- Israel

- /

- Food and Staples Retail

- /

- TASE:TTAM

Undiscovered Gems in Middle East Stocks for November 2025

Reviewed by Simply Wall St

In recent weeks, Middle Eastern stock markets have experienced mixed performances, with Gulf bourses reacting to weak corporate earnings and uncertainty surrounding potential U.S. interest rate cuts. Despite these challenges, opportunities remain for discerning investors who can identify stocks with strong fundamentals and growth potential amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Altin Yunus Çesme Turistik Tesisler (IBSE:AYCES)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Altin Yunus Çesme Turistik Tesisler A.S. operates a hotel in Turkey with a market cap of TRY11.36 billion.

Operations: Altin Yunus Çesme Turistik Tesisler generates revenue from its hotel operations in Turkey. The company's market capitalization stands at TRY11.36 billion.

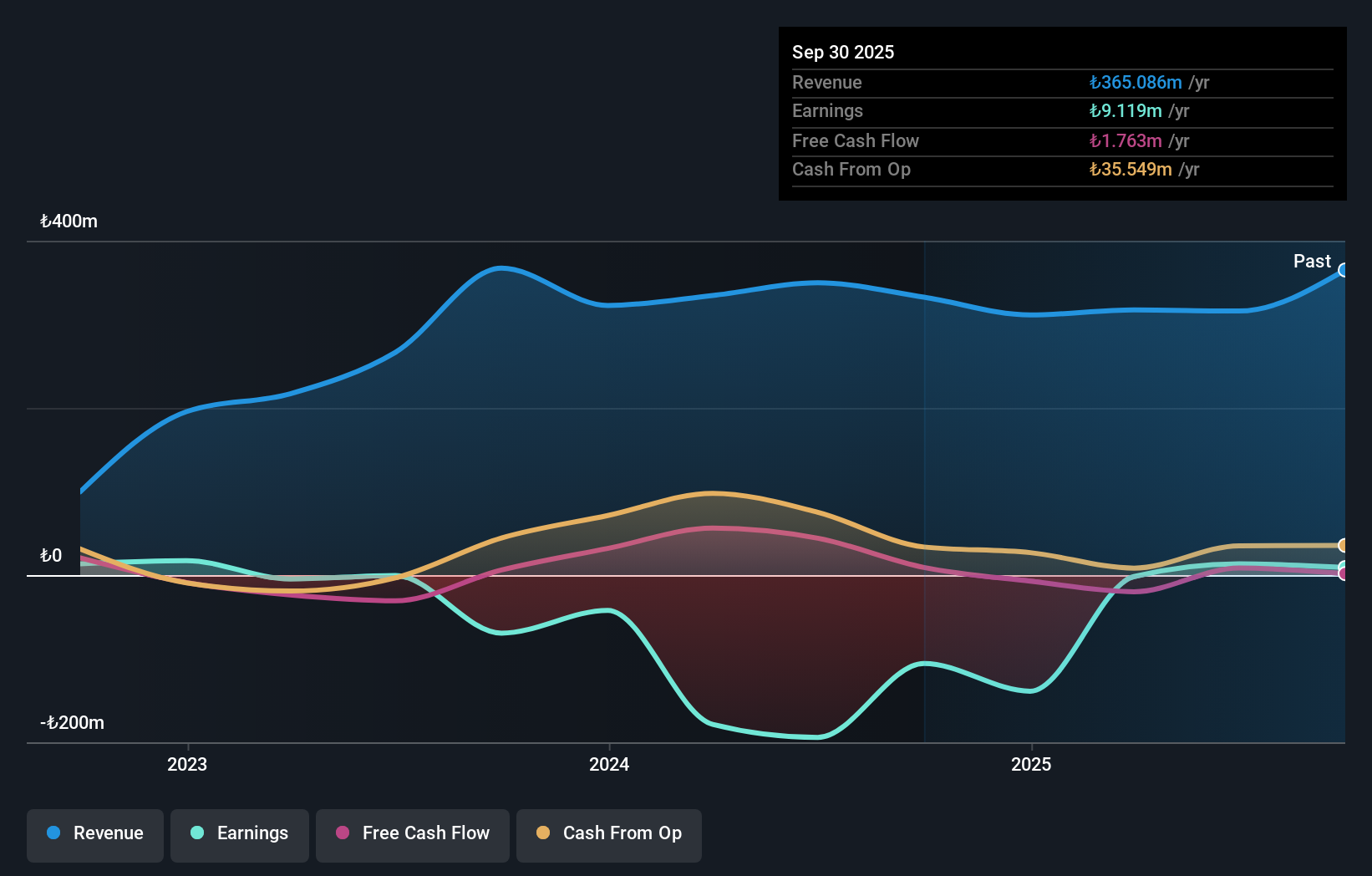

Altin Yunus Çesme's recent performance highlights its resilience despite challenges. The company has turned a corner, reporting a net income of TRY 15.76 million for the first nine months of 2025, compared to a substantial net loss of TRY 128.94 million last year. Sales for the third quarter stood at TRY 190.86 million, slightly down from TRY 201.48 million in the same period last year, yet it managed to achieve high-quality earnings and reduce its debt-to-equity ratio from 3.7% to just 0.05% over five years. With more cash than total debt and positive free cash flow, Altin Yunus Çesme seems well-positioned in the hospitality sector despite industry challenges.

Dagi Yatirim Holding (IBSE:TRHOL)

Simply Wall St Value Rating: ★★★★★★

Overview: Dagi Yatirim Holding A.S. is involved in investment activities within Turkey and has a market capitalization of TRY12.52 billion.

Operations: TRHOL's revenue streams are primarily derived from its investment activities within Turkey. The company focuses on maximizing returns through strategic investments, with a market capitalization of TRY12.52 billion indicating its significant presence in the market.

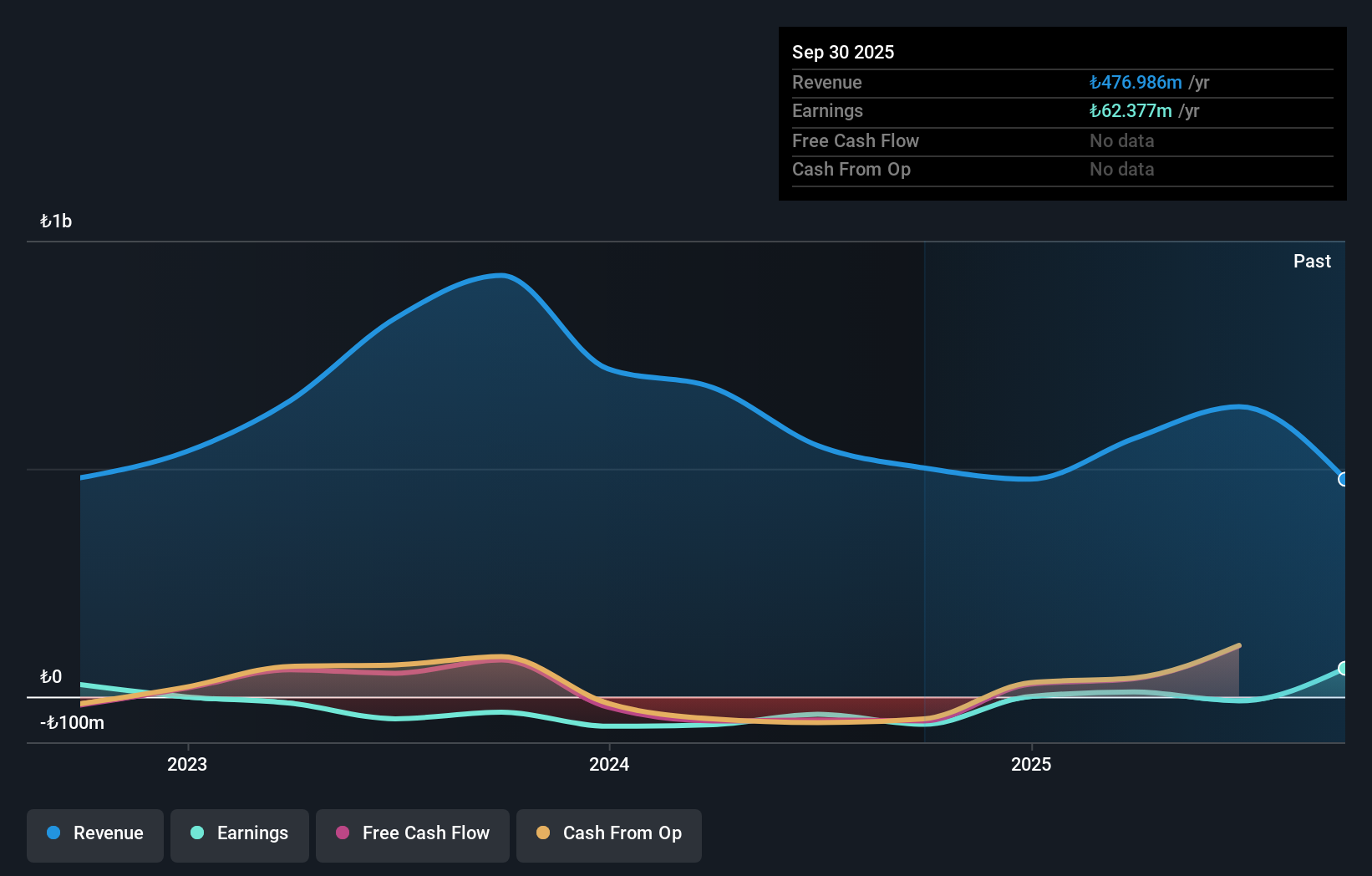

Dagi Yatirim Holding, a nimble player in the Middle East market, has recently turned profitable, reporting a net income of TRY 85.37 million for Q3 2025 compared to a net loss of TRY 9.94 million the previous year. The company remains debt-free and enjoys positive free cash flow, indicating financial stability despite its highly volatile share price over recent months. However, its financials were impacted by a significant one-off loss of TRY 30.5 million over the past year. With sales reaching TRY 421.02 million for the first half of 2025, up from TRY 261.66 million last year, Dagi Yatirim is showing signs of robust growth amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Dagi Yatirim Holding.

Assess Dagi Yatirim Holding's past performance with our detailed historical performance reports.

Tiv Taam Holdings 1 (TASE:TTAM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tiv Taam Holdings 1 Ltd. is involved in the production, marketing, and importation of food products in Israel with a market capitalization of approximately ₪974.21 million.

