- Israel

- /

- Commercial Services

- /

- TASE:UTRN

Middle Eastern Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown mixed performance, influenced by underwhelming corporate earnings and uncertainty surrounding U.S. interest rate cuts. For investors exploring opportunities in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a viable investment area. These stocks, when backed by solid financial foundations, can offer both affordability and growth potential. In this article, we will explore three such penny stocks that exhibit financial strength and could present hidden value for discerning investors.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.55 | SAR1.41B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.1B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.25 | AED13.78B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.795 | AED2.28B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.824 | AED501.81M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.726 | ₪213.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sanica Isi Sanayi (IBSE:SNICA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanica Isi Sanayi A.S. operates in Turkey, offering radiators, combi boilers, and related products, with a market cap of TRY2.99 billion.

Operations: The company generates revenue from its Building Products segment, amounting to TRY2.22 billion.

Market Cap: TRY2.99B

Sanica Isi Sanayi A.S., with a market cap of TRY2.99 billion, operates in Turkey's building products sector. Despite generating TRY2.22 billion in revenue, the company remains unprofitable and has seen its losses increase by 31.6% annually over the past five years. Its short-term assets comfortably cover both its short- and long-term liabilities, indicating solid liquidity management. However, recent financial results show a decline in sales and a shift from net income to significant net losses for both the second quarter and first half of 2025 compared to the previous year, highlighting ongoing profitability challenges despite stable debt levels and operating cash flow coverage.

- Click here to discover the nuances of Sanica Isi Sanayi with our detailed analytical financial health report.

- Gain insights into Sanica Isi Sanayi's past trends and performance with our report on the company's historical track record.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novolog (Pharm-Up 1966) Ltd operates in the healthcare services sector in Israel with a market cap of ₪655.96 million.

Operations: The company generates revenue through its Logistics Division (₪1.82 billion), Health Services Division (₪194.23 million), and Digital Division (₪26.65 million).

Market Cap: ₪655.96M

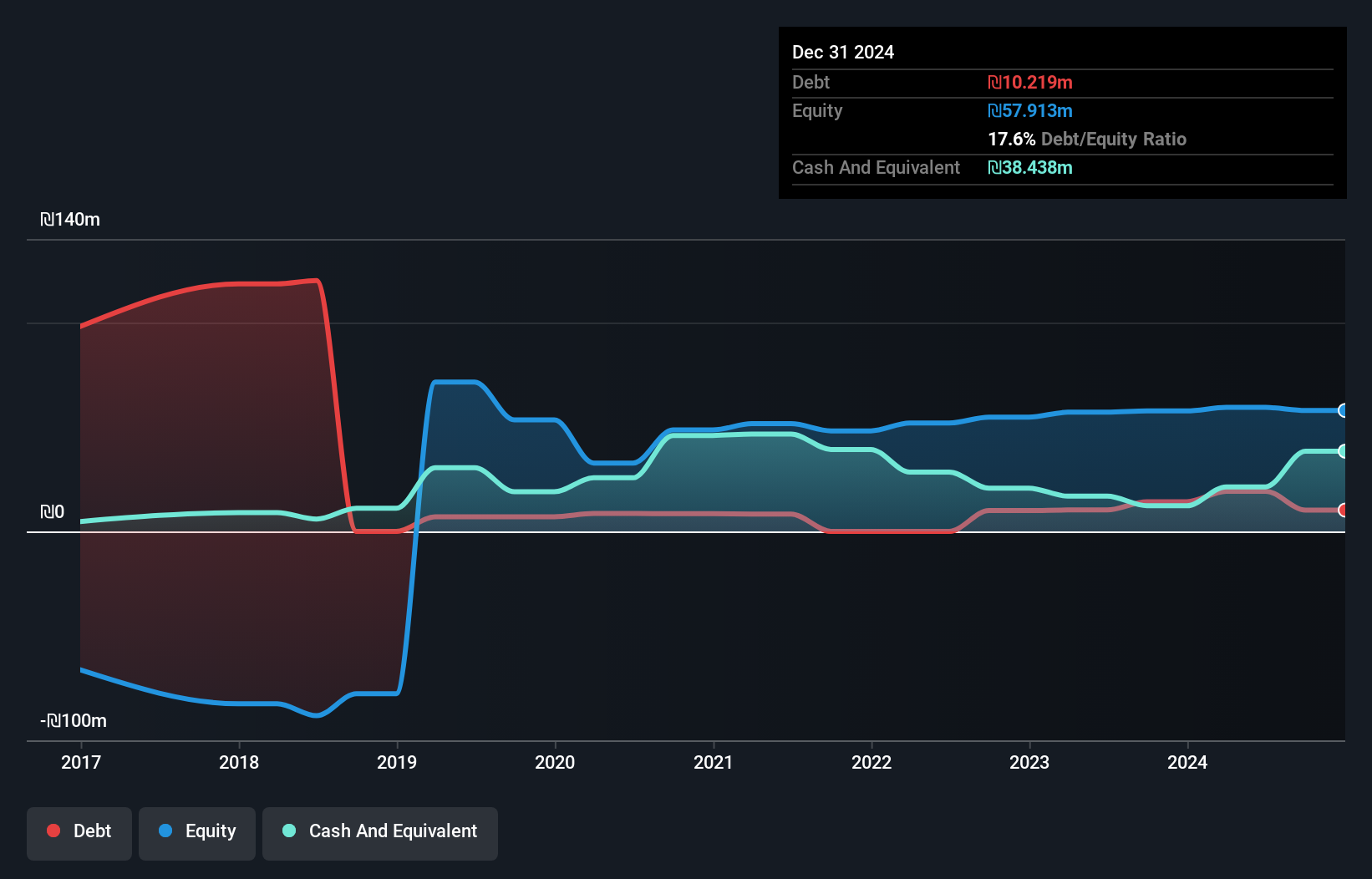

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪655.96 million, operates in Israel's healthcare services sector. Despite becoming profitable recently, its earnings have been impacted by a significant one-off loss of ₪31.6 million over the past year. The company's short-term assets fall slightly short of covering its short-term liabilities but exceed long-term liabilities comfortably. Novolog is debt-free, easing concerns about interest coverage and leverage risks. However, earnings have declined annually by 25.3% over the past five years and recent quarterly results show reduced sales and net income compared to the previous year, challenging sustained profitability despite stable weekly volatility and experienced management.

- Get an in-depth perspective on Novolog (Pharm-Up 1966)'s performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Novolog (Pharm-Up 1966)'s track record.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions and has a market cap of ₪102.52 million.

Operations: The company generates revenue from its heavy construction segment, amounting to ₪101.91 million.

Market Cap: ₪102.52M

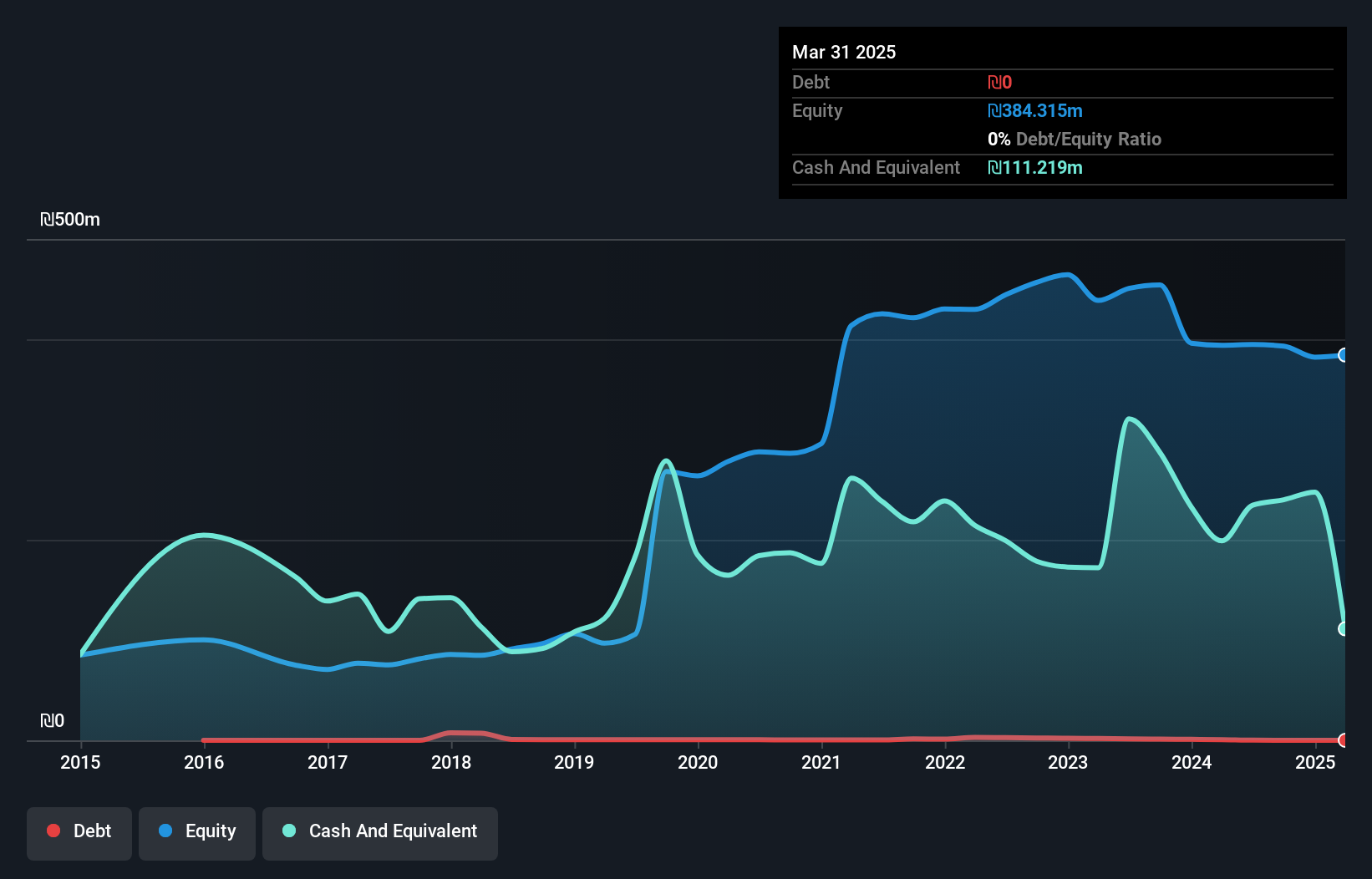

Utron Ltd, with a market cap of ₪102.52 million, has shown promising financial growth in recent times. The company reported half-year sales of ₪56.33 million and net income increased to ₪1.41 million, reflecting improved profitability with higher profit margins than last year. Utron's short-term assets comfortably cover both its short and long-term liabilities, indicating solid financial health. Despite its low return on equity at 2.6%, the company benefits from stable weekly volatility and an experienced management team with no significant shareholder dilution recently noted. Additionally, Utron's debt is well-covered by operating cash flow, reducing leverage concerns significantly.

- Dive into the specifics of Utron here with our thorough balance sheet health report.

- Learn about Utron's historical performance here.

Seize The Opportunity

- Reveal the 77 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:UTRN

Utron

Engages in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives