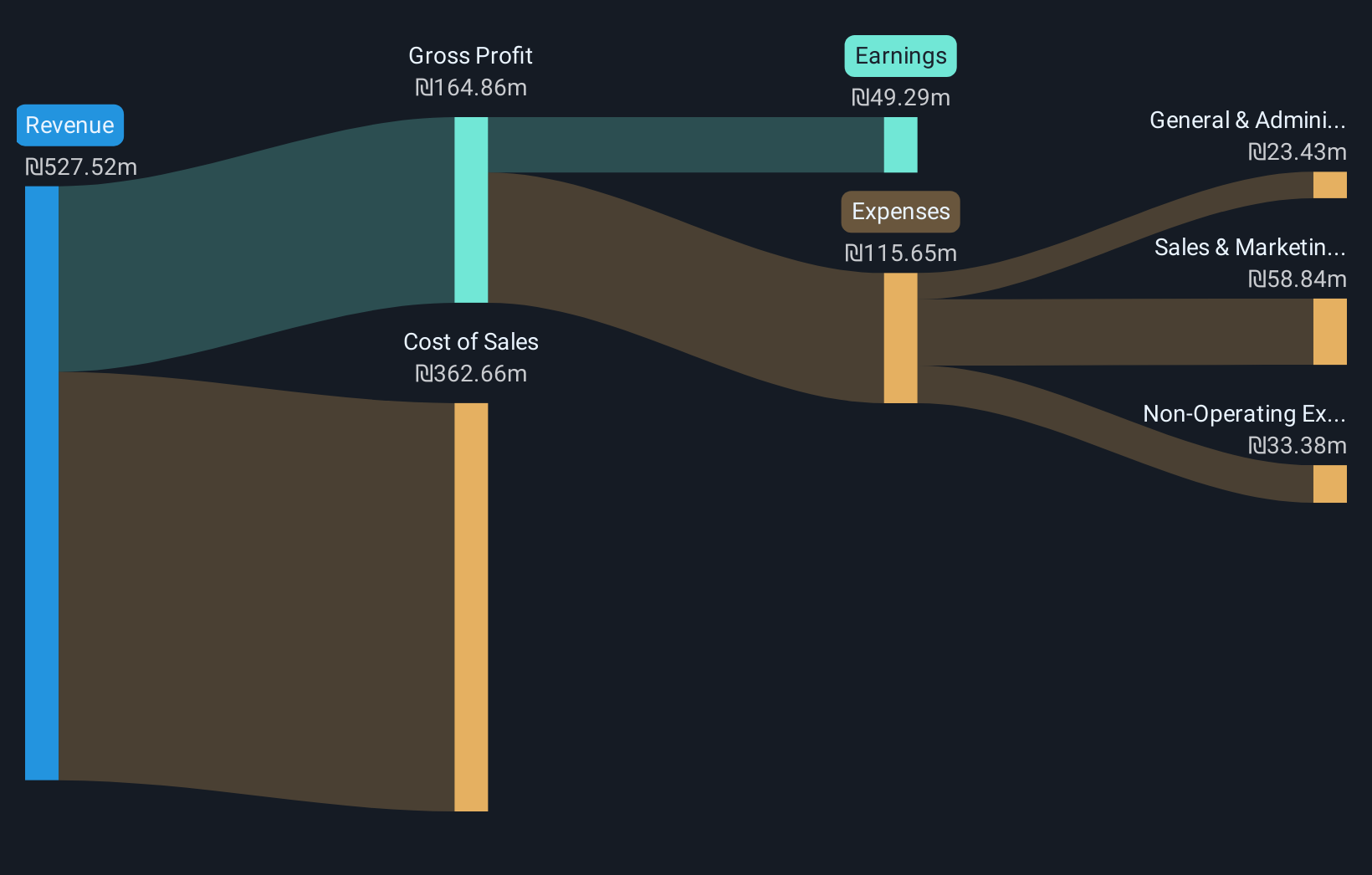

- Net profit margin over the past year was 9.3%, down from 10.1% the previous year, while trailing twelve month earnings growth came in at just 0.3% compared to a robust five-year compound annual growth rate of 26.1%.

- What stands out in the prevailing market perspective is that, although Zanlakol has long delivered high quality earnings, the combination of slower profit growth and thinner margins represents a clear shift from the company’s historical momentum.

- Trailing twelve month net income reached 49.3 million ILS, slightly increased from 49.1 million ILS a year ago, showing stagnation following years of much stronger annual increases.

- Consensus narrative emphasizes that while the business remains fundamentally solid, investor attention will look for signs of renewed earnings momentum or margin expansion in future periods.

Get the complete breakdown of how analysts interpret these margin and growth changes in the full consensus narrative. 📊 Read the full Zanlakol Consensus Narrative.

Valuation Still Undercuts Peers

- Zanlakol trades at a price-to-earnings ratio of 13x, which is lower than the Asian Food industry average of 16.5x, the peer group at 13.5x, and the broader Israel market’s average of 15.4x.

- For market observers, this relatively modest P/E multiple, despite the company’s stock price of ₪46.24 sitting well above the DCF fair value of ₪1.12, strongly supports the argument that investors continue to value Zanlakol for its stability in a defensive industry.

- The lower valuation compared to peers may compensate for the recent deceleration in profit growth, providing a margin of safety for current and prospective shareholders.

- However, the large premium relative to intrinsic value (per the DCF fair value) is a reminder for cautious investors to keep a close watch on future earnings strength.

Dividend Flagged for Coverage Risk

- The 3.1% dividend yield stands out but is not comfortably covered by free cash flows, based on the latest risk and reward analysis from the trailing twelve months.

- Critics highlight that, although the payout rate appeals to income investors, the lack of robust free cash flow coverage could become an issue if profitability stalls or capital needs rise.

- Dividend sustainability metrics will be an important watchpoint going forward, especially with net profit growth nearly flat over the last year.

- Market opinion suggests investors should weigh the yield against the recent softening in both margins and growth rates before focusing on income alone.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Zanlakol's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Stagnant earnings growth, compressed margins, and questionable dividend coverage all signal that Zanlakol is falling short on stable, sustainable performance compared to its past momentum.

If you want to focus on stocks that deliver consistent earnings and reliable growth instead, discover stable growth stocks screener (2073 results) which is built to help you find exactly that.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zanlakol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ZNKL

Zanlakol

Engages in the development, production, marketing, and sale vegetable products in Israel.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success