Carmel (TASE:CRML) Net Loss Narrows in Q3, Persistent Unprofitability Fuels Bearish Narratives

Reviewed by Simply Wall St

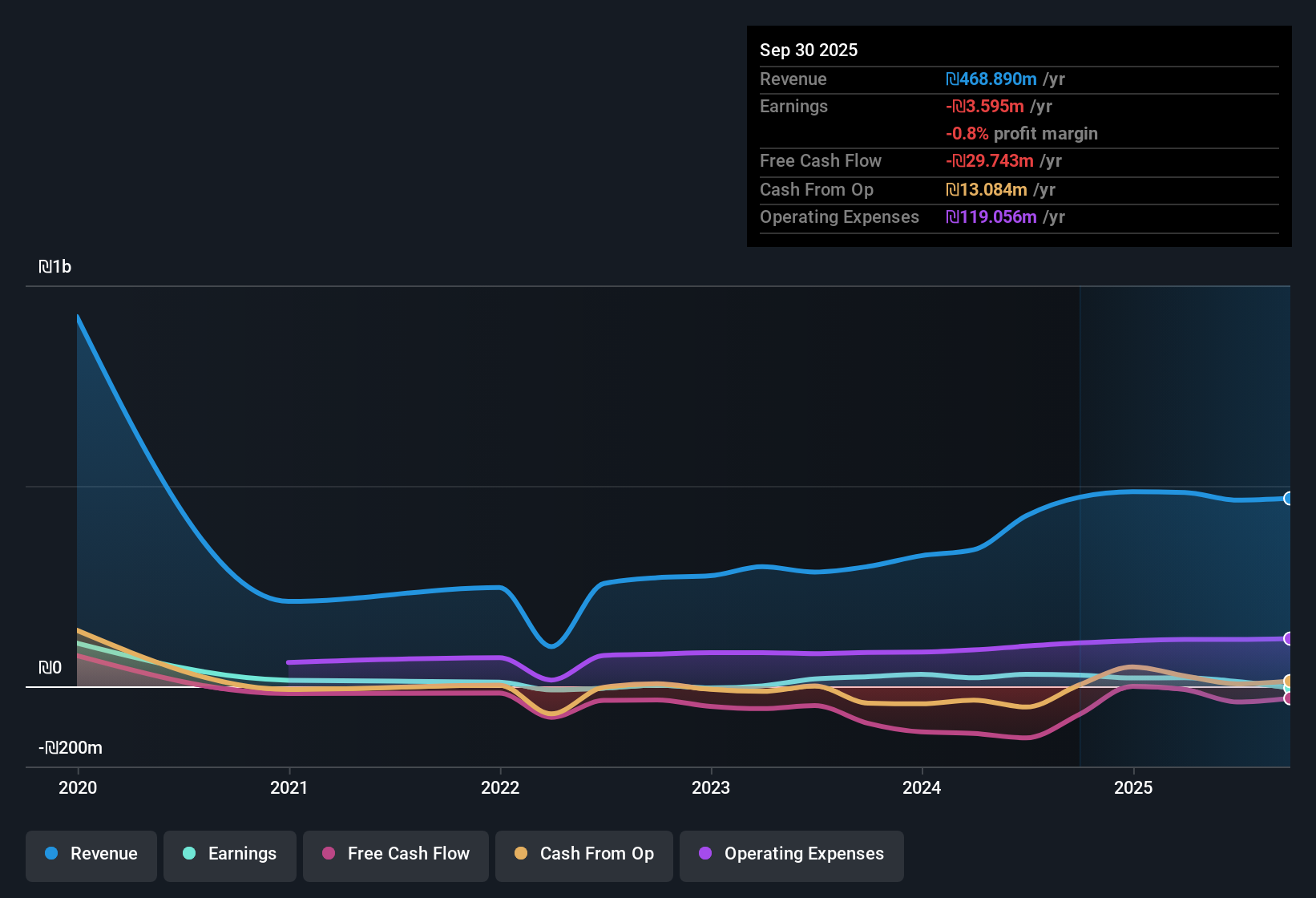

Carmel (TASE:CRML) just released its Q3 2025 results, posting revenue of 147.49 million ILS and basic EPS of -0.12 ILS for the quarter. The company has seen revenue fluctuate over recent periods, from 143.05 million ILS in Q3 2024 to 110.05 million ILS in Q2 2025, while EPS moved from 0.66 ILS last year to negative territory this quarter. Operating margins remain under pressure and the latest results keep profitability firmly in focus for investors.

See our full analysis for Carmel.Now let’s see how these numbers compare to the major market narratives. The next section lines up the figures with community and analyst expectations to uncover where the story holds up and where it breaks.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow as Net Income Improves Over Five Years

- Net losses have been shrinking at an average rate of 23.8% per year over the past five years, with net income (excluding extra items) at -2.36 million ILS in Q3 2025, compared to -2.88 million ILS in Q2 2025 and -5.22 million ILS in Q4 2024.

- Even with this steady improvement, the company has remained unprofitable on a trailing twelve month basis. The market narrative suggests that while narrowing losses may attract attention, persistent negative net margin means any further progress needs to be monitored closely.

- Despite reduced losses, critics highlight that there is still no evidence of sustained profitability emerging, and the company has yet to deliver high-quality earnings over recent quarters.

- The tension for investors lies in recognizing operational momentum but acknowledging that the financial turnaround remains incomplete.

Attractive Price-to-Sales Ratio versus Industry

- Carmel’s price-to-sales ratio stands at 0.8x, substantially below the Asian Beverage industry average of 2.2x and exactly in line with its direct peer group, based on the past twelve months.

- This valuation discount gives supporters something to point to, as bulls argue that being valued so far below the sector average on sales alone may reflect an overlooked opportunity if margins eventually recover.

- Consensus narrative notes that such discounted multiples could draw patient investors, but ongoing losses and debt challenges mean few are expecting a quick rerating.

- Justified skepticism is warranted, as valuation support alone will not offset prolonged negative net income or weak debt coverage if performance does not improve.

Debt Coverage Flags Material Financial Risk

- Carmel’s operating cash flow has not been sufficient to cover debt, raising real concerns around liquidity and balance sheet strength despite some operational improvements.

- What is most relevant in the prevailing market view is that while cost controls may be helping to shrink losses, investors should be aware that unresolved debt risks and negative cash coverage remain a key vulnerability.

- Over the past twelve months, financial risk has been persistently noted, with commentary explicitly warning about the company’s fragile debt cover and the absence of evidence that this risk is receding.

- Until cash flow strengthens enough to address these concerns, any optimism grounded in valuation or revenue will stay matched by caution over leverage.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Carmel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Carmel continues to struggle with persistent net losses and unresolved debt coverage issues. These factors cast doubt on its financial stability and turnaround potential.

If you want to focus on companies with healthier balance sheets and stronger financial foundations, check out solid balance sheet and fundamentals stocks screener (1942 results) built to help investors reduce these risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CRML

Carmel

Engages in the production and marketing of various soft drinks and mineral water in Israel.

Slightly overvalued with worrying balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026