- Turkey

- /

- Transportation

- /

- IBSE:GRSEL

Unveiling 3 Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

The Middle East market has recently experienced a positive shift, with most Gulf bourses rising due to encouraging U.S. economic data and ongoing trade talks, leading to renewed investor confidence particularly in the financial and real estate sectors. In this dynamic environment, identifying promising stocks often involves looking for companies that can capitalize on regional economic trends and demonstrate resilience amidst global uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gür-Sel Turizm Tasimacilik ve Servis Ticaret (IBSE:GRSEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gür-Sel Turizm Tasimacilik ve Servis Ticaret A.S. operates in the transportation sector, focusing on railroads, with a market capitalization of TRY27.23 billion.

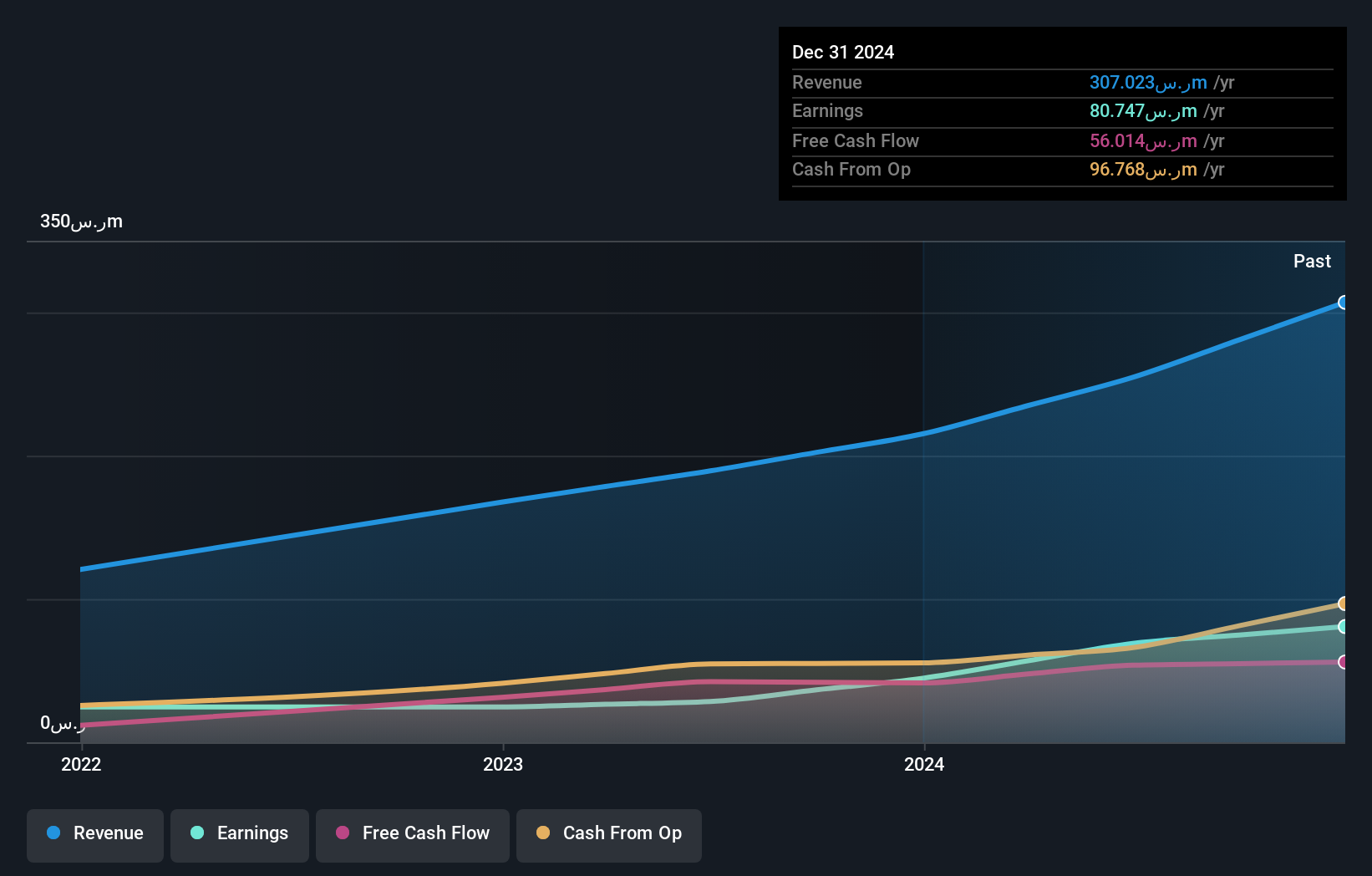

Operations: The company generates revenue primarily from its rail transportation segment, amounting to TRY8.43 billion.

Gür-Sel Turizm, a notable player in the Middle East's transportation sector, showcases a robust financial position with cash surpassing its total debt. The company's interest payments are comfortably covered by EBIT at 68.5 times, reflecting strong earnings quality. Despite reporting TRY 2,422 million in sales for Q1 2025 compared to TRY 2,318 million the previous year, net income slightly dipped to TRY 583.8 million from TRY 594.71 million. Trading at approximately 61% below estimated fair value suggests potential undervaluation amidst recent negative earnings growth of -19.3%, aligning with industry trends over the past year.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications, with a market capitalization of SAR1.67 billion.

Operations: The company's primary revenue stream is from sales, contributing SAR273.90 million, while contracting adds SAR33.12 million.

Mohammed Hadi Al-Rasheed, a promising player in the Middle East, showcases strong financial health with earnings growth of 80.6% over the past year, outpacing its industry peers by a notable margin. The company is trading at 43.6% below its estimated fair value, suggesting potential upside for investors. Despite recent share price volatility, its interest payments are impressively covered by EBIT at 92.7 times over, indicating robust financial management. Additionally, the board's decision to distribute SAR 24 million in dividends reflects confidence in sustained profitability and shareholder value creation moving forward.

Tiv Taam Holdings 1 (TASE:TTAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tiv Taam Holdings 1 Ltd. is involved in the production, marketing, and importation of food products in Israel with a market capitalization of ₪883.81 million.

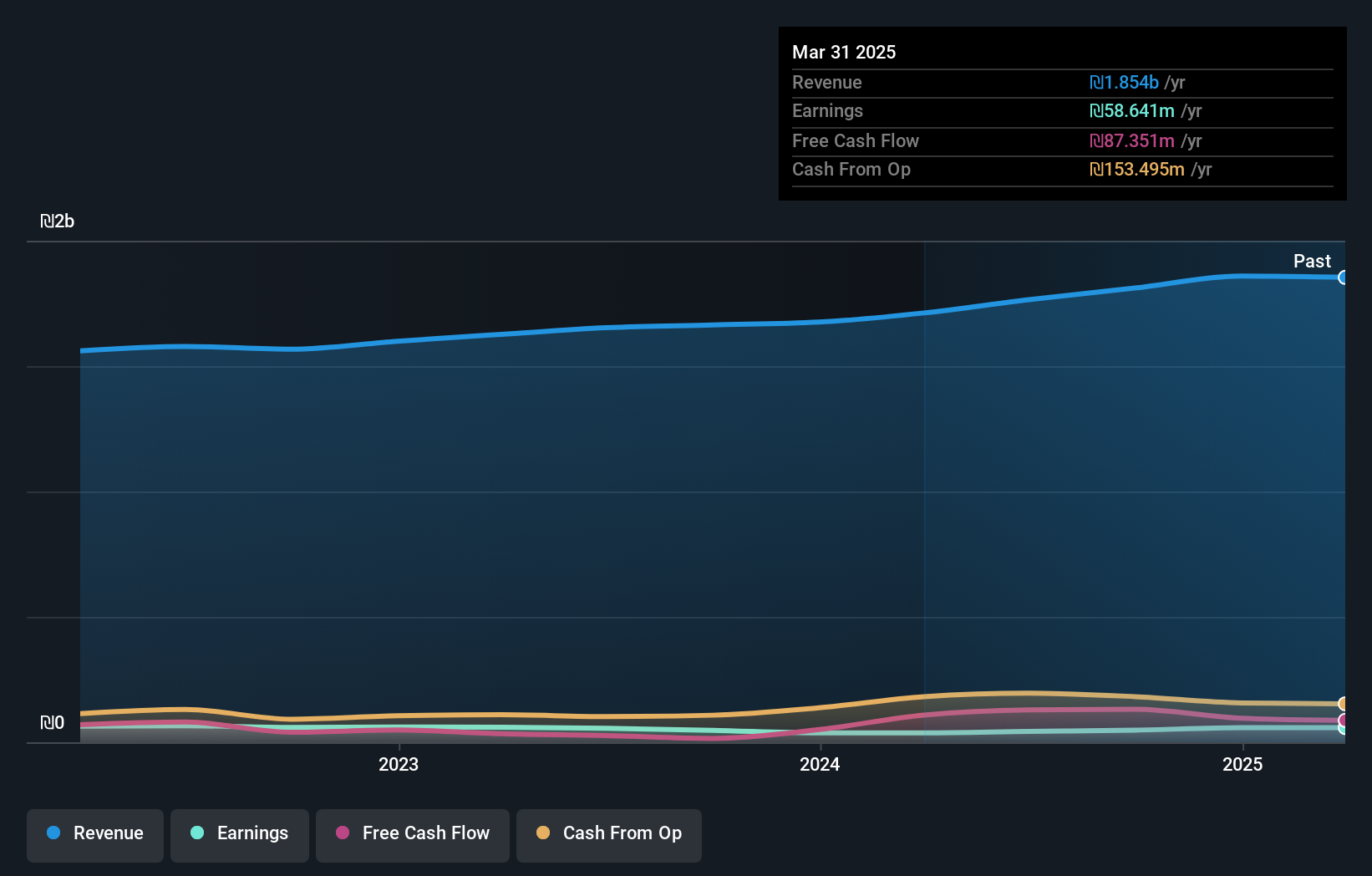

Operations: Tiv Taam Holdings 1 derives its revenue primarily from two segments: retail, generating ₪1.59 billion, and the manufacture, import, and marketing of food products, contributing ₪390.17 million.

Tiv Taam Holdings, a small player in the Middle Eastern market, showcases impressive earnings growth of 55.1% over the past year, outpacing its industry peers. With a price-to-earnings ratio of 15.1x below the IL market average, it presents an attractive valuation. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 87.3%, indicating improved financial health. Despite a slight dip in earnings by 0.9% annually over five years, recent results show net income rising to ILS 11 million from ILS 10 million last year and basic EPS climbing to ILS 0.1 from ILS 0.09.

Next Steps

- Click this link to deep-dive into the 221 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GRSEL

Gür-Sel Turizm Tasimacilik ve Servis Ticaret

Gür-Sel Turizm Tasimacilik ve Servis Ticaret A.S.

Excellent balance sheet and fair value.

Market Insights

Community Narratives