- Israel

- /

- Food and Staples Retail

- /

- TASE:YHNF

Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, small-cap stocks have shown resilience despite broader market challenges. Amidst this backdrop, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and the ability to adapt to changing conditions, making them potential undiscovered gems in an evolving investment landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 246.97% | 20.29% | 38.28% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Electrolux Professional (OM:EPRO B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Electrolux Professional AB (publ) offers comprehensive food service, beverage, and laundry solutions to various sectors including restaurants, hotels, healthcare, and educational facilities with a market cap of SEK21.53 billion.

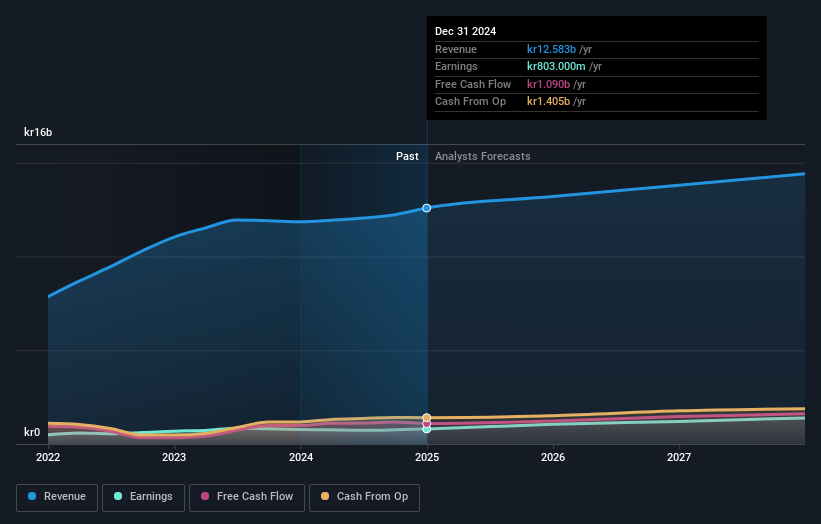

Operations: Electrolux Professional generates revenue primarily from its Food & Beverage segment, which accounts for SEK7.59 billion, and the Laundry segment, contributing SEK4.99 billion.

Electrolux Professional, a standout in the machinery industry, has shown steady performance with earnings growth of 3.6% over the past year, outpacing the industry's 2.4%. The company's net debt to equity ratio stands at a satisfactory 36.8%, indicating prudent financial management. Trading at 41% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Recent financial results highlight sales of SEK 12.58 billion and net income of SEK 803 million for 2024, alongside a proposed dividend increase to SEK 0.85 per share from SEK 0.80, reflecting confidence in future earnings prospects and shareholder returns.

- Click here and access our complete health analysis report to understand the dynamics of Electrolux Professional.

Understand Electrolux Professional's track record by examining our Past report.

M.Yochananof and Sons (1988) (TASE:YHNF)

Simply Wall St Value Rating: ★★★★☆☆

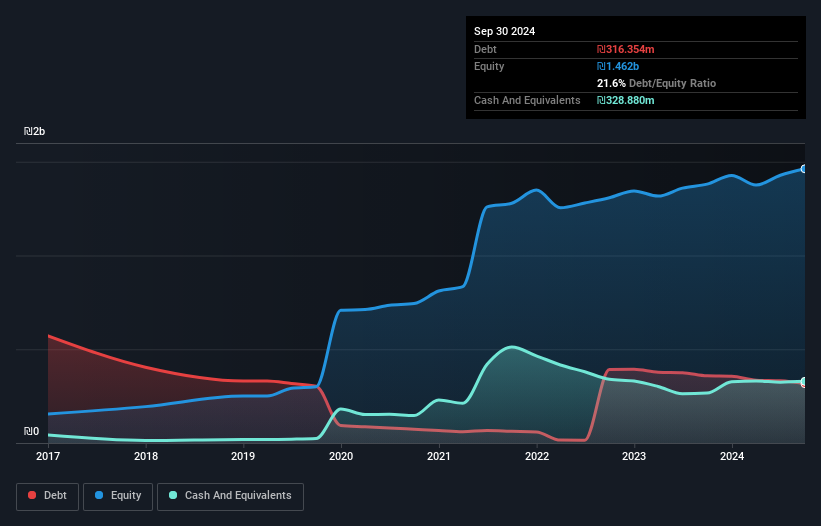

Overview: M.Yochananof and Sons (1988) Ltd operates in the marketing and retail trade of food and related products in Israel, with a market cap of ₪3.68 billion.

Operations: The company generates revenue primarily from the food retail sector, amounting to ₪4.38 billion.

Yochananof's recent performance paints a promising picture, with earnings surging by 59.6% over the past year, outpacing the Consumer Retailing industry's 56.7%. The company reported third-quarter sales of ILS 1.25 billion, up from ILS 1.05 billion last year, while net income doubled to ILS 51.07 million from ILS 25.56 million, reflecting high-quality earnings and effective cost management. Trading at a significant discount of about 71.8% below estimated fair value suggests potential undervaluation in the market's eyes; moreover, its debt-to-equity ratio has impressively decreased from 101.2% to just 21.6% over five years, indicating robust financial health and prudent fiscal management strategies in place for future growth opportunities amidst industry competition dynamics shifting rapidly around them today!

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

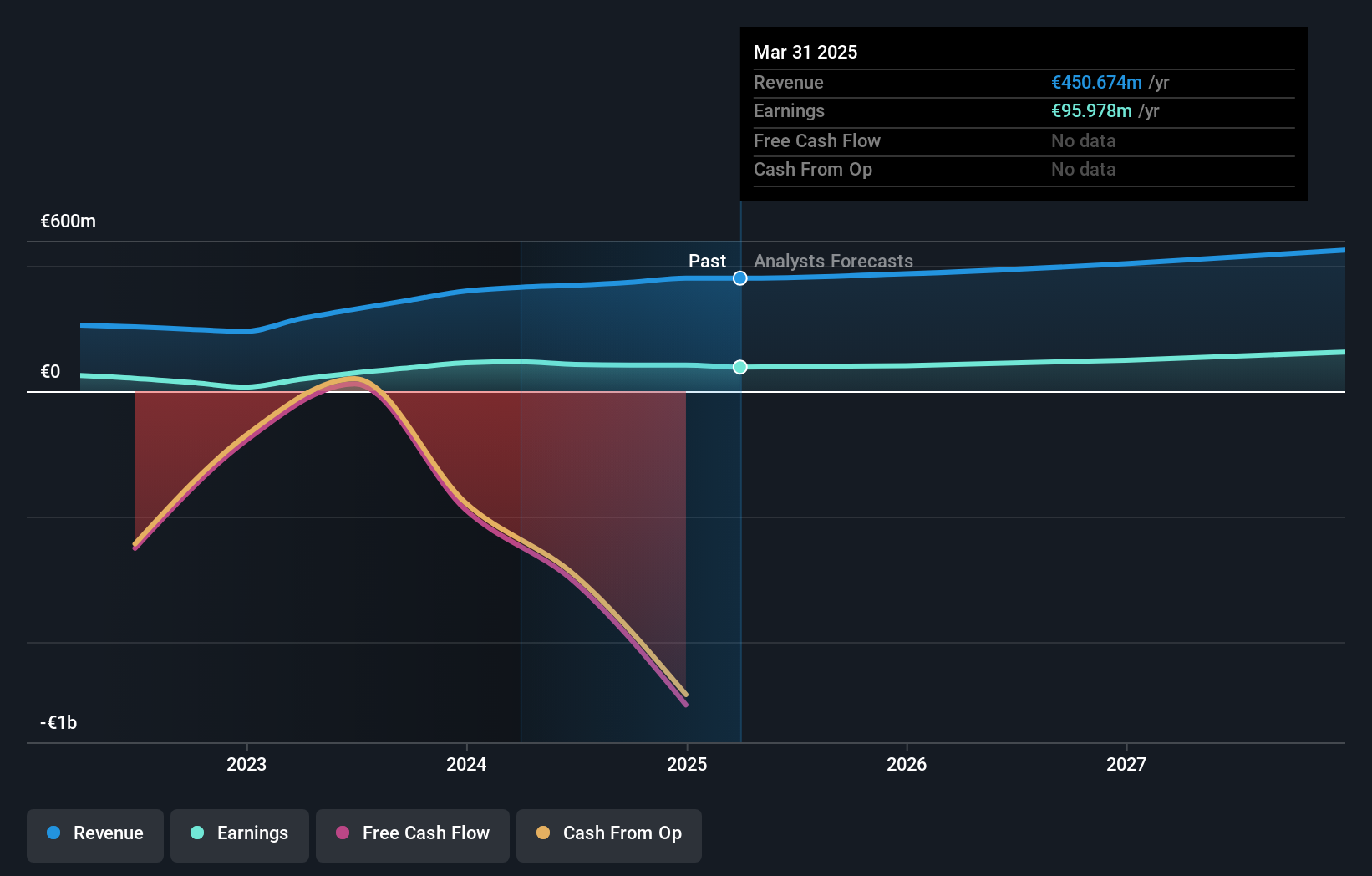

Overview: ProCredit Holding AG, along with its subsidiaries, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany, with a market capitalization of €531.26 million.

Operations: ProCredit Holding generates revenue primarily from its banking services, amounting to €433.86 million. The company's financial performance includes a net profit margin that reflects its efficiency in managing costs relative to its revenue streams.

ProCredit Holding, a notable player in the financial sector, is making strides with its €10.3 billion in total assets and €1 billion equity. The bank's strategic focus on expanding its lending portfolio to small and micro enterprises aims to bolster revenue diversification. With deposits totaling €7.8 billion against loans of €7.1 billion, it maintains a net interest margin of 3.6%. Despite having a high level of bad loans at 2.1%, ProCredit has sufficient allowance for these risks at 122%. Trading significantly below estimated fair value by 57%, it presents an intriguing opportunity for investors considering its growth prospects and industry positioning amidst economic challenges in Eastern Europe and beyond.

Make It Happen

- Click here to access our complete index of 4708 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:YHNF

M.Yochananof and Sons (1988)

Engages in the marketing and retail trade in the food and related products in Israel.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)