- Israel

- /

- Capital Markets

- /

- TASE:TASE

Tel-Aviv Stock Exchange (TASE:TASE) Is Up 6.5% After Posting Strong Q3 Revenue and Net Income Growth

Reviewed by Sasha Jovanovic

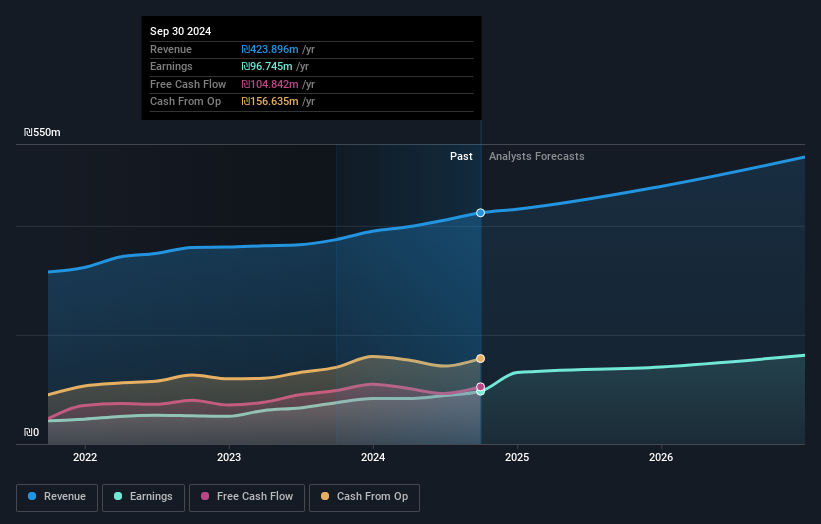

- The Tel-Aviv Stock Exchange Ltd. reported results for the third quarter and first nine months of 2025, with revenue rising to ILS 147.1 million and net income reaching ILS 49.98 million for the quarter, both higher than the same periods last year.

- The strong financials highlight significant improvements in profitability and earnings per share, reflecting robust operational performance during the period.

- With revenue and net income rising year-over-year, we'll look at how this performance contributes to the company's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Tel-Aviv Stock Exchange's Investment Narrative?

To believe in Tel-Aviv Stock Exchange Ltd. as a shareholder, you need confidence that operational improvements can drive profit growth, even though sector expectations for high annual profit expansion have cooled recently. The latest quarterly results were meaningfully strong, with revenue and net income surging well above 2024 levels. Those figures add momentum to an investment thesis that emphasizes quality earnings, robust margins, and ongoing new product launches like the TA-Real Estate 35 Index. In the short term, these strong results update investor conversations about catalysts, especially as the company’s relative valuation remains high versus peers despite recent price appreciation. The big risk now is that while profit momentum looks good, future growth is expected to be modest, and the board’s short tenures could eventually test governance stability. For now, this earnings beat is material and could shift risk perceptions and raise expectations for upcoming shareholder meetings or regulatory developments.

But even with strong earnings, the company’s high P/E ratio is something investors should not ignore. Tel-Aviv Stock Exchange's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Tel-Aviv Stock Exchange - why the stock might be worth as much as ₪72.71!

Build Your Own Tel-Aviv Stock Exchange Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tel-Aviv Stock Exchange research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Tel-Aviv Stock Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tel-Aviv Stock Exchange's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives