Neto M.E Holdings Ltd (TLV:NTO) Shares Fly 29% But Investors Aren't Buying For Growth

Despite an already strong run, Neto M.E Holdings Ltd (TLV:NTO) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 143% in the last year.

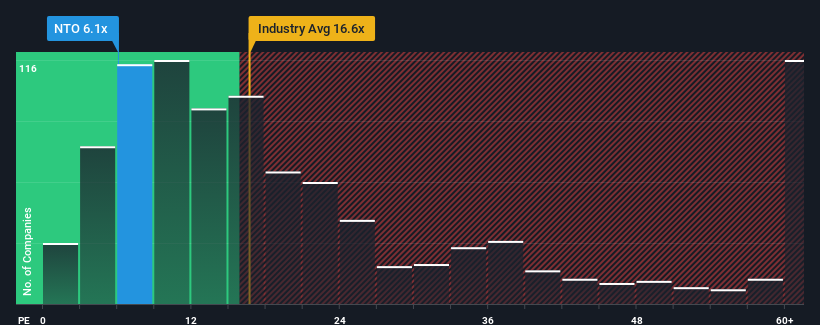

Although its price has surged higher, given about half the companies in Israel have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Neto M.E Holdings as a highly attractive investment with its 6.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Neto M.E Holdings has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Neto M.E Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Neto M.E Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 123% last year. Still, incredibly EPS has fallen 8.5% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Neto M.E Holdings' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Neto M.E Holdings' P/E?

Neto M.E Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Neto M.E Holdings maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Neto M.E Holdings that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Neto M.E Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NTO

Neto M.E Holdings

Produces, processes, imports, markets, and distributes a range of food products in Israel.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026