- Israel

- /

- Oil and Gas

- /

- TASE:NWMD

NewMed Energy (TASE:NWMD): Assessing Valuation Following Weaker Q3 and Nine-Month Earnings Results

Reviewed by Simply Wall St

NewMed Energy, Limited Partnership (TASE:NWMD), just released its earnings for the third quarter and first nine months of 2025, showing lower revenue and net income compared to last year. Investors are paying close attention to these weaker results.

See our latest analysis for NewMed Energy - Limited Partnership.

While NewMed Energy’s latest numbers disappointed, the market has kept its eye on the long game. Despite recent earnings pressure, the stock’s share price has actually climbed 48% so far this year, and the one-year total shareholder return stands at an impressive 55%. That kind of momentum suggests investors still see solid value here, even as shorter-term results fluctuate.

If these shifts have you curious about what’s driving market outperformance, it might be the perfect moment to discover fast growing stocks with high insider ownership

With shares surging despite cooling profits, the key question now is whether NewMed Energy is trading below its true value or if the company’s future growth is already fully reflected in the current share price.

Price-to-Earnings of 13.9x: Is it justified?

NewMed Energy’s current share price commands a price-to-earnings (P/E) ratio of 13.9x, slightly above the average for the Asian Oil and Gas sector, yet below the wider Israel market benchmark.

The P/E multiple is a snapshot of how much the market is willing to pay for each shekel of earnings. A higher P/E can imply that investors expect greater profit growth compared to peers, or that quality and stability justify a richer valuation.

For NewMed Energy, the 13.9x P/E sits just above the Asian industry average of 13.4x. Compared to select peer companies, NewMed appears reasonable in its sector. It is also below the Israeli market average (16.3x). However, it is trading above our estimate of fair value, and analyst targets trail the current price, suggesting expectations may already be factored in.

Additionally, NewMed’s earnings quality is considered high, but its latest growth has underwhelmed relative to prior years, and its one-year returns are not ahead of the broader market or industry.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.9x (ABOUT RIGHT)

However, slowing revenue growth and shares already trading above analyst targets could challenge NewMed Energy’s upbeat momentum if results continue to underwhelm.

Find out about the key risks to this NewMed Energy - Limited Partnership narrative.

Another View: What Does Our SWS DCF Model Say?

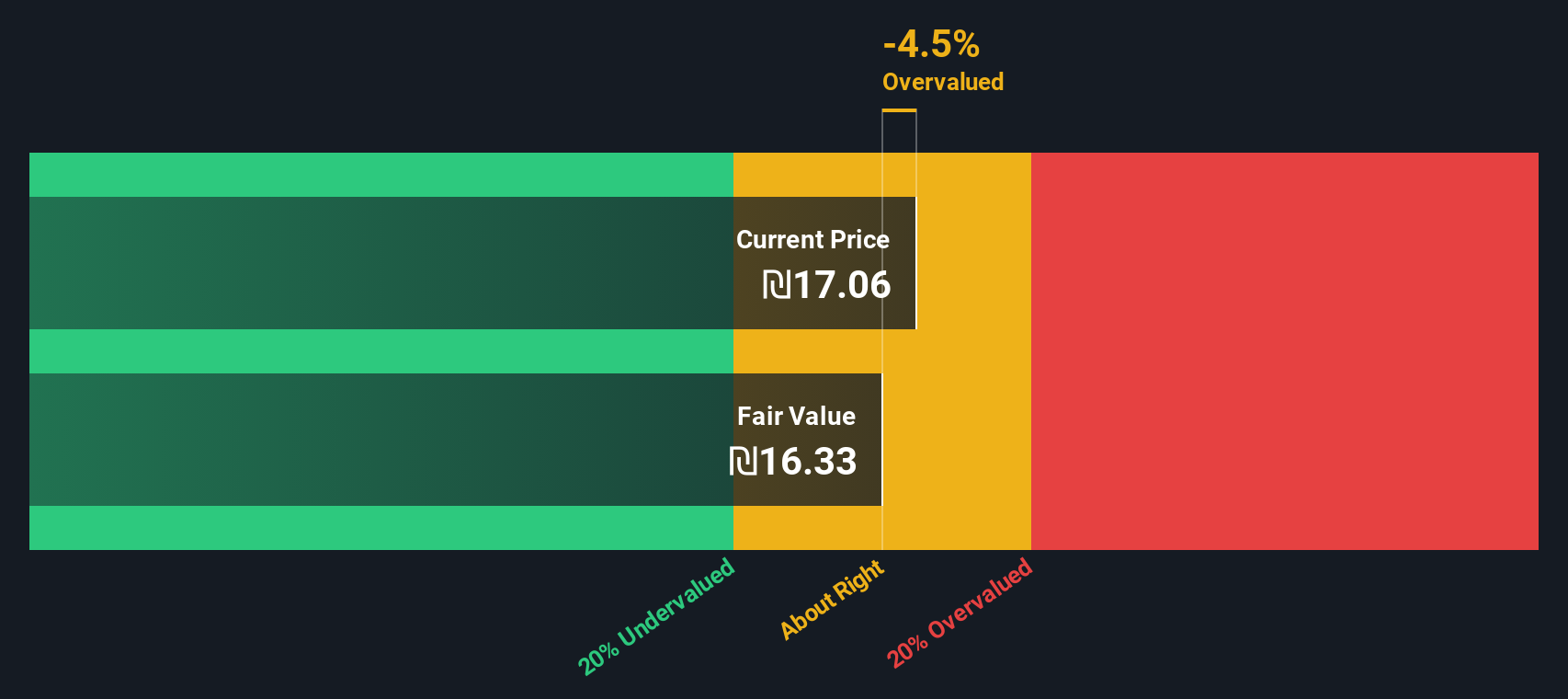

While the price-to-earnings approach points to a valuation that is a little elevated, the SWS DCF model takes a different angle. Our DCF estimate currently places fair value for NewMed Energy at ₪16.28, slightly below the latest trading price, suggesting a mild risk of overvaluation. But does the market have other catalysts in mind?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewMed Energy - Limited Partnership for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewMed Energy - Limited Partnership Narrative

If you’d rather investigate the numbers yourself or take a fresh approach, you can craft your own view of NewMed Energy in just a few minutes, and Do it your way.

A great starting point for your NewMed Energy - Limited Partnership research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to a single opportunity when whole sectors are sparking with potential. Use the Simply Wall Street Screener to pinpoint unique investments you might otherwise miss.

- Uncover real cash flow potential by checking out these 870 undervalued stocks based on cash flows that could be overlooked gems in today’s market.

- Capture tomorrow’s biggest healthcare innovations by running through these 31 healthcare AI stocks with transformative technology at their core.

- Accelerate your portfolio’s growth potential with these 3585 penny stocks with strong financials offering strong financials and surprising resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMed Energy - Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NWMD

NewMed Energy - Limited Partnership

Engages in the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel, Jordan and Egypt.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives