Does Strauss Group’s Q3 Profit Growth Signal Sustained Momentum for TASE:STRS Investors?

Reviewed by Sasha Jovanovic

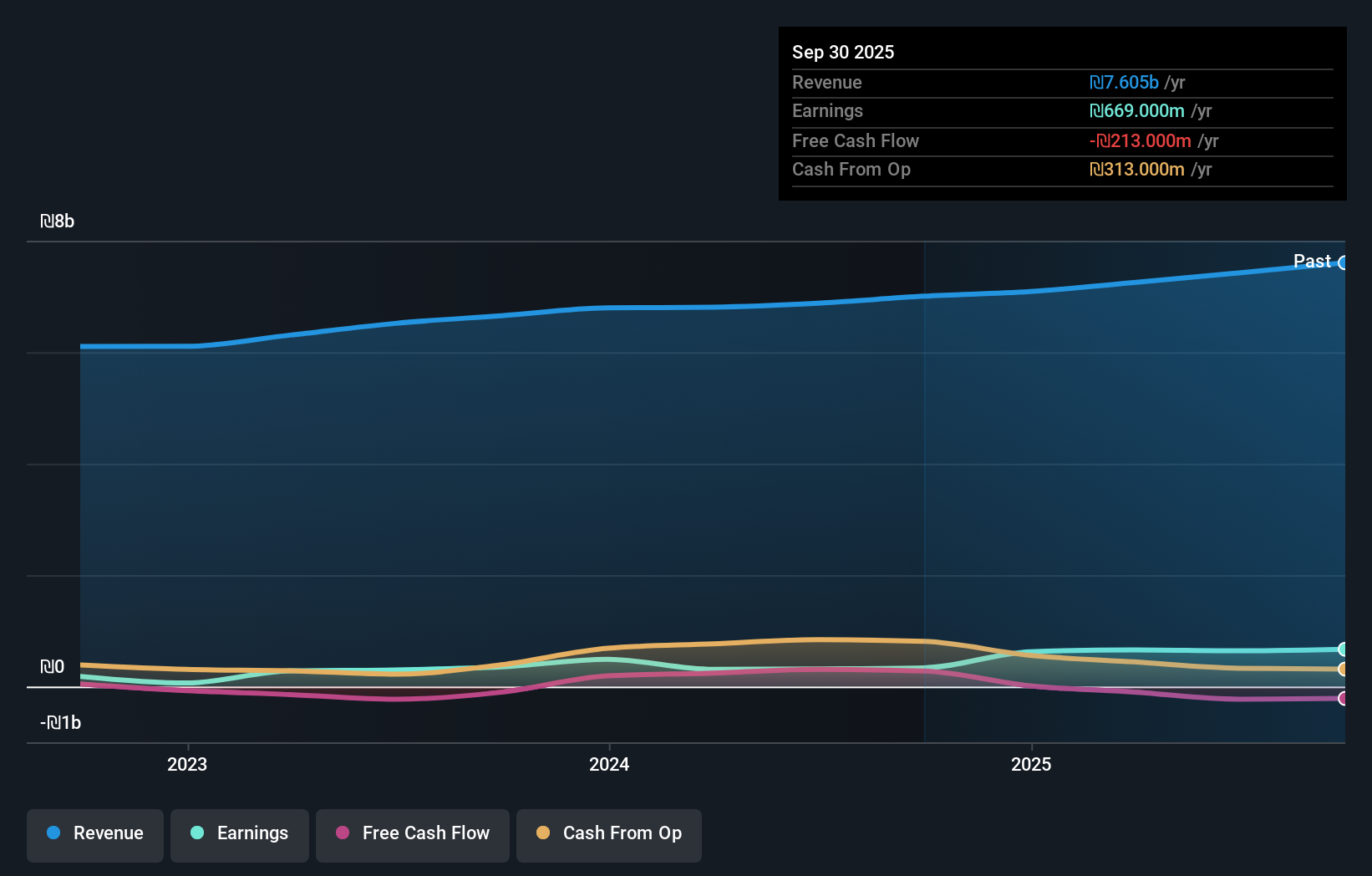

- Strauss Group reported its third quarter 2025 earnings, with sales rising to ILS 2.05 billion and net income reaching ILS 127 million compared to the previous year.

- The company's improved basic earnings per share from continuing operations highlights ongoing growth momentum across both quarterly and nine-month periods.

- We’ll now explore how sustained earnings growth factors into Strauss Group’s broader investment narrative for potential investors.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Strauss Group's Investment Narrative?

Strauss Group’s latest earnings update shows solid sales and profit gains, and this continued improvement could give investors more confidence in the company’s future. The news comes at a time when momentum has picked up following a mixed start to the year, and recent results now tilt some short-term catalysts, like debt coverage and underlying profit margins, into a more positive light than earlier analysis suggested. While last year’s large one-off gain still lingers in trailing figures, the lift in third-quarter net income and basic EPS hints the underlying business may be returning to steadier growth. That said, the recent uptick hasn’t erased longer-term questions over expensive valuation, board independence and reliance on non-recurring results, which remain key issues for many investors.

But, with only 30% board independence, the decision-making process could still be a concern. Strauss Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Strauss Group - why the stock might be worth less than half the current price!

Build Your Own Strauss Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strauss Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Strauss Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strauss Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:STRS

Strauss Group

Develops, manufactures, markets, sells, and distributes various food and beverage products in Israel, North America, Brazil, Europe, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success