- Israel

- /

- Diversified Financial

- /

- TASE:VALC

Take Care Before Diving Into The Deep End On Group Psagot for Finance and Investments Ltd (TLV:GPST)

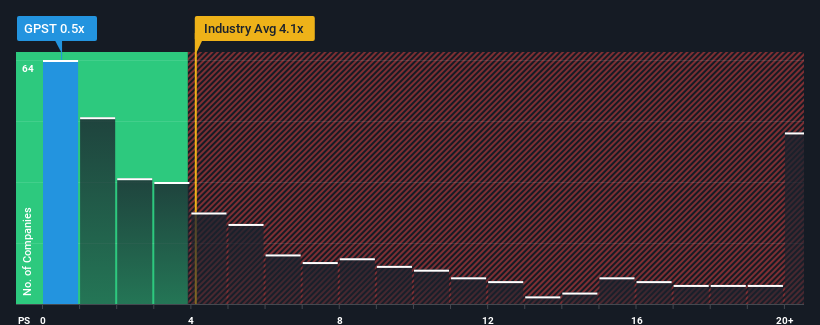

When you see that almost half of the companies in the Diversified Financial industry in Israel have price-to-sales ratios (or "P/S") above 2.3x, Group Psagot for Finance and Investments Ltd (TLV:GPST) looks to be giving off some buy signals with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Group Psagot for Finance and Investments

How Has Group Psagot for Finance and Investments Performed Recently?

With revenue growth that's exceedingly strong of late, Group Psagot for Finance and Investments has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Group Psagot for Finance and Investments, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Group Psagot for Finance and Investments?

The only time you'd be truly comfortable seeing a P/S as low as Group Psagot for Finance and Investments' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 84% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 9.5% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Group Psagot for Finance and Investments' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Group Psagot for Finance and Investments' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Group Psagot for Finance and Investments is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Group Psagot for Finance and Investments that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:VALC

Value Capital One

Provides financial services to small and medium-sized, associations, regional councils, municipalities, corporations, and large companies in Israel.

Slight with mediocre balance sheet.

Market Insights

Community Narratives