- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

3 Middle Eastern Penny Stocks With Market Caps Up To US$5B

Reviewed by Simply Wall St

As most Gulf stock markets rise, buoyed by steady oil prices, the Middle Eastern financial landscape is capturing attention with its resilience and potential. Penny stocks, though often seen as a throwback to past market trends, remain relevant due to their affordability and growth potential when backed by solid financials. In this context, we'll explore several promising penny stocks that combine value with the possibility for significant long-term growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.25 | SAR1.29B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.528 | ₪181.24M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.89 | SAR986M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.70 | AED15.77B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.891 | AED547.43M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.512 | ₪197.19M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Investments PJSC, with a market cap of AED15.77 billion, operates in property, investment, manufacturing, contracting, and services both in the United Arab Emirates and internationally through its subsidiaries.

Operations: The company's revenue is derived from property (AED2.16 billion), manufacturing, contracting, and services (AED1.47 billion), and investments (AED289.47 million).

Market Cap: AED15.77B

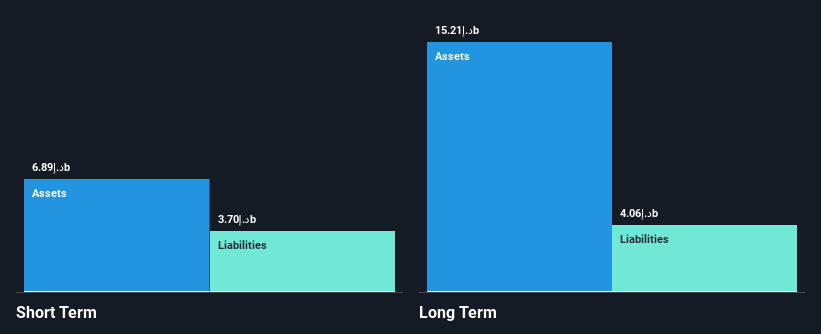

Dubai Investments PJSC has shown robust financial performance, with net income for the third quarter reaching AED 510.76 million, a significant increase from AED 241.31 million in the previous year. The company's earnings growth of 62.6% over the past year outpaced both its historical average and industry benchmarks, although this was partly influenced by a large one-off gain of AED1.1 billion. While its debt levels have improved over time, interest payments are not well covered by EBIT or operating cash flow, raising concerns about financial flexibility despite satisfactory net debt to equity ratio and strong asset coverage for liabilities.

- Unlock comprehensive insights into our analysis of Dubai Investments PJSC stock in this financial health report.

- Gain insights into Dubai Investments PJSC's outlook and expected performance with our report on the company's earnings estimates.

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sonovia Ltd., with a market cap of ₪9.12 million, is an Israeli company focused on developing and producing anti-bacterial textile products.

Operations: No revenue segments have been reported for this Israeli company specializing in anti-bacterial textile products.

Market Cap: ₪9.12M

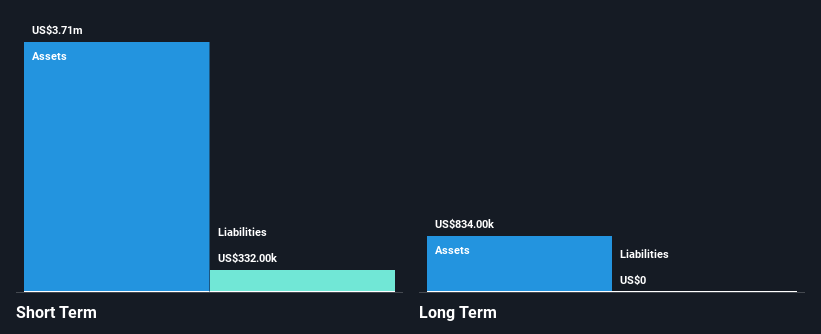

Sonovia Ltd., with a market cap of ₪9.12 million, is an Israeli company focused on anti-bacterial textile products and is currently pre-revenue, generating less than US$1 million. The company's share price has been highly volatile over the past three months, reflecting its speculative nature typical of penny stocks. Despite being debt-free and having sufficient short-term assets to cover liabilities, Sonovia's cash runway is limited to just over a year if cash flow continues to decline at historical rates. Management inexperience may pose challenges, although the board's tenure suggests some stability in governance.

- Click here to discover the nuances of Sonovia with our detailed analytical financial health report.

