- Israel

- /

- Consumer Durables

- /

- TASE:ECP

Electra Consumer Products (TASE:ECP) Profit Margin Doubles, Reinforcing Operational Recovery Narrative

Reviewed by Simply Wall St

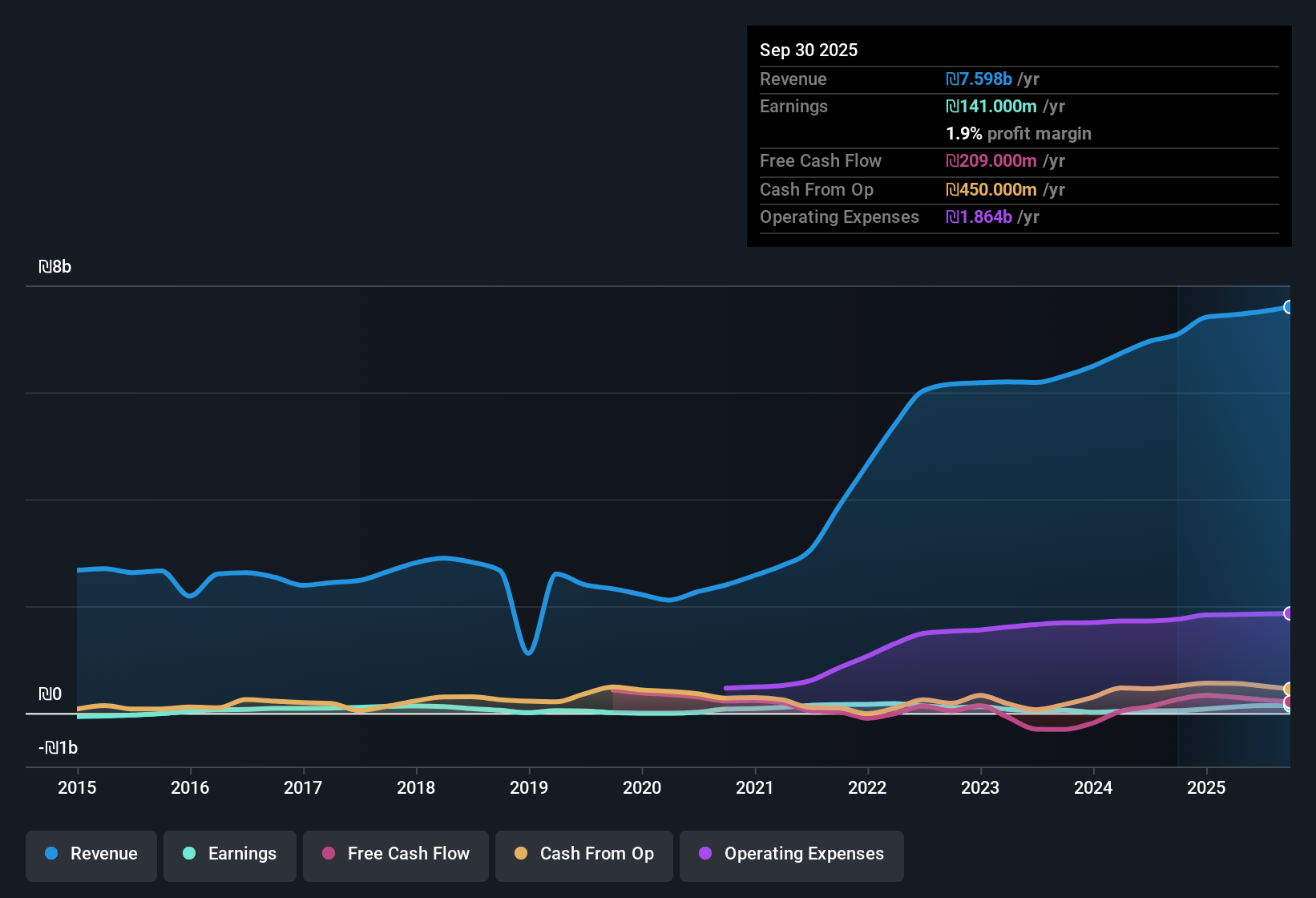

Electra Consumer Products (TASE:ECP) just released its Q3 2025 numbers, reporting total revenue of ₪2.0 billion and basic EPS of ₪1.45 for the quarter. Looking back, quarterly revenue has hovered around the ₪1.8 to 2.0 billion mark over the last year, with EPS ranging from ₪0.09 to ₪2.37, showing some sharp swings each quarter. Investors will be eyeing how profit margins are trending, as these latest results put the company’s recent momentum in the spotlight.

See our full analysis for Electra Consumer Products (1970).The next section lines these headline numbers up with the most widely held narratives for Electra Consumer Products, pointing out where investor expectations and the hard data converge and where they go in different directions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Recover, But Remain Thin

- Profit margins climbed to 1.8% over the last twelve months, more than doubling from 0.7% a year ago. This notable turnaround is anchored by improved net income of ₪138.57 million on total revenue of ₪7.6 billion.

- The prevailing market view holds that this sharp margin recovery supports the narrative of operational improvement.

- However, even with the rise, margins are still modest for the industry and investors will closely watch whether this rebound can be sustained or if sector pressures reassert themselves.

- Some analysts note that this profitability shift may drive renewed interest in Electra Consumer Products if costs remain contained and scale advantages materialize.

Price-to-Earnings Signals Relative Value

- The company's trailing price-to-earnings ratio is now 16.6x, which is below the Asian Consumer Durables industry average of 17.4x and well beneath the peer group’s 38.8x. This valuation stance suggests the share price of ₪107.90 trades at a lower earnings multiple than many rivals.

- Favorable market opinion emphasizes that this below-average multiple, paired with recent margin gains, adds weight to the argument that Electra Consumer Products may be undervalued among consumer durables companies.

- This is especially noted as its profit margin upswing is not yet fully reflected in longer-term earnings trends that have historically lagged the sector.

- Bulls point out that persistent value gaps of this kind can attract investors hunting for discounted growth stories in regional equities.

Long-Term Earnings Trend Remains a Drag

- Despite the past year’s profit surge, longer-term earnings have contracted by 8.8% per year on average over the last five years. This highlights a structural headwind even as net profits have rebounded recently.

- Market analysis frequently cautions that the swift jump in margins and net income may not erase these historical declines.

- Ongoing risk factors, such as weak coverage of interest payments by current earnings, underscore why some investors remain cautious regarding future growth durability.

- This tension between strong short-term recovery and persistent longer-term earnings slippage will shape how sentiment develops around the stock.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Electra Consumer Products (1970)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Electra Consumer Products has rebounded recently, its longer-term earnings have declined and core profit trends remain inconsistent compared to more stable peers.

If you want companies with reliable performance through every cycle, use our stable growth stocks screener (2074 results) to target businesses that deliver consistent growth and robust results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra Consumer Products (1970) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ECP

Electra Consumer Products (1970)

Manufactures, imports, exports, distributes, sells, and services for various consumer electrical products in Israel.

Proven track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success