- United Arab Emirates

- /

- Diversified Financial

- /

- DFM:AMANAT

Exploring Middle East's Hidden Gems Including Amanat Holdings PJSC and Two Promising Small Caps

Reviewed by Simply Wall St

As most Gulf markets experience gains driven by strong corporate earnings and rising oil prices, the Middle East's investment landscape is capturing increasing attention from global investors. In this dynamic environment, discovering stocks with solid fundamentals and growth potential can be particularly rewarding, as they stand to benefit from the region's economic momentum and sectoral developments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC is an investment company that focuses on the education and healthcare sectors in the UAE and internationally, with a market capitalization of AED2.85 billion.

Operations: Amanat Holdings PJSC generates revenue primarily from its investments in the education sector, contributing AED485.25 million, and the healthcare sector, contributing AED365.18 million.

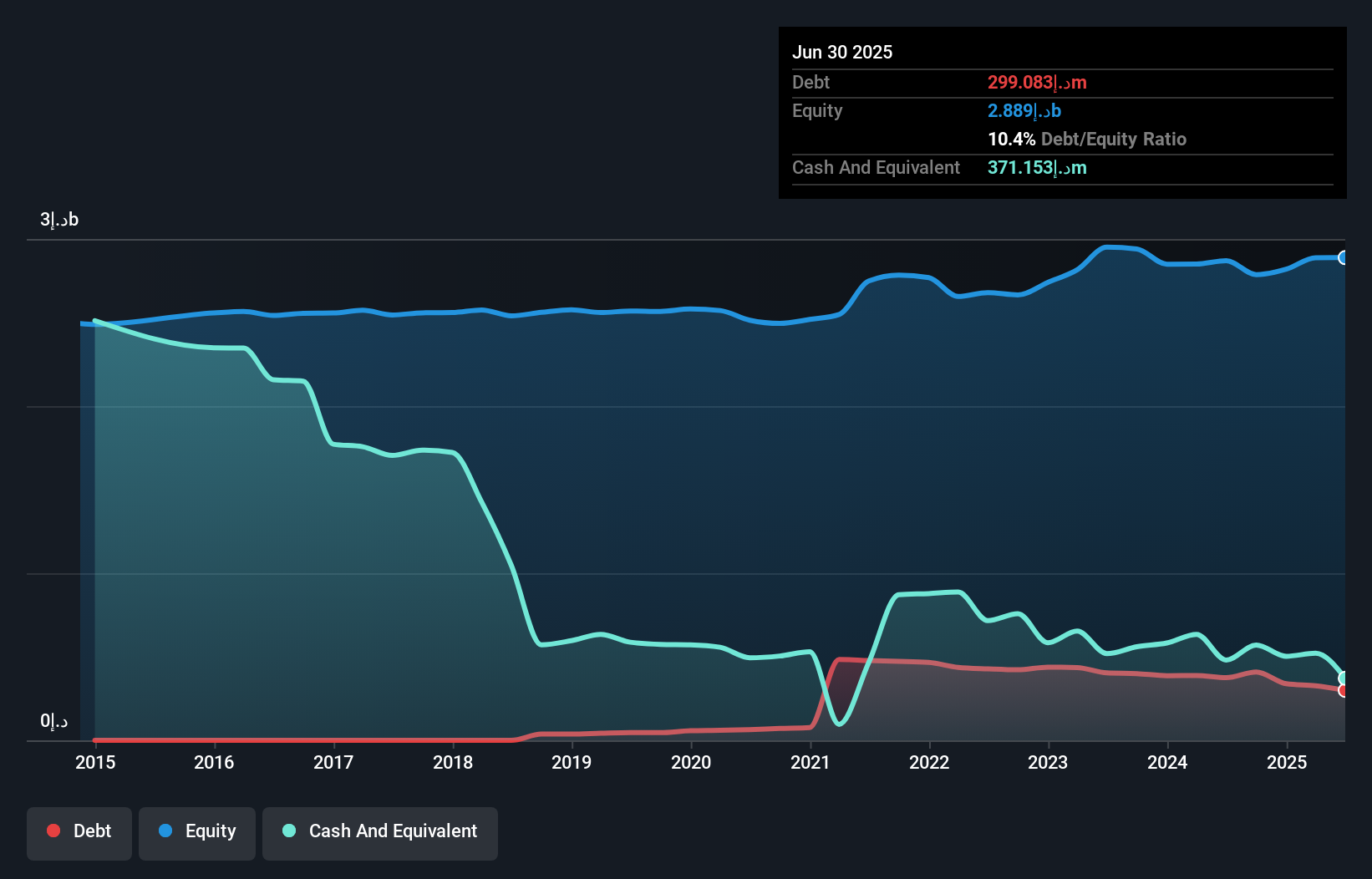

Amanat Holdings, a standout in the Middle East's financial landscape, has shown impressive earnings growth of 212.5% over the past year, outpacing its industry peers. The company reported sales of AED 227.66 million for Q2 2025, up from AED 200.56 million a year prior, with net income rising to AED 47.36 million from AED 40.43 million. Despite a rise in its debt-to-equity ratio from 2.5% to 10.4% over five years, Amanat maintains high-quality earnings and positive free cash flow while holding more cash than total debt—an encouraging sign for potential investors seeking robust financial health and growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Amanat Holdings PJSC.

Explore historical data to track Amanat Holdings PJSC's performance over time in our Past section.

National Company for Learning and Education (SASE:4291)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Company for Learning and Education operates a network of educational institutions across various levels in Saudi Arabia, with a market capitalization of SAR 7.23 billion.

Operations: The company's revenue streams are primarily generated from its network of schools, with significant contributions from Al-Rayan Schools at SAR 96.96 million and Al Qairwan Schools at SAR 91.19 million. Cost structures and profitability metrics are not detailed in the provided data, limiting further analysis on margins.

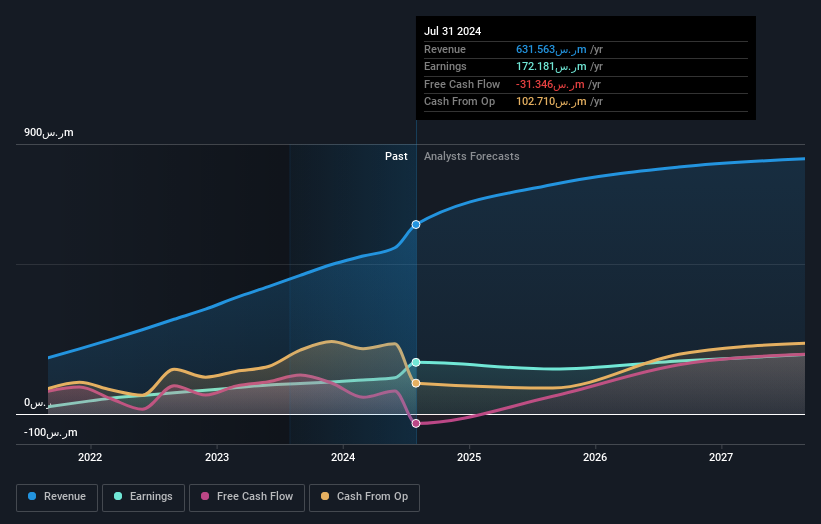

National Company for Learning and Education (NCLE) is making waves with its strategic expansion in Riyadh, aiming to establish a new educational complex at an estimated cost of SR 64 million. This initiative aligns with NCLE's growth strategy, targeting increased student enrollment. Financially robust, NCLE boasts more cash than total debt and has reduced its debt-to-equity ratio from 8.2% to 4% over five years. With earnings surging by 71.9%, outpacing the industry average of 13.5%, the company demonstrates strong performance metrics, including interest coverage by EBIT at a notable 12x ratio, underscoring financial stability and growth potential.

Analyst I.M.S. Investment Management Services (TASE:ANLT)

Simply Wall St Value Rating: ★★★★★★

Overview: Analyst I.M.S. Investment Management Services Ltd is a publicly owned investment manager with a market cap of ₪1.58 billion.

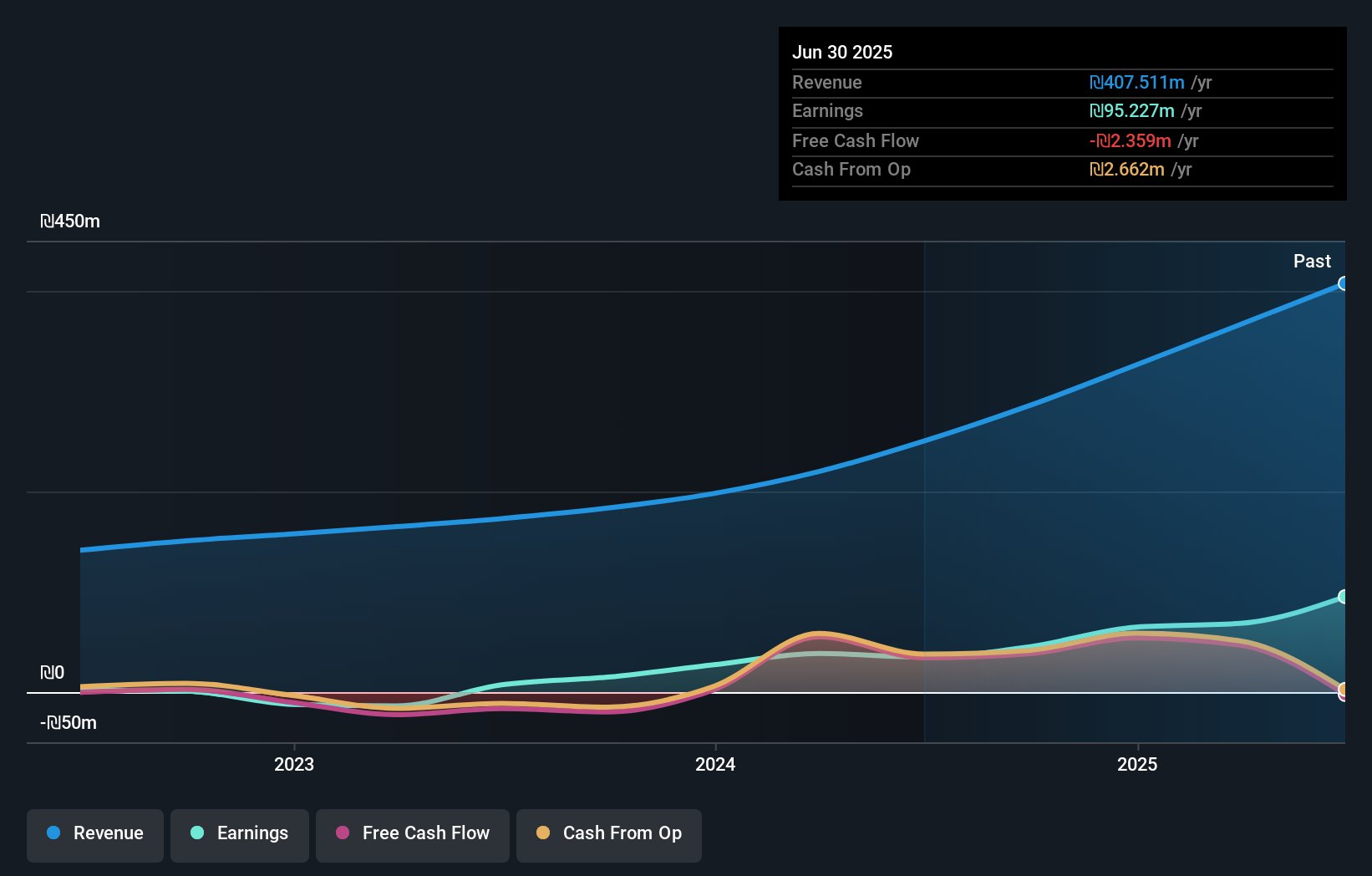

Operations: Analyst I.M.S. generates revenue primarily from investment management services, amounting to ₪407.51 million. The company also engages in investments for its own account, contributing ₪43.29 million to its revenue.

Analyst I.M.S. Investment Management Services, a modestly sized player in the financial sector, recently joined the S&P Global BMI Index, signaling its growing relevance. With no debt on its books for over five years and a remarkable earnings growth of 172.7% last year, it outpaced the Capital Markets industry's 42.3%. The company reported impressive second-quarter results with revenue hitting ILS 117.93 million and net income at ILS 32.61 million compared to last year's figures of ILS 76.89 million and ILS 5.88 million respectively, reflecting robust performance despite not being free cash flow positive yet.

Turning Ideas Into Actions

- Gain an insight into the universe of 203 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AMANAT

Amanat Holdings PJSC

Engages in the investment in companies and enterprises in the fields of education and healthcare in the United Arab Emirates and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives