Stock Analysis

- Israel

- /

- Consumer Durables

- /

- TASE:DUNI

Pulling back 10% this week, Duniec Bros' TLV:DUNI) five-year decline in earnings may be coming into investors focus

It hasn't been the best quarter for Duniec Bros. Ltd (TLV:DUNI) shareholders, since the share price has fallen 20% in that time. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 97% in that time.

Although Duniec Bros has shed ₪151m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Duniec Bros

We don't think that Duniec Bros' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Duniec Bros saw its revenue grow at 2.0% per year. Put simply, that growth rate fails to impress. While it's hard to say just how much value the company added over five years, the annualised share price gain of 14% seems about right. The business could be one worth watching but we generally prefer faster revenue growth.

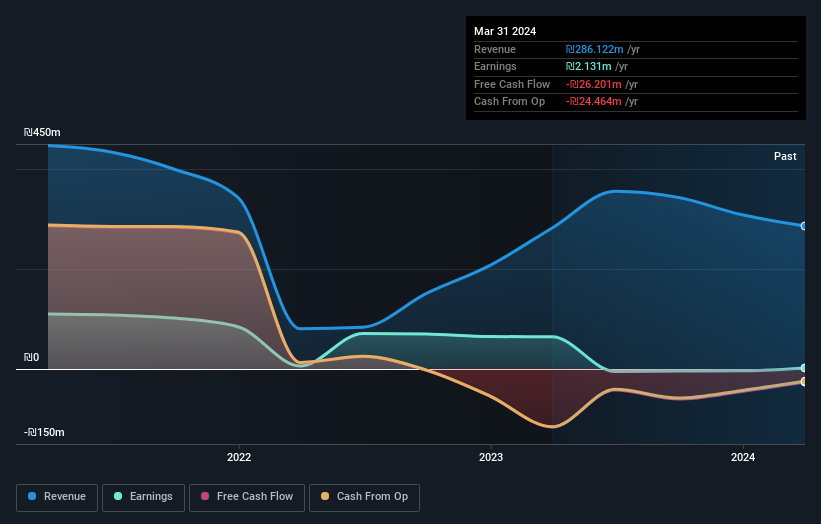

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Duniec Bros' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Duniec Bros' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Duniec Bros' TSR of 144% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 0.8% in the twelve months, Duniec Bros shareholders did even worse, losing 5.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Duniec Bros (2 are concerning) that you should be aware of.

Of course Duniec Bros may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Duniec Bros is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Duniec Bros is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DUNI

Duniec Bros

Operates as a public construction company primarily in Israel.

Mediocre balance sheet with poor track record.