- Israel

- /

- Oil and Gas

- /

- TASE:SPGS

Electra Power (2019) Ltd (TLV:ELCP) Stock Rockets 26% But Many Are Still Ignoring The Company

The Electra Power (2019) Ltd (TLV:ELCP) share price has done very well over the last month, posting an excellent gain of 26%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.1% in the last twelve months.

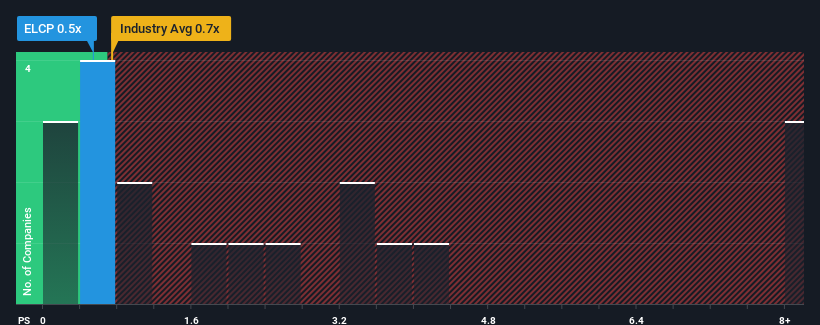

In spite of the firm bounce in price, Electra Power (2019) may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Oil and Gas industry in Israel have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Electra Power (2019)

What Does Electra Power (2019)'s P/S Mean For Shareholders?

Electra Power (2019) has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Electra Power (2019)'s earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Electra Power (2019)?

The only time you'd be truly comfortable seeing a P/S as low as Electra Power (2019)'s is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.4% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Electra Power (2019)'s P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Electra Power (2019)'s P/S Mean For Investors?

Despite Electra Power (2019)'s share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at the figures, it's surprising to see Electra Power (2019) currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Having said that, be aware Electra Power (2019) is showing 5 warning signs in our investment analysis, and 3 of those are potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SPGS

Supergas Power (2019)

Supergas Power (2019) Ltd markets, sells, and distributes liquefied petroleum gas, natural gas, electricity, and thermal energy in Israel.

Moderate risk with poor track record.

Similar Companies

Market Insights

Community Narratives