- United Arab Emirates

- /

- Insurance

- /

- ADX:DHAFRA

Middle Eastern Penny Stock Highlights For June 2025

Reviewed by Simply Wall St

As tensions rise in the Middle East due to the ongoing Israel-Iran conflict, most Gulf markets have seen declines, with investors exercising caution amid fears of regional instability. Despite these challenges, certain investment opportunities remain noteworthy, particularly in the realm of penny stocks. Although often considered a relic of past trading days, penny stocks still offer potential value and growth when backed by strong financials. In this article, we explore three such stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Terminal X Online (TASE:TRX) | ₪4.629 | ₪587.91M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.84 | ₪13.05M | ✅ 1 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.72 | SAR1.49B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.032 | ₪282.99M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.02B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.91 | TRY2.06B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.24 | AED375.38M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.31 | AED9.78B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.688 | AED418.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.377 | ₪176.71M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Al Dhafra Insurance Company P.S.C (ADX:DHAFRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Dhafra Insurance Company P.S.C. operates in the insurance and reinsurance sectors across the United Arab Emirates, other GCC countries, and internationally, with a market cap of AED486 million.

Operations: The company's revenue is derived from two main segments: AED49.43 million from investments and AED70.61 million from underwriting activities.

Market Cap: AED486M

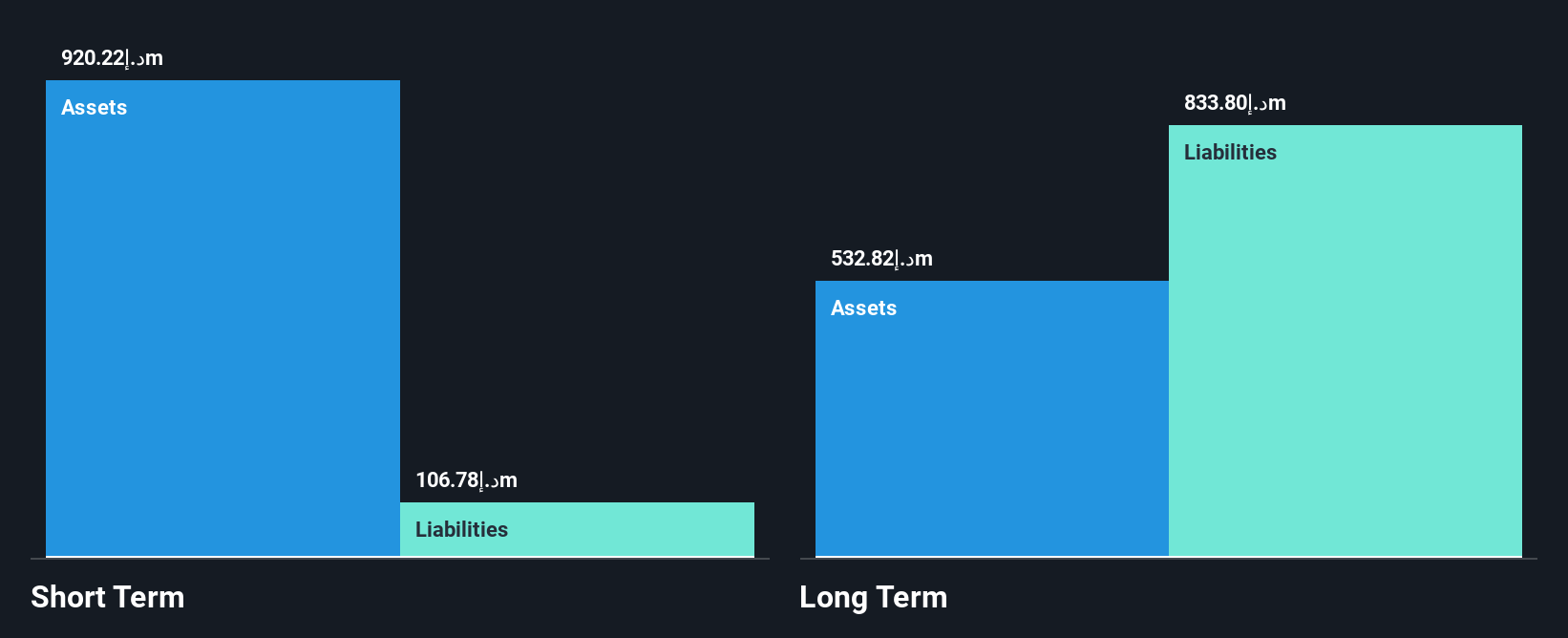

Al Dhafra Insurance Company P.S.C. recently reported a net income of AED 28.04 million for Q1 2025, showing a slight increase from AED 26.3 million the previous year, with basic earnings per share rising to AED 0.28. Despite being debt-free and having short-term assets exceeding both short- and long-term liabilities, the company has experienced declining earnings growth over the past five years at an annual rate of 9.7%. The board is experienced with an average tenure of 9.4 years, yet the company's return on equity remains low at 7.8%, alongside unstable dividend records and decreasing profit margins.

- Click here to discover the nuances of Al Dhafra Insurance Company P.S.C with our detailed analytical financial health report.

- Examine Al Dhafra Insurance Company P.S.C's past performance report to understand how it has performed in prior years.

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sonovia Ltd. is an Israeli company focused on developing and producing anti-bacterial textile products, with a market cap of ₪6.34 million.

Operations: No specific revenue segments have been reported for this Israeli company focused on anti-bacterial textile products.

Market Cap: ₪6.34M

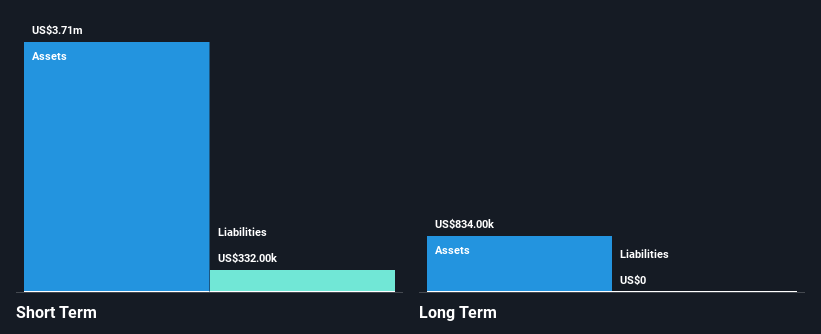

Sonovia Ltd., an Israeli company with a market cap of ₪6.34 million, remains pre-revenue, generating less than US$1 million. The company reported a net loss of US$2.86 million for 2024, improving from the previous year's loss of US$3.84 million. Despite being debt-free and having short-term assets exceeding liabilities by a significant margin, Sonovia's cash runway is limited to under a year if current cash flow trends persist. The management team is relatively new with an average tenure of 1.8 years, while the board has more experience at 3.8 years on average, amidst high share price volatility and negative returns on equity at -74.88%.

- Unlock comprehensive insights into our analysis of Sonovia stock in this financial health report.

- Learn about Sonovia's historical performance here.

Terminal X Online (TASE:TRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Terminal X Online Ltd. operates as an online retailer providing clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪587.91 million.

Operations: Terminal X Online generates revenue from its primary segment, Terminal X, amounting to ₪438.47 million, and additional income from Independent Websites totaling ₪50.48 million.

Market Cap: ₪587.91M

Terminal X Online Ltd., with a market cap of ₪587.91 million, has demonstrated significant growth and financial stability. The company's revenue for the full year 2024 was ₪492.34 million, an increase from the previous year, alongside net income turning positive at ₪25.21 million from a prior loss. Its debt-to-equity ratio has improved markedly over five years, and it maintains more cash than total debt, with short-term assets covering both short and long-term liabilities comfortably. Recent earnings showed continued growth in sales and net income for Q1 2025, while dividends were affirmed at ILS 0.1825 per share for shareholders.

- Get an in-depth perspective on Terminal X Online's performance by reading our balance sheet health report here.

- Understand Terminal X Online's track record by examining our performance history report.

Make It Happen

- Access the full spectrum of 95 Middle Eastern Penny Stocks by clicking on this link.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DHAFRA

Al Dhafra Insurance Company P.S.C

Engages in the insurance and reinsurance business in the United Arab Emirates, other GCC countries, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives