- Israel

- /

- Capital Markets

- /

- TASE:TASE

If You Had Bought Tel-Aviv Stock Exchange (TLV:TASE) Stock A Year Ago, You Could Pocket A 40% Gain Today

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the The Tel-Aviv Stock Exchange Ltd. (TLV:TASE) share price is 40% higher than it was a year ago, much better than the market return of around 2.1% (not including dividends) in the same period. That's a solid performance by our standards! Tel-Aviv Stock Exchange hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Tel-Aviv Stock Exchange

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

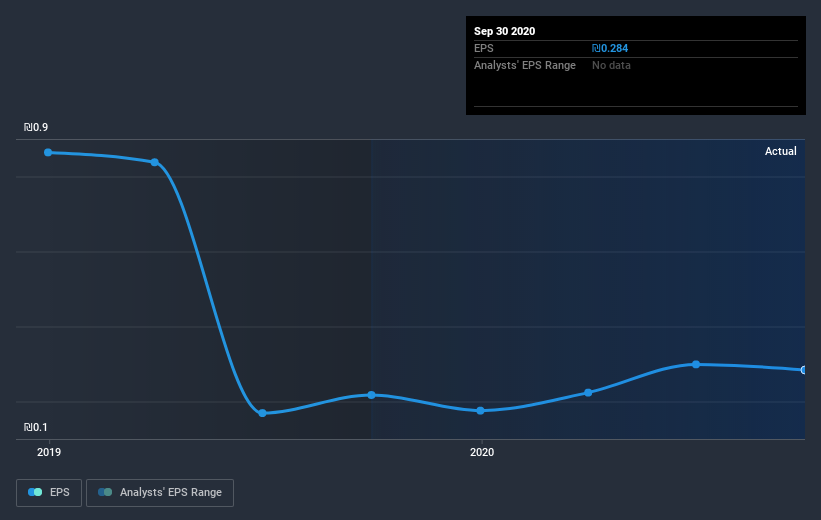

Tel-Aviv Stock Exchange was able to grow EPS by 31% in the last twelve months. This EPS growth is significantly lower than the 40% increase in the share price. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 57.88 also points to this optimism.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Tel-Aviv Stock Exchange has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's nice to see that Tel-Aviv Stock Exchange shareholders have gained 41% over the last year, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 8.9% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Tel-Aviv Stock Exchange is showing 1 warning sign in our investment analysis , you should know about...

Of course Tel-Aviv Stock Exchange may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you’re looking to trade Tel-Aviv Stock Exchange, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:TASE

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026