- Evaluate Sonovia's historical performance by accessing our past performance report.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd, along with its subsidiaries, operates an internet platform in Israel and has a market cap of ₪171.88 million.

Operations: The company generates revenue through two main segments: Credit Brokerage, which accounts for ₪37.86 million, and Providing Credit, contributing ₪0.3 million.

Market Cap: ₪171.88M

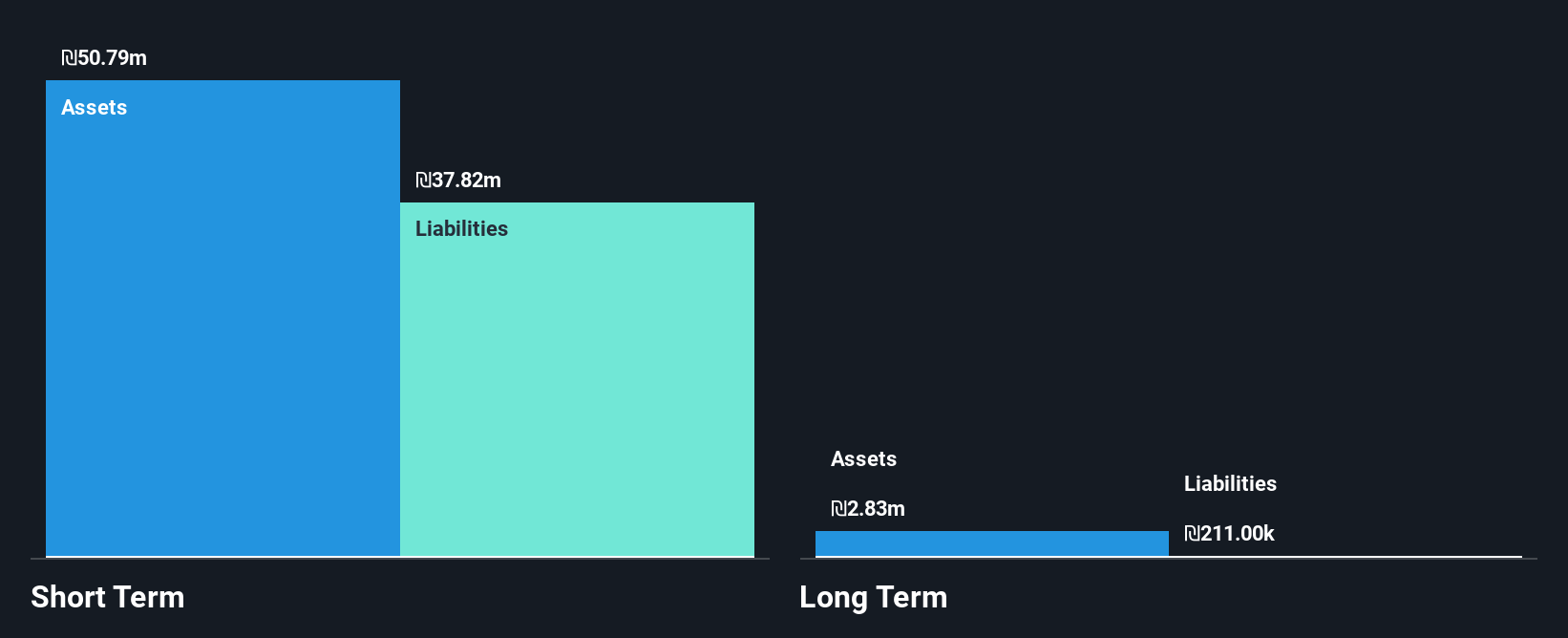

Tarya Israel Ltd, with a market cap of ₪171.88 million, operates an internet platform in Israel and faces challenges typical of penny stocks. The company reported declining sales and a net loss for the recent quarter, highlighting its unprofitable status despite reducing losses over five years at a significant rate. Tarya's financial stability is supported by more cash than debt, sufficient short-term assets to cover liabilities, and a cash runway exceeding three years based on current free cash flow. However, negative return on equity and management tenure data gaps may concern potential investors seeking stability in leadership.

- Navigate through the intricacies of Tarya Israel with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Tarya Israel's track record.

Turning Ideas Into Actions

- Discover the full array of 80 Middle Eastern Penny Stocks right here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion