- Israel

- /

- Oil and Gas

- /

- TASE:RATI

Ratio Energies (TASE:RATI) Is Down 6.6% After Persistent Revenue and Earnings Declines in Q3 2025

Reviewed by Sasha Jovanovic

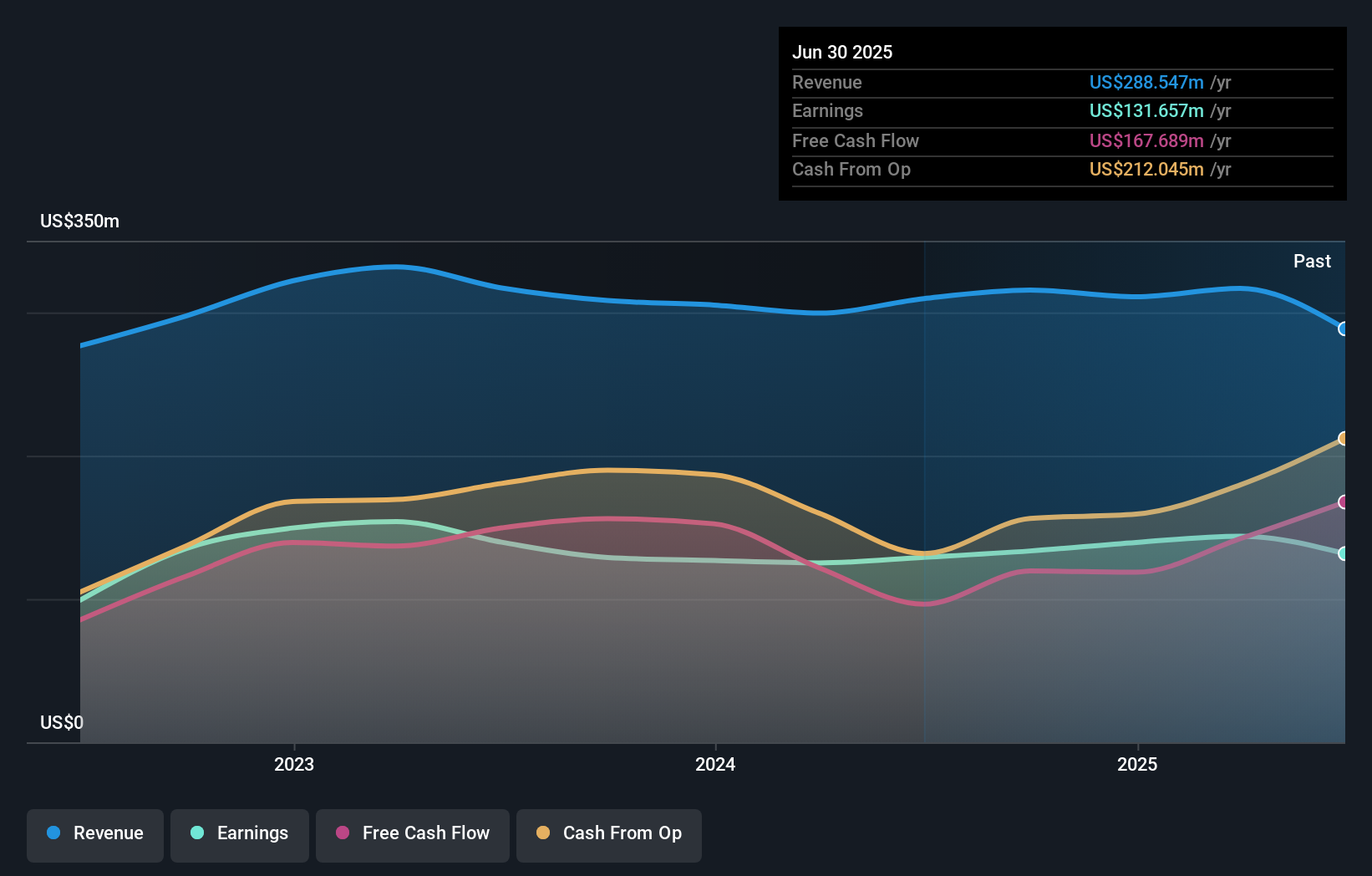

- Ratio Energies - Limited Partnership recently reported its third quarter 2025 results, showing revenue of US$76.34 million and net income of US$34.73 million, both declining compared to the same period last year.

- This performance highlights a continued downward trend in both revenue and earnings for the company over the nine-month period ending September 30, 2025.

- We'll look at how declines in revenue and net income shape the ongoing investment narrative for Ratio Energies - Limited Partnership.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Ratio Energies - Limited Partnership's Investment Narrative?

To believe in Ratio Energies - Limited Partnership as a shareholder, you need confidence that the company’s strong profitability and disciplined management will outweigh recent pressure on both revenue and earnings. The latest earnings report reflects a continuation of quarterly declines, as third quarter revenue and net income both fell compared to last year. While this downward trend in results may put some short term catalysts, such as potential dividend increases or renewed confidence in profit growth, on hold, it likely intensifies the spotlight on underlying risks like the company’s high debt levels and limited board independence. The most recent results fit into this by reinforcing questions about how resilient Ratio is to external shocks or industry headwinds, influencing how the market assesses its outlook. For now, the overall market reaction and price moves suggest the impact of this news is significant enough to affect near term sentiment and priorities for shareholders.

But, companies with high debt loads can face added financial pressure when profits trend lower. Despite retreating, Ratio Energies - Limited Partnership's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Ratio Energies - Limited Partnership - why the stock might be worth less than half the current price!

Build Your Own Ratio Energies - Limited Partnership Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ratio Energies - Limited Partnership research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ratio Energies - Limited Partnership research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ratio Energies - Limited Partnership's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RATI

Ratio Energies - Limited Partnership

Explores, develops, and produces oil and natural gas in Israel.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success