Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Delek Royalties (2012) Ltd (TLV:DLRL) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Delek Royalties (2012)

What Is Delek Royalties (2012)'s Net Debt?

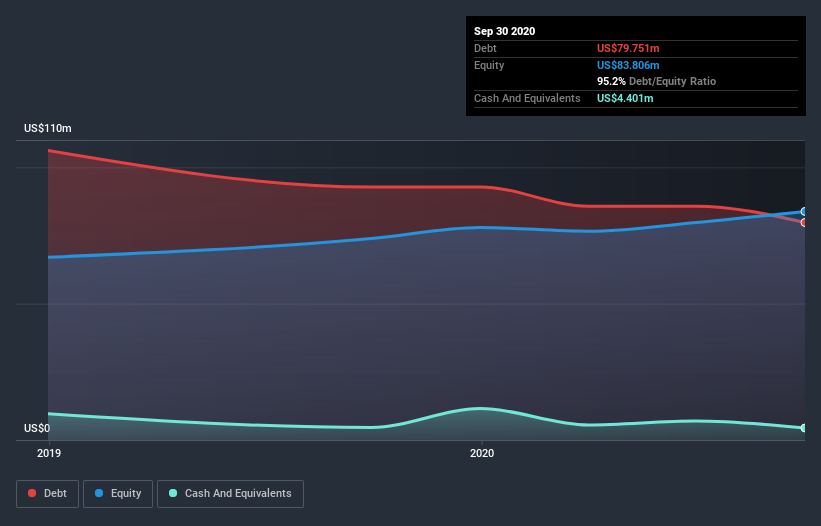

The image below, which you can click on for greater detail, shows that Delek Royalties (2012) had debt of US$79.7m at the end of September 2020, a reduction from US$92.8m over a year. However, it also had US$4.40m in cash, and so its net debt is US$75.3m.

A Look At Delek Royalties (2012)'s Liabilities

According to the last reported balance sheet, Delek Royalties (2012) had liabilities of US$12.3m due within 12 months, and liabilities of US$70.0m due beyond 12 months. Offsetting these obligations, it had cash of US$4.40m as well as receivables valued at US$2.29m due within 12 months. So it has liabilities totalling US$75.6m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$39.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Delek Royalties (2012) would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Delek Royalties (2012) has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 3.7 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Even worse, Delek Royalties (2012) saw its EBIT tank 42% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Delek Royalties (2012) will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, Delek Royalties (2012) burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Delek Royalties (2012)'s EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. Considering all the factors previously mentioned, we think that Delek Royalties (2012) really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Delek Royalties (2012) you should be aware of, and 1 of them is a bit concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Delek Royalties (2012), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tomer Energy Royalties (2012) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:TOEN

Tomer Energy Royalties (2012)

A special-purpose yield company, holds the right to receive overriding royalties in respect of oil and/or gas, and/or other valuable materials derived from the shares of various oil and gas companies and entities in Israel.

Acceptable track record with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026