As Gulf markets experience gains driven by a rebound in oil prices and investor anticipation of the Federal Reserve's policy meeting, the Middle Eastern financial landscape continues to present opportunities for dividend-seeking investors. In such an environment, stocks that offer strong dividend yields can provide a reliable income stream while potentially benefiting from regional economic dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.46% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.25% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.54% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.05% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.72% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.97% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 9.09% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.13% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.00% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.64% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers commercial banking and financial products and services both in Turkey and internationally, with a market cap of TRY196.14 billion.

Operations: Yapi ve Kredi Bankasi A.S. generates revenue through several segments, including Retail Banking (Incl. Private Banking and Wealth Management) at TRY86.38 billion, Treasury, Asset Liability Management and Other at TRY61.59 billion, Commercial and SME Banking at TRY54.40 billion, Corporate Banking at TRY18.85 billion, Other Foreign Operations at TRY5.52 billion, and Other Domestic Operations at TRY14.79 billion.

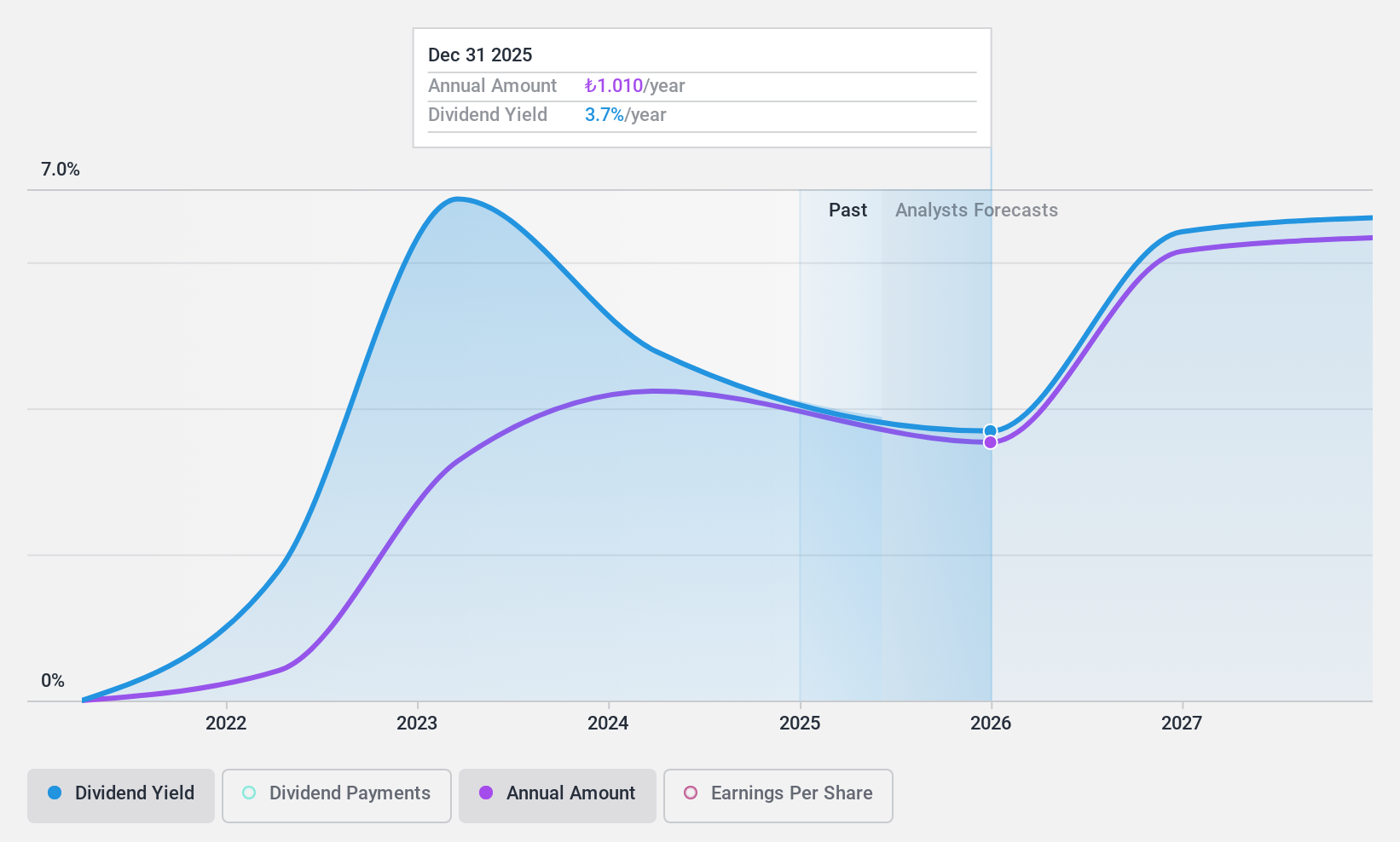

Dividend Yield: 5.2%

Yapi ve Kredi Bankasi's dividend payments are well covered by earnings with a low payout ratio of 24.5%, although they have been volatile over the past decade. Despite this instability, dividends have grown and are expected to remain covered in three years with a forecasted 15% payout ratio. The bank's dividend yield of 5.21% ranks it among the top 25% in Turkey, but high bad loans at 3.2% pose risks to sustainability. Recent earnings show increased net interest income and net income year-over-year, indicating potential for future growth amidst current challenges.

- Navigate through the intricacies of Yapi ve Kredi Bankasi with our comprehensive dividend report here.

- According our valuation report, there's an indication that Yapi ve Kredi Bankasi's share price might be on the cheaper side.

ETGA Group (TASE:ETGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ETGA Group Ltd operates in logistics and financing activities in Israel with a market cap of ₪449.65 million.

Operations: ETGA Group Ltd generates revenue from its logistics segment, amounting to ₪513.21 million, and its non-bank financing segment, contributing ₪42.96 million.

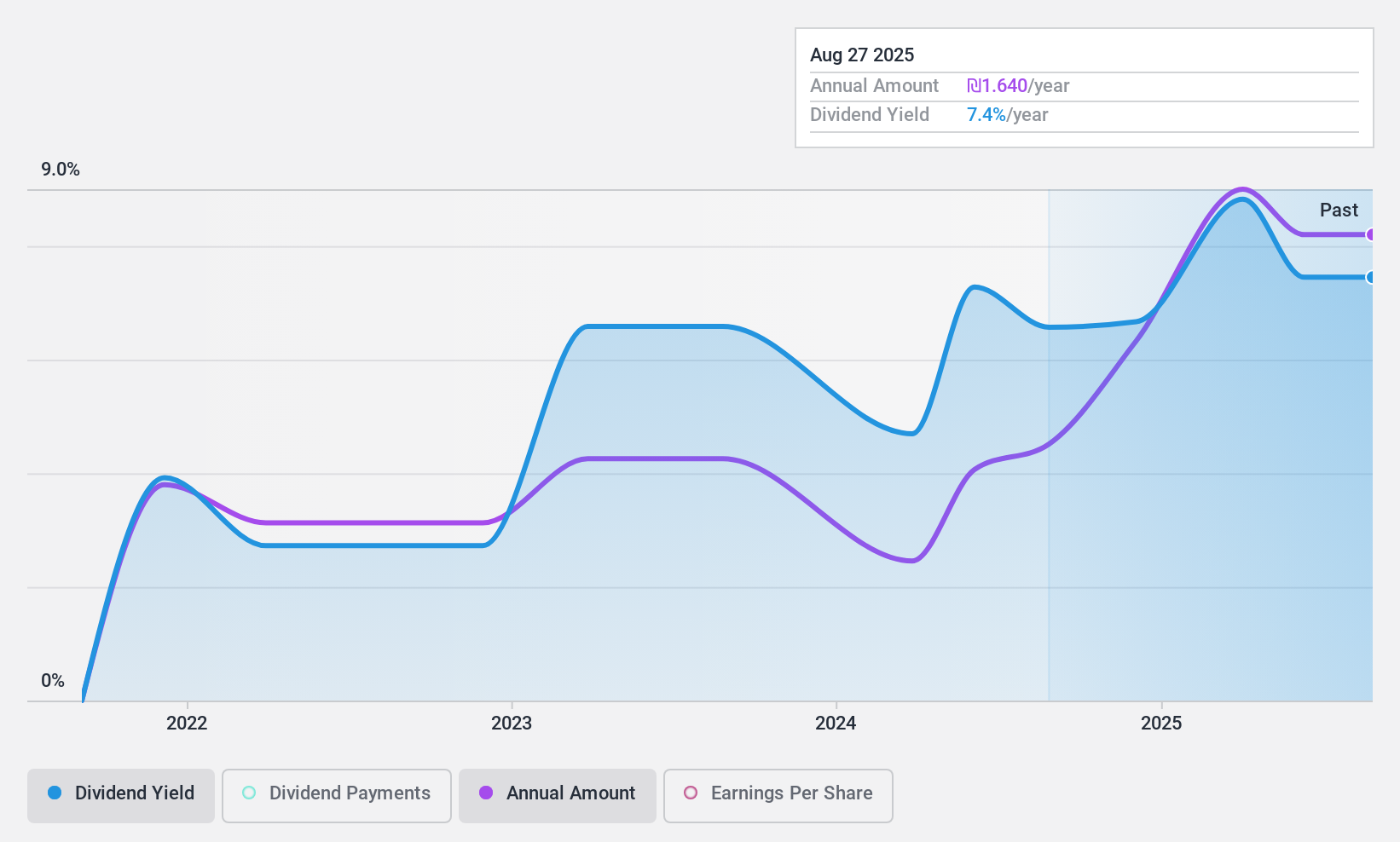

Dividend Yield: 8.8%

ETGA Group's dividend payments are covered by earnings and cash flows, with a payout ratio of 79% and a cash payout ratio of 57.5%. Despite being in the top 25% for dividend yield in the IL market at 8.85%, ETGA's dividends have been volatile over its three-year history. Recent earnings show strong growth, with revenue increasing to ILS 556.16 million from ILS 354.79 million year-over-year, but high debt levels may impact future sustainability.

- Unlock comprehensive insights into our analysis of ETGA Group stock in this dividend report.

- Our valuation report unveils the possibility ETGA Group's shares may be trading at a discount.

Shufersal (TASE:SAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shufersal Ltd. operates a chain of supermarkets under the Shufersal brand name in Israel, with a market cap of ₪9.32 billion.

Operations: Shufersal Ltd.'s revenue is primarily derived from its supermarket operations in Israel.

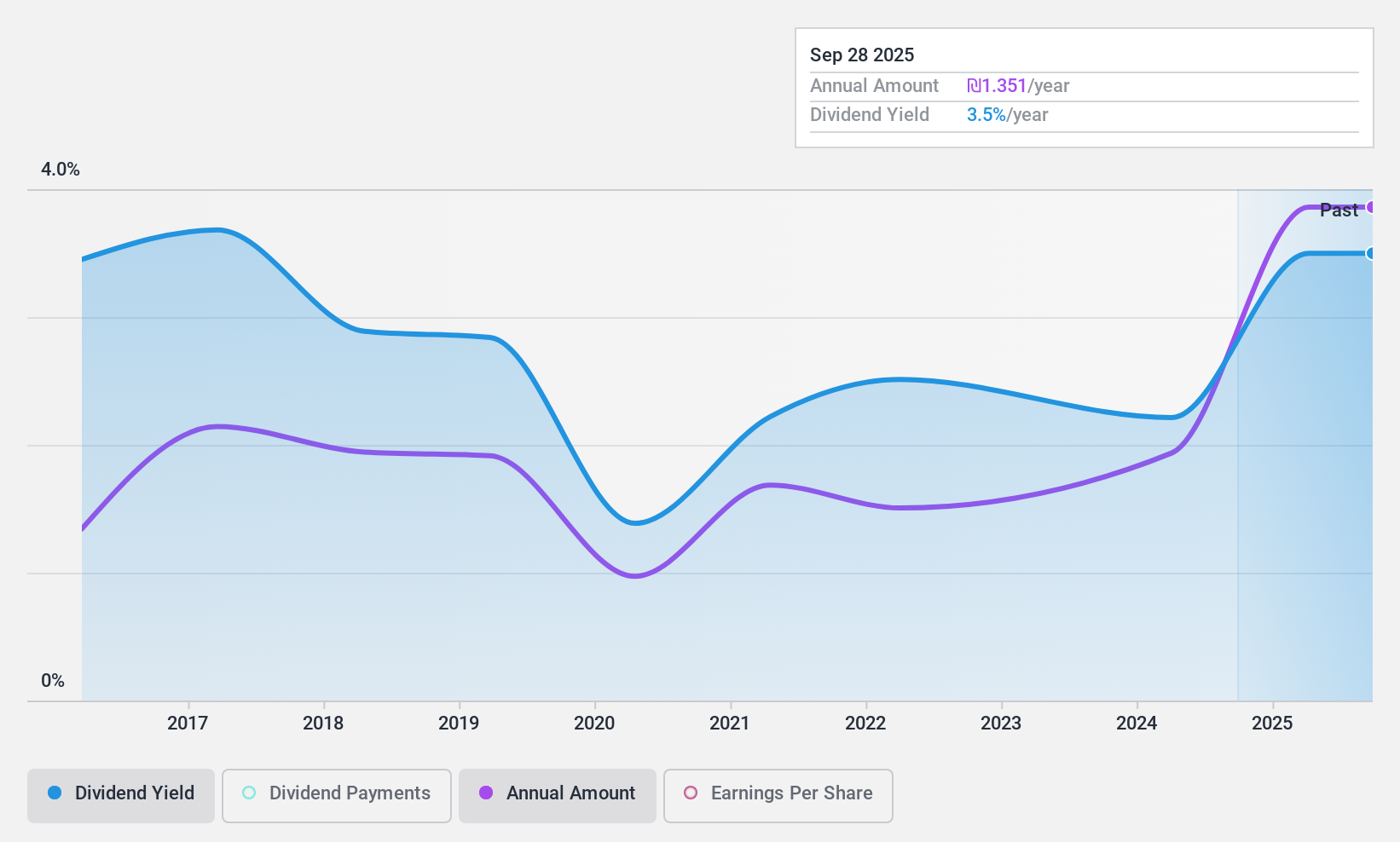

Dividend Yield: 3.9%

Shufersal's recent earnings report shows significant growth, with net income rising to ILS 657 million from ILS 312 million. While its dividend yield of 3.86% is below the top tier in the IL market, dividends are well-covered by earnings and cash flows, with payout ratios of 29.1% and 19.2%, respectively. However, Shufersal's dividend history has been volatile over the past decade despite recent increases, which may concern some investors seeking stable income streams.

- Get an in-depth perspective on Shufersal's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shufersal's current price could be quite moderate.

Turning Ideas Into Actions

- Gain an insight into the universe of 73 Top Middle Eastern Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ETGA Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ETGA

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives