- Israel

- /

- Capital Markets

- /

- TASE:BIGT

Middle Eastern Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

Most Gulf markets have recently seen gains, spurred by easing US-China trade tensions and a shift in focus towards upcoming Federal Reserve policy decisions. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies, when built on solid financials, can lead to significant returns and offer investors the chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.60 | SAR1.44B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.08 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED14.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.79 | AED3.35B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.844 | AED513.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.717 | ₪213.28M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions in the United Arab Emirates and internationally, with a market capitalization of AED338 million.

Operations: The company's revenue is primarily derived from its Life segment, contributing AED80.30 million, and its Medical segment, which accounts for AED25.36 million.

Market Cap: AED338M

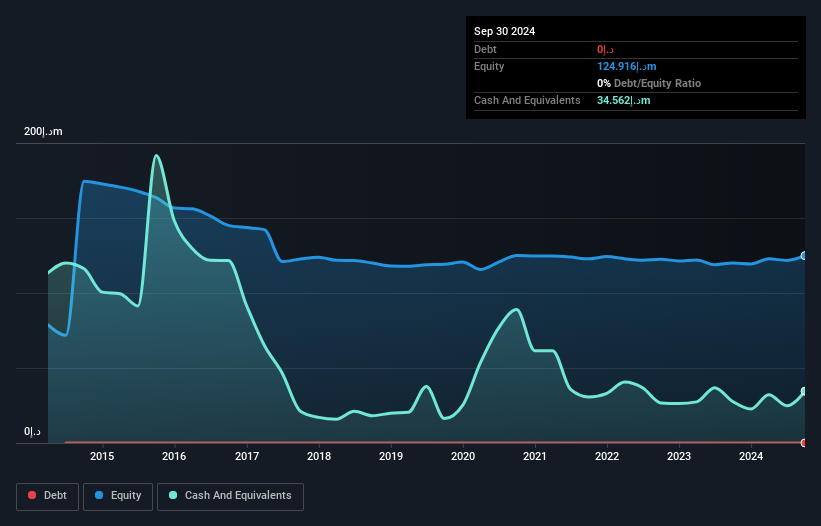

HAYAH Insurance Company P.J.S.C., with a market capitalization of AED338 million, faces challenges typical of penny stocks. Despite being debt-free and having sufficient cash runway for over three years, HAYAH is unprofitable with increasing losses over the past five years at 18.1% annually. Its revenue mainly comes from its Life and Medical segments, contributing AED80.30 million and AED25.36 million respectively. The company's short-term assets exceed both its short-term and long-term liabilities, indicating financial stability in the near term despite recent increased net losses reported for Q2 2025 compared to the previous year.

- Navigate through the intricacies of HAYAH Insurance Company P.J.S.C with our comprehensive balance sheet health report here.

- Examine HAYAH Insurance Company P.J.S.C's past performance report to understand how it has performed in prior years.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪20 million.

Operations: The partnership's revenue segment includes a negative contribution of $-2.08 million from Blank Checks.

Market Cap: ₪20M

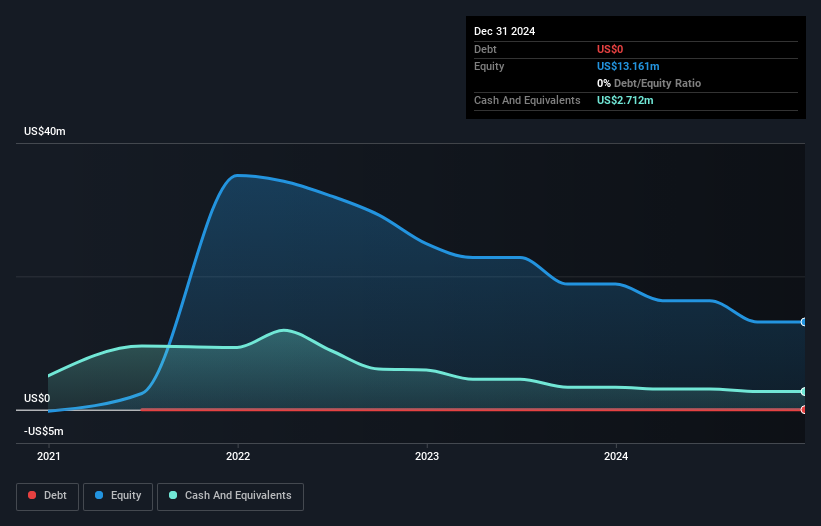

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪20 million, is pre-revenue and faces challenges typical of penny stocks. Despite being debt-free and having sufficient cash runway for over three years, the company remains unprofitable with losses increasing by 35.8% per year over the past five years. Recent earnings results show improvement, reporting a net income of US$0.806 million for H1 2025 compared to a net loss in the previous year. However, its dividend yield of 24.06% is not well-supported by earnings or free cash flow, raising sustainability concerns amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Big Tech 50 R&D-Limited Partnership stock in this financial health report.

- Review our historical performance report to gain insights into Big Tech 50 R&D-Limited Partnership's track record.

SavorEat (TASE:SVRT-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SavorEat Ltd. is a company that produces cellulose-based meat substitutes designed to mimic the eating experience of traditional meat, with a market cap of ₪5.45 million.

Operations: SavorEat Ltd. has not reported any specific revenue segments.

Market Cap: ₪5.45M

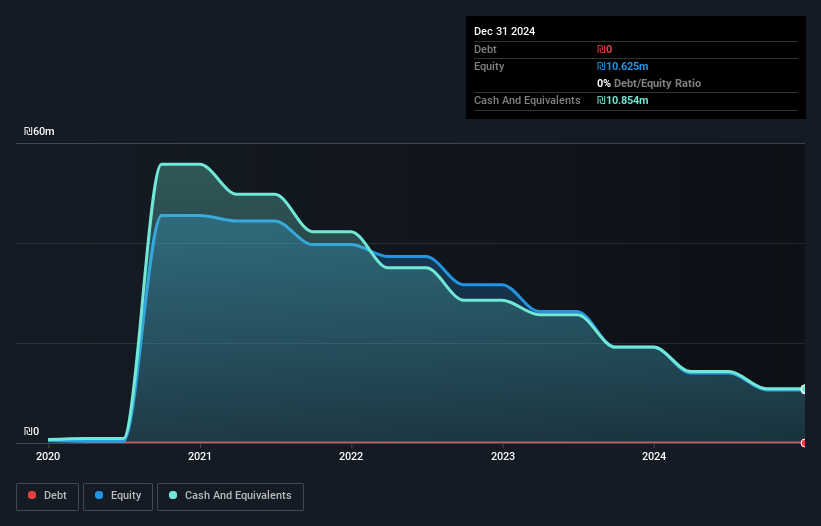

SavorEat Ltd., with a market cap of ₪5.45 million, is pre-revenue and unprofitable, reflecting typical challenges for penny stocks. The company has no debt and its short-term assets of ₪6.2 million exceed liabilities of ₪840,000, but it faces a cash runway of less than one year if current cash flow trends persist. Despite reporting a reduced net loss for H1 2025 compared to the previous year, share price volatility remains high. The board's average tenure is 5.7 years, indicating experience in navigating the uncertain financial landscape characteristic of early-stage companies like SavorEat Ltd.

- Click here to discover the nuances of SavorEat with our detailed analytical financial health report.

- Understand SavorEat's track record by examining our performance history report.

Taking Advantage

- Jump into our full catalog of 75 Middle Eastern Penny Stocks here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Big Tech 50 R&D-Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BIGT

Big Tech 50 R&D-Limited Partnership

Invests in technology companies in Israel.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives