- Israel

- /

- Electrical

- /

- TASE:GNCL

Middle Eastern Penny Stocks To Watch With Market Caps Over US$3M

Reviewed by Simply Wall St

The Middle Eastern markets have been experiencing gains, particularly in the Gulf region, driven by a rebound in oil prices and anticipation of the Federal Reserve's policy decisions. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated terminology—remain an intriguing area of investment. These stocks can offer substantial value when backed by strong financial health, presenting opportunities for growth and stability amidst the evolving market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.97 | SAR1.59B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.979 | ₪120.58M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.44 | ₪170.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.901 | ₪2.8B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.192 | ₪162.96M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.708 | AED423.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.67 | AED423.88M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED9.99B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across various sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.74 billion.

Operations: The company generated AED150.11 million in revenue from its Private Investments segment, excluding Waha Land.

Market Cap: AED2.74B

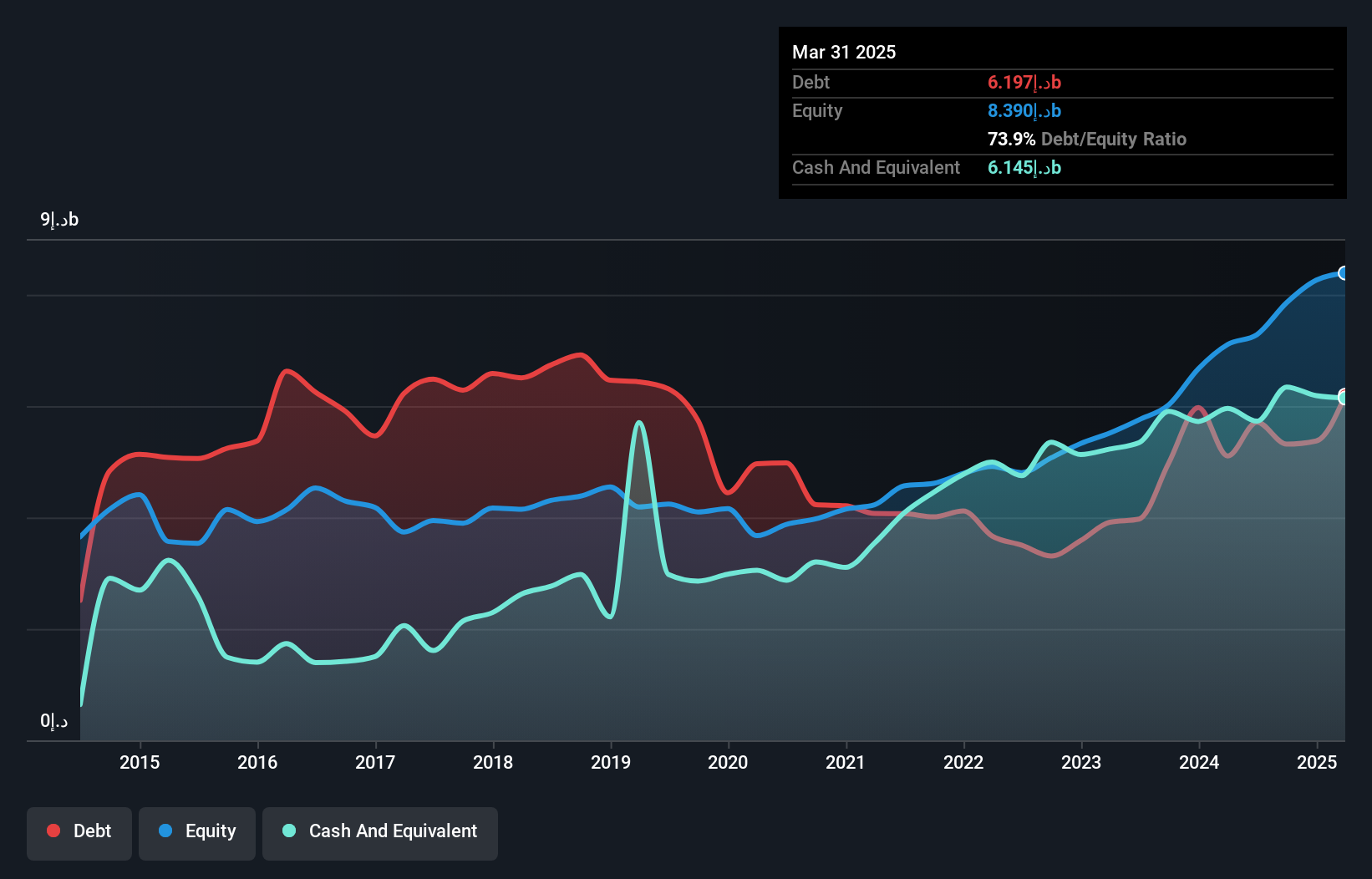

Al Waha Capital PJSC, with a market cap of AED2.74 billion, has demonstrated financial prudence by reducing its debt to equity ratio from 106.9% to 65% over five years and maintaining short-term assets that exceed both short- and long-term liabilities. Despite a low return on equity at 8.2%, the company remains profitable with high-quality earnings, although recent net profit margins have declined compared to last year. Its dividend yield of 6.8% is not well covered by free cash flows, but shareholders have not faced dilution recently. Recent earnings showed net income of AED381.28 million for 2024, down from AED440.1 million in the previous year, reflecting challenges in profit growth acceleration amidst negative earnings growth over the past year.

- Navigate through the intricacies of Al Waha Capital PJSC with our comprehensive balance sheet health report here.

- Learn about Al Waha Capital PJSC's historical performance here.

Gencell (TASE:GNCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GenCell Ltd. develops and produces fuel cell-based energy systems, with a market cap of ₪27.95 million.

Operations: The company's revenue is derived entirely from its segment focused on the development and production of fuel cell-based energy systems, totaling $9.55 million.

Market Cap: ₪27.95M

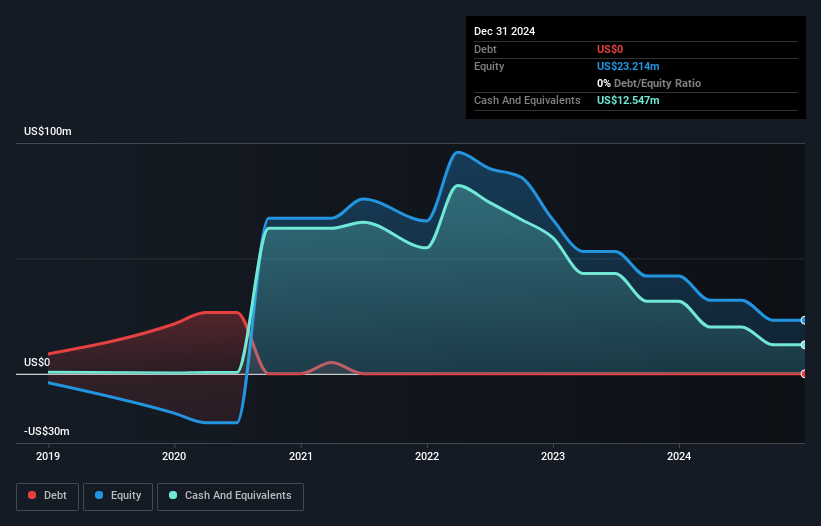

GenCell Ltd., with a market cap of ₪27.95 million, has seen its revenue grow to US$9.55 million for 2024, yet remains unprofitable with a net loss of US$19.43 million. The company benefits from an experienced management team and board, with average tenures of 3.4 and 4.4 years respectively, and maintains a stable share price despite high volatility over the past three months. GenCell's short-term assets cover both short- and long-term liabilities effectively; however, it faces challenges with less than one year of cash runway based on current free cash flow trends and negative return on equity at -83.72%.

- Jump into the full analysis health report here for a deeper understanding of Gencell.

- Gain insights into Gencell's past trends and performance with our report on the company's historical track record.

Unicorn Technologies - Limited Partnership (TASE:UNCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unicorn Technologies - Limited Partnership is a principal investment firm located in Tel Aviv, Israel with a market cap of ₪13.20 million.

Operations: Unicorn Technologies - Limited Partnership has not reported any revenue segments.

Market Cap: ₪13.2M

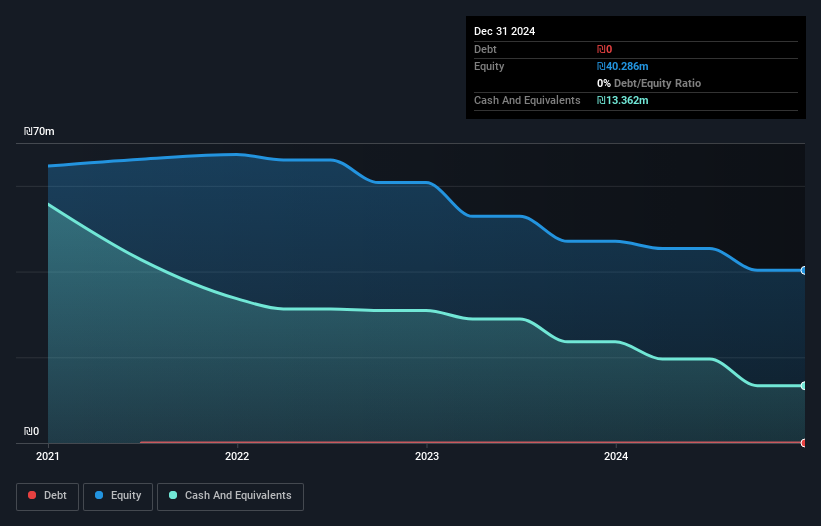

Unicorn Technologies - Limited Partnership, with a market cap of ₪13.20 million, is currently pre-revenue and unprofitable, having reported a net loss of ILS 6.81 million for 2024. Despite this, the company maintains strong financial stability with no debt and short-term assets exceeding liabilities significantly. It boasts an experienced board with an average tenure of 5.3 years and has not diluted shareholders recently. Although its share price has been highly volatile over the past three months, Unicorn Technologies possesses a cash runway sufficient for over three years if current free cash flow trends continue without significant changes.

- Unlock comprehensive insights into our analysis of Unicorn Technologies - Limited Partnership stock in this financial health report.

- Assess Unicorn Technologies - Limited Partnership's previous results with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 94 Middle Eastern Penny Stocks by clicking here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:GNCL

Gencell

GenCell Ltd. engages in the development and production of fuel cell-based energy systems.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026