- Israel

- /

- Capital Markets

- /

- TASE:ANLT

Did You Participate In Any Of Analyst I.M.S. Investment Management Services' (TLV:ANLT) Respectable 67% Return?

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But Analyst I.M.S. Investment Management Services Ltd (TLV:ANLT) has fallen short of that second goal, with a share price rise of 38% over five years, which is below the market return. Zooming in, the stock is up just 4.8% in the last year.

View our latest analysis for Analyst I.M.S. Investment Management Services

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Analyst I.M.S. Investment Management Services' earnings per share are down 39% per year, despite strong share price performance over five years. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 10% per year is probably viewed as evidence that Analyst I.M.S. Investment Management Services is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

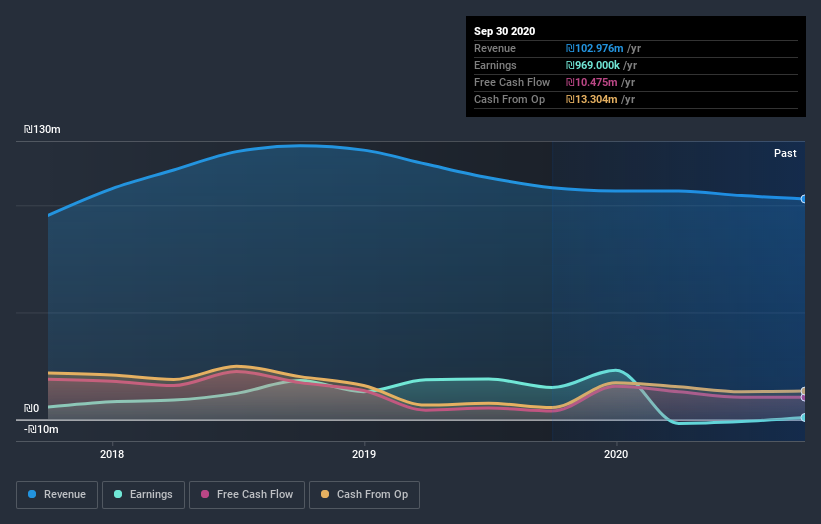

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Analyst I.M.S. Investment Management Services' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Analyst I.M.S. Investment Management Services' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Analyst I.M.S. Investment Management Services shareholders, and that cash payout contributed to why its TSR of 67%, over the last 5 years, is better than the share price return.

A Different Perspective

It's good to see that Analyst I.M.S. Investment Management Services has rewarded shareholders with a total shareholder return of 4.8% in the last twelve months. However, the TSR over five years, coming in at 11% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Analyst I.M.S. Investment Management Services better, we need to consider many other factors. For example, we've discovered 3 warning signs for Analyst I.M.S. Investment Management Services that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Analyst I.M.S. Investment Management Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ANLT

Analyst I.M.S. Investment Management Services

A publicly owned investment manager.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success