- Israel

- /

- Food and Staples Retail

- /

- TASE:YHNF

These 4 Measures Indicate That M.Yochananof and Sons (1988) (TLV:YHNF) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that M.Yochananof and Sons (1988) Ltd (TLV:YHNF) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for M.Yochananof and Sons (1988)

How Much Debt Does M.Yochananof and Sons (1988) Carry?

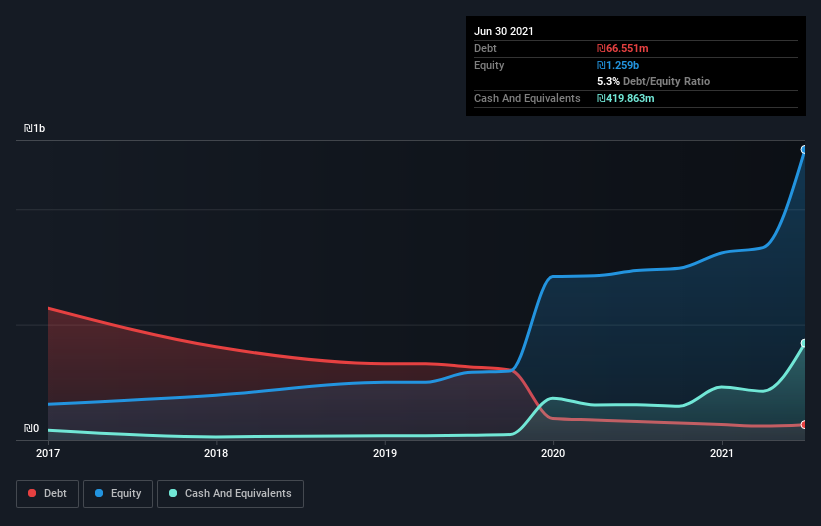

The image below, which you can click on for greater detail, shows that M.Yochananof and Sons (1988) had debt of ₪66.6m at the end of June 2021, a reduction from ₪80.1m over a year. However, it does have ₪419.9m in cash offsetting this, leading to net cash of ₪353.3m.

How Strong Is M.Yochananof and Sons (1988)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that M.Yochananof and Sons (1988) had liabilities of ₪668.4m due within 12 months and liabilities of ₪1.29b due beyond that. Offsetting this, it had ₪419.9m in cash and ₪296.2m in receivables that were due within 12 months. So it has liabilities totalling ₪1.24b more than its cash and near-term receivables, combined.

This deficit isn't so bad because M.Yochananof and Sons (1988) is worth ₪3.40b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, M.Yochananof and Sons (1988) also has more cash than debt, so we're pretty confident it can manage its debt safely.

It is well worth noting that M.Yochananof and Sons (1988)'s EBIT shot up like bamboo after rain, gaining 56% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is M.Yochananof and Sons (1988)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While M.Yochananof and Sons (1988) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, M.Yochananof and Sons (1988) recorded free cash flow of 43% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

Although M.Yochananof and Sons (1988)'s balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₪353.3m. And we liked the look of last year's 56% year-on-year EBIT growth. So we are not troubled with M.Yochananof and Sons (1988)'s debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for M.Yochananof and Sons (1988) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:YHNF

M.Yochananof and Sons (1988)

Engages in the marketing and retail trade in the food and related products in Israel.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success