We Believe That Carmit Candy Industries' (TLV:CRMT) Weak Earnings Are A Good Indicator Of Underlying Profitability

Carmit Candy Industries Ltd.'s (TLV:CRMT) stock wasn't much affected by its recent lackluster earnings numbers. We did some digging, and we believe that investors are missing some worrying factors underlying the profit figures.

View our latest analysis for Carmit Candy Industries

A Closer Look At Carmit Candy Industries' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

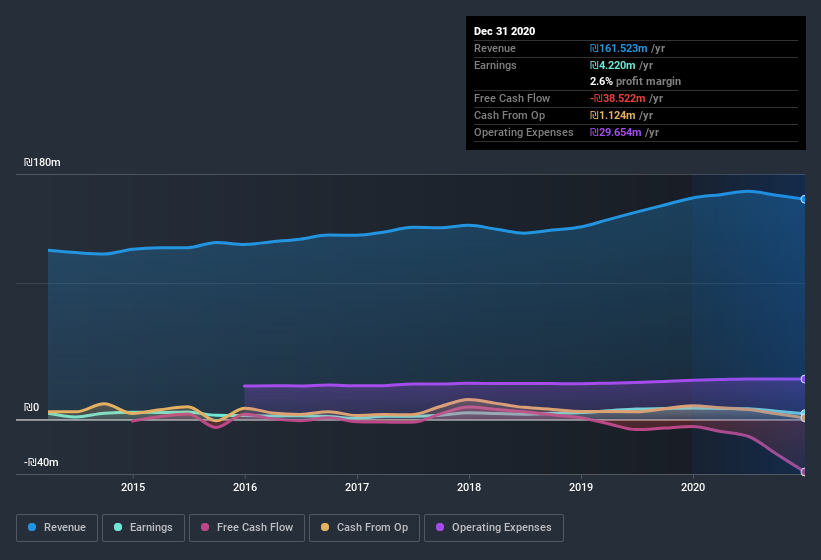

Over the twelve months to December 2020, Carmit Candy Industries recorded an accrual ratio of 0.40. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of ₪39m despite its profit of ₪4.22m, mentioned above. We also note that Carmit Candy Industries' free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₪39m. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Carmit Candy Industries.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by ₪843k, in the last year, probably goes some way to explain why its accrual ratio was so weak. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. If Carmit Candy Industries doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Carmit Candy Industries' Profit Performance

Summing up, Carmit Candy Industries received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Carmit Candy Industries' profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To help with this, we've discovered 4 warning signs (2 are a bit unpleasant!) that you ought to be aware of before buying any shares in Carmit Candy Industries.

Our examination of Carmit Candy Industries has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Carmit Candy Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:CRMT

Carmit Candy Industries

Develops, produces, markets, exports, imports, and sells chocolates, baked goods, spreads, granola, frozen snacks, marshmallows, and tropicals in Israel and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives