- Israel

- /

- Construction

- /

- TASE:YACO

Subdued Growth No Barrier To Ya'acobi Brothers Group (YSB) Ltd (TLV:YAAC) With Shares Advancing 30%

The Ya'acobi Brothers Group (YSB) Ltd (TLV:YAAC) share price has done very well over the last month, posting an excellent gain of 30%. Notwithstanding the latest gain, the annual share price return of 2.1% isn't as impressive.

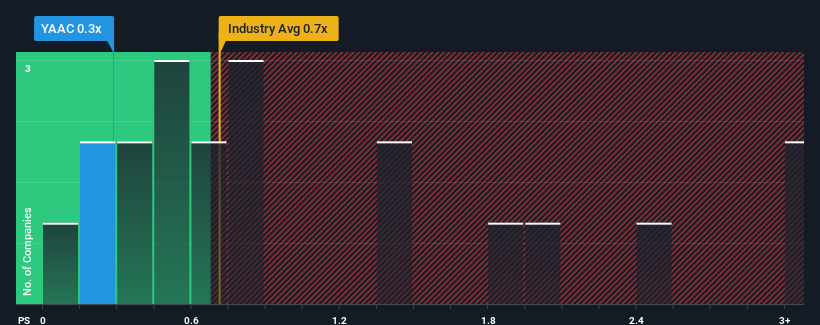

Even after such a large jump in price, there still wouldn't be many who think Ya'acobi Brothers Group (YSB)'s price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Israel's Construction industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Ya'acobi Brothers Group (YSB)

How Has Ya'acobi Brothers Group (YSB) Performed Recently?

For example, consider that Ya'acobi Brothers Group (YSB)'s financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ya'acobi Brothers Group (YSB)'s earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Ya'acobi Brothers Group (YSB) would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 27% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Ya'acobi Brothers Group (YSB) is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Ya'acobi Brothers Group (YSB)'s P/S

Ya'acobi Brothers Group (YSB) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We find it unexpected that Ya'acobi Brothers Group (YSB) trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ya'acobi Brothers Group (YSB) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:YACO

Yacobi Brothers Group (YSB)

Operates in the fields of construction, infrastructure, and entrepreneurship in Israel and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success