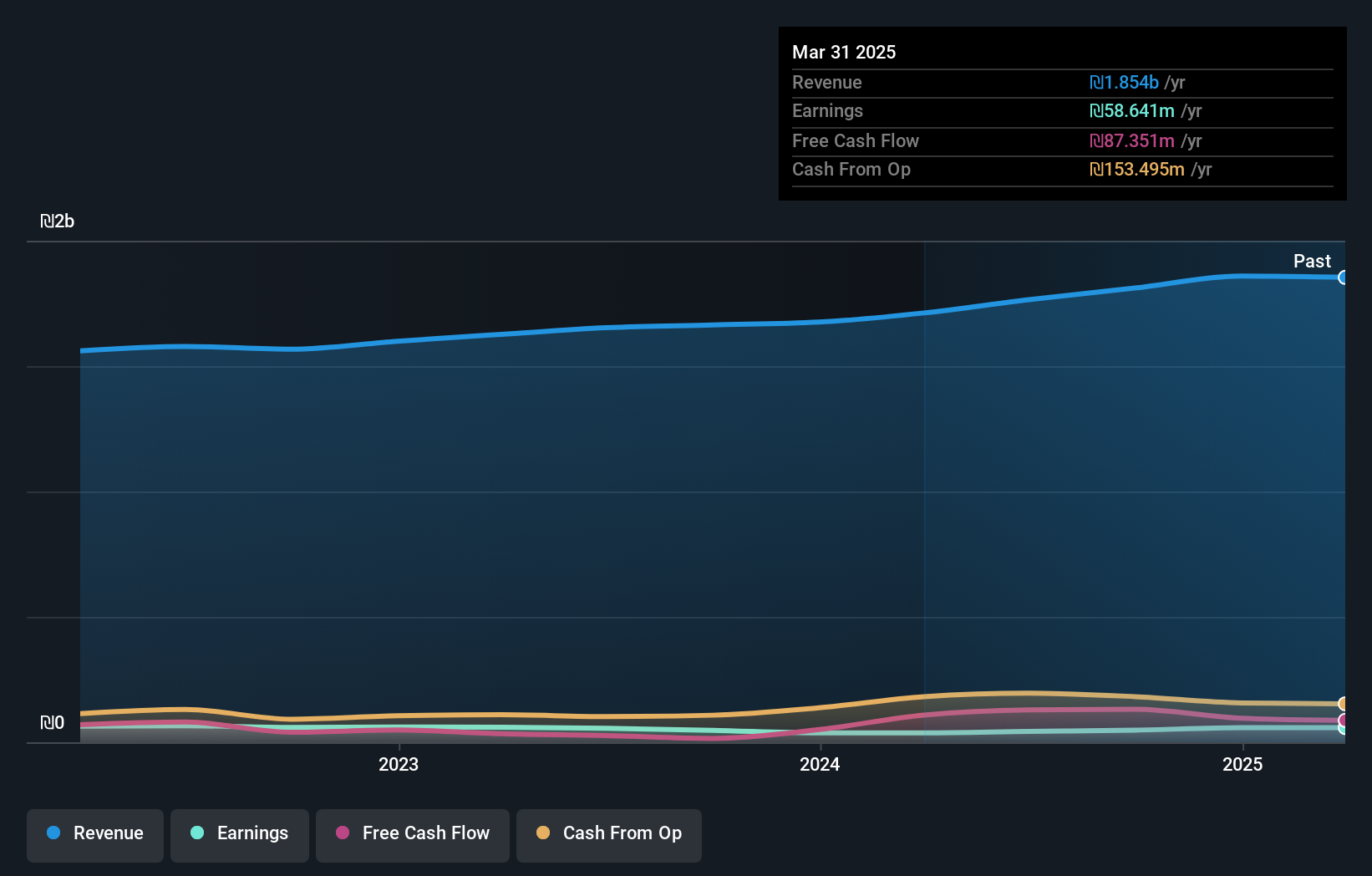

Operations: Tiv Taam generates revenue primarily from its retail segment, contributing ₪1.59 billion, and the manufacture, import, and marketing of food products, which adds another ₪441.20 million.

Tiv Taam Holdings, a notable player in the Middle Eastern market, showcases a promising profile with its debt to equity ratio improving from 56.1% to 18.3% over five years. The company reported second-quarter sales of ILS 539.71 million and net income of ILS 24.6 million, reflecting growth compared to last year’s figures. With earnings per share rising from ILS 0.2 to ILS 0.23, Tiv Taam's profitability is evident alongside a price-to-earnings ratio of 15.7x, which is favorable against the IL market average of 16.3x, suggesting potential value for investors seeking robust financial health and growth prospects in this region's consumer retailing sector.

Seize The Opportunity

- Delve into our full catalog of 212 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tiv Taam Holdings 1 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TTAM

Tiv Taam Holdings 1

Produces, markets, and imports of food products in Israel.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion