- Israel

- /

- Consumer Durables

- /

- TASE:ECP

Why It Might Not Make Sense To Buy Electra Consumer Products (1970) Ltd (TLV:ECP) For Its Upcoming Dividend

Electra Consumer Products (1970) Ltd (TLV:ECP) stock is about to trade ex-dividend in 3 days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. This means that investors who purchase Electra Consumer Products (1970)'s shares on or after the 31st of March will not receive the dividend, which will be paid on the 8th of April.

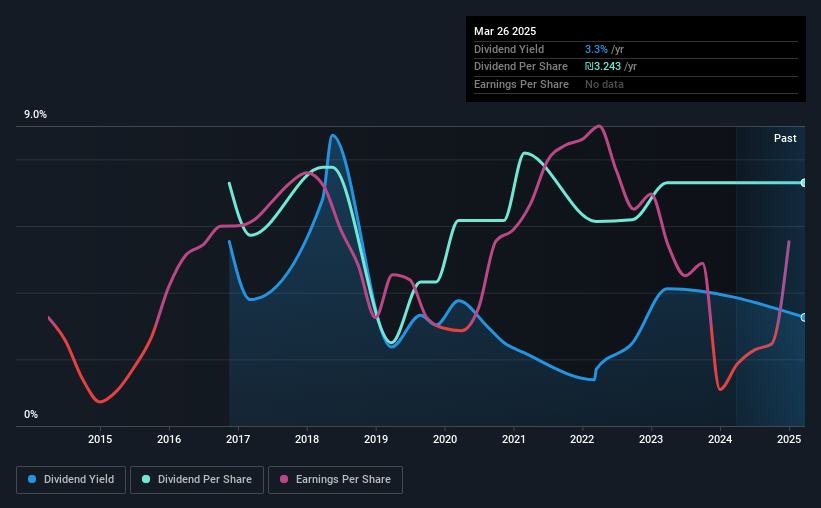

The company's next dividend payment will be ₪1.7228 per share. Last year, in total, the company distributed ₪3.24 to shareholders. Based on the last year's worth of payments, Electra Consumer Products (1970) has a trailing yield of 3.3% on the current stock price of ₪99.53. If you buy this business for its dividend, you should have an idea of whether Electra Consumer Products (1970)'s dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Electra Consumer Products (1970) paid out 64% of its earnings to investors last year, a normal payout level for most businesses.

Check out our latest analysis for Electra Consumer Products (1970)

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Readers will understand then, why we're concerned to see Electra Consumer Products (1970)'s earnings per share have dropped 15% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Electra Consumer Products (1970)'s dividend payments are effectively flat on where they were eight years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

To Sum It Up

Is Electra Consumer Products (1970) worth buying for its dividend? Earnings per share have been declining and the company is paying out more than half its profits to shareholders; not an enticing combination. We think there are likely better opportunities out there.

With that being said, if dividends aren't your biggest concern with Electra Consumer Products (1970), you should know about the other risks facing this business. Our analysis shows 2 warning signs for Electra Consumer Products (1970) that we strongly recommend you have a look at before investing in the company.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Electra Consumer Products (1970) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ECP

Electra Consumer Products (1970)

Manufactures, imports, exports, distributes, sells, and services for various consumer electrical products in Israel.

Proven track record low.

Market Insights

Community Narratives