Strauss Group (TASE:STRS) Net Profit Margin Doubles, Reinforcing Bullish Narrative Despite One-Off Gain

Reviewed by Simply Wall St

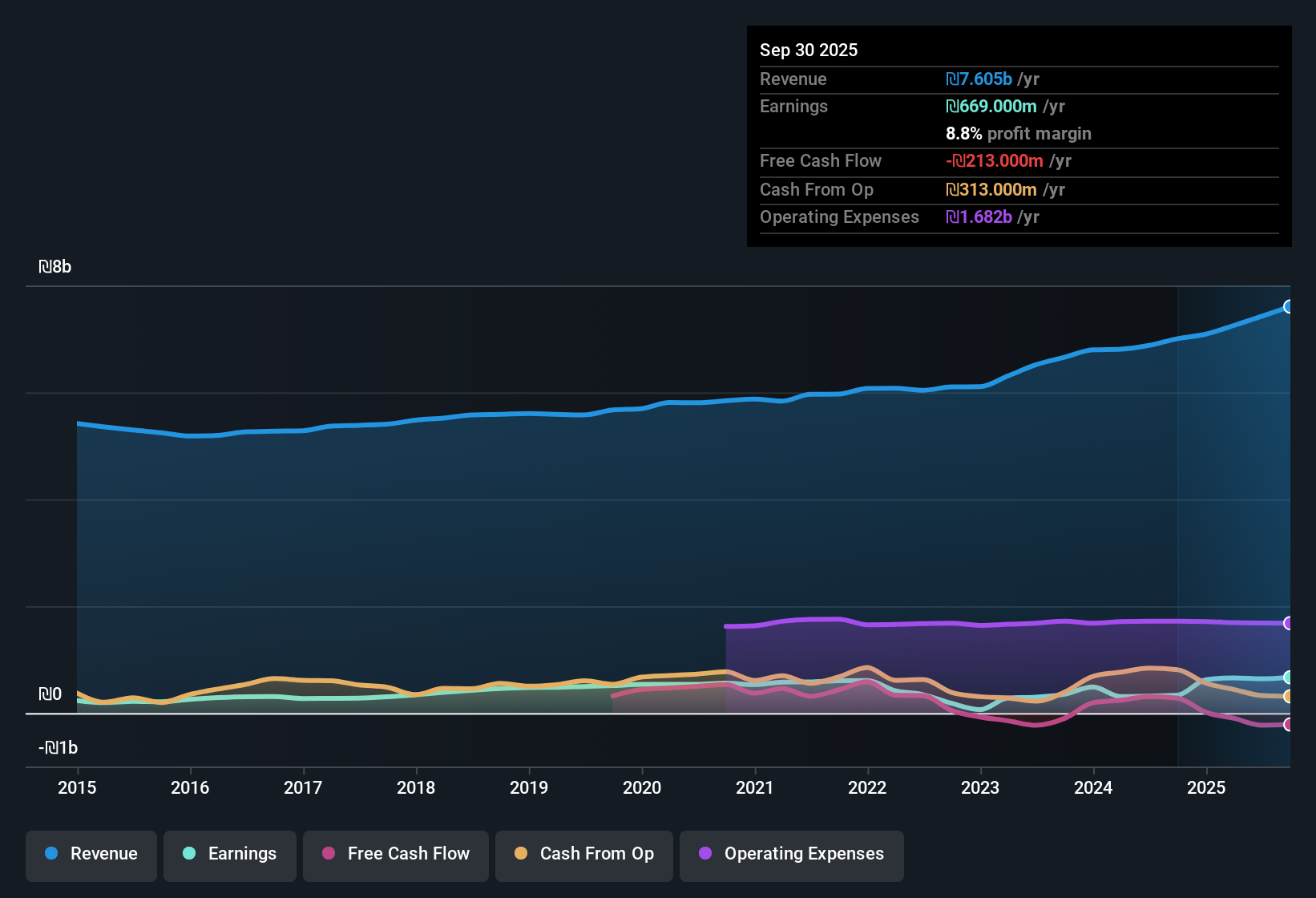

Strauss Group (TASE:STRS) just posted its Q3 2025 results, reporting total revenue of ₪2.1 billion and basic EPS of ₪1.09, while net income came in at ₪127 million. Looking at recent trends, the company has seen quarterly revenue rise from ₪1.7 billion in Q2 2024 to ₪2.1 billion this quarter, and EPS climb from ₪0.7 to ₪1.09 over the same period. Margins benefited from these results, but a substantial one-off gain has influenced the headline profitability metric for investors keeping a close eye on quality.

See our full analysis for Strauss Group.Now, let's see how these fresh numbers compare to the key market narratives. Sometimes the data backs up the crowd’s story, and sometimes it flips the script entirely.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Doubles to 8.8%

- Strauss Group’s net profit margin increased from 4.8% a year earlier to 8.8%, highlighting a dramatic improvement in underlying profitability across its diversified business segments.

- Investors weighing the latest trends are likely to focus on how this wider margin heavily supports the bullish case that the company’s strong brand portfolio and operational efficiencies allow it to outpace sector averages.

- The margin jump is supported by a trailing 12-month net income of ₪669 million (about $1.8 billion) on ₪7.6 billion ($7.6 billion) in revenue, doubling profit growth versus the company’s longer-term trend of just 0.5% annual earnings growth over five years.

- However, the reported period was boosted by a one-off gain of ₪452 million, so bulls need to account for this when assessing recurring profitability.

Valuation Premium Still Stands

- Strauss Group is currently trading at a Price-To-Earnings ratio of 17.1x, which is above both the Asian Food industry average (16.7x) and its peer group (15.9x), and its market price of ₪97.99 far exceeds the DCF fair value estimate of ₪26.07.

- What’s surprising for value-focused investors is how the market narrative keeps justifying this premium with the company’s resilience and margin gains.

- At over 3 times the DCF fair value, current valuation challenges the likelihood of near-term upside.

- The narrative's optimism around brand leadership and sector defensiveness may already be fully priced in.

Debt Coverage Draws Scrutiny

- Strauss Group’s latest statements reveal that company debt is not well covered by operating cash flow, flagging it as a potential vulnerability despite robust reported profits.

- Consensus analysis flags this contrast, as strong earnings growth can often offset some balance sheet risks, but the quality of those earnings is heavily influenced by exceptional items and not supported by improvements in cash generation. Analysts consider this a key area to watch for downside in future quarters.

- Near doubling of annual net profit conceals risks in debt coverage reflected in the company’s filings.

- Focus may shift from headline profit strength to sustainability of operating fundamentals as market cycles change.

Analysts suggest that the real story for Strauss Group lies in whether profit quality and cash flow improvements can sustain this momentum. Get the broader view in the consensus narrative for more.

📊 Read the full Strauss Group Consensus Narrative.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Strauss Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Strauss Group’s impressive headline profits are diminished by debt coverage concerns and reliance on one-off gains, which raises questions about financial resilience.

If you want to focus on businesses with stronger financial footing and fewer debt risks, check out solid balance sheet and fundamentals stocks screener (1931 results) for healthier alternatives built for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:STRS

Strauss Group

Develops, manufactures, markets, sells, and distributes various food and beverage products in Israel, North America, Brazil, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success