- Israel

- /

- Capital Markets

- /

- TASE:ANLT

Analyst I.M.S. Investment Management Services And These 3 Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

The Gulf markets have recently rebounded, reflecting a temporary improvement in investor sentiment amid the ongoing Israel-Iran conflict and positive economic data from China. As regional indices like Saudi Arabia's benchmark and Dubai's main share index show signs of recovery, investors are increasingly on the lookout for stocks that can withstand geopolitical tensions while capitalizing on local economic growth. In this context, identifying undiscovered gems becomes crucial for those aiming to navigate these volatile yet promising markets effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Analyst I.M.S. Investment Management Services (TASE:ANLT)

Simply Wall St Value Rating: ★★★★★★

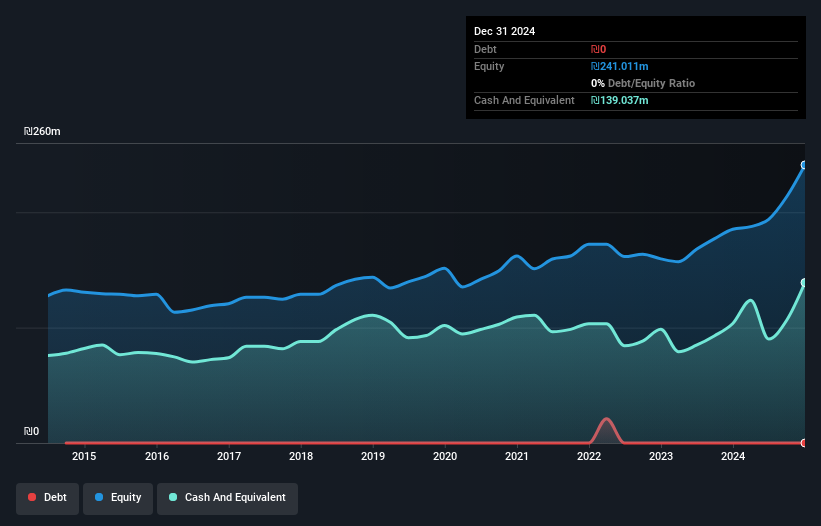

Overview: Analyst I.M.S. Investment Management Services Ltd is a publicly owned investment manager with a market capitalization of ₪1.11 billion.

Operations: Analyst I.M.S. generates revenue primarily from investment management, amounting to ₪366.47 million, with a net profit margin of 5%.

Analyst I.M.S. Investment Management Services, a nimble player in the financial sector, has showcased impressive earnings growth of 77.9% over the past year, outpacing the Capital Markets industry average of 28.5%. The company reported first-quarter revenue of ILS 106.41 million, up from ILS 66.13 million last year, with net income rising to ILS 16.79 million from ILS 13.11 million previously. Basic earnings per share climbed to ILS 1.44 compared to last year's ILS 1.13, reflecting solid performance amidst industry challenges and highlighting its potential as an emerging gem in the Middle East market landscape.

- Unlock comprehensive insights into our analysis of Analyst I.M.S. Investment Management Services stock in this health report.

Understand Analyst I.M.S. Investment Management Services' track record by examining our Past report.

One Software Technologies (TASE:ONE)

Simply Wall St Value Rating: ★★★★★★

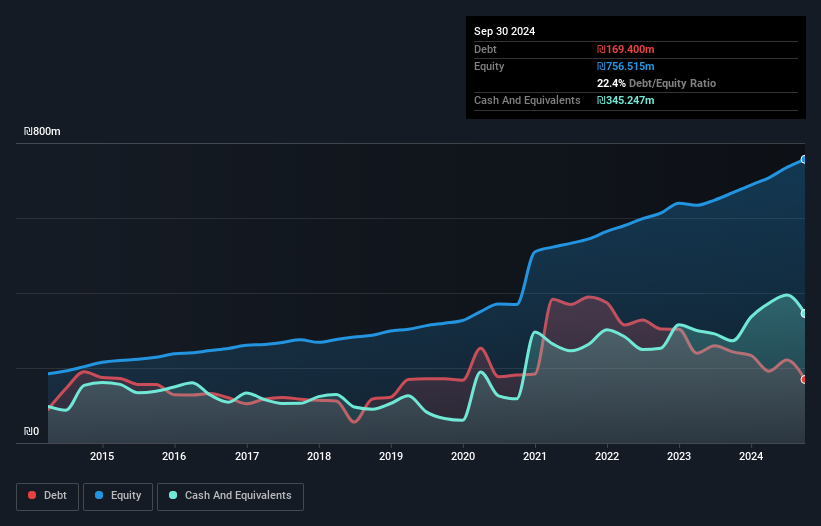

Overview: One Software Technologies Ltd offers software, hardware, and integration services with a market capitalization of ₪5.73 billion.

Operations: The company generates revenue primarily from infrastructure and computing solutions (₪1.28 billion) and outsourcing of business processes and technological support centers (₪326.89 million). Segment adjustments contribute an additional ₪2.57 billion to the revenue stream.

One Software Technologies, an intriguing player in the IT sector, has shown robust financial health with a debt to equity ratio dropping from 72.1% to 19.6% over five years. Its earnings grew by 25.2%, outpacing the industry average of 25.1%. The company remains profitable and boasts high-quality past earnings alongside strong free cash flow generation, reaching ILS 380.6 million recently. With interest payments well covered at a multiple of 24.6x EBIT, this firm seems well-positioned for continued growth in its niche market while trading at an attractive valuation slightly below estimated fair value by about 4%.

- Take a closer look at One Software Technologies' potential here in our health report.

Gain insights into One Software Technologies' past trends and performance with our Past report.

Orbit Technologies (TASE:ORBI)

Simply Wall St Value Rating: ★★★★★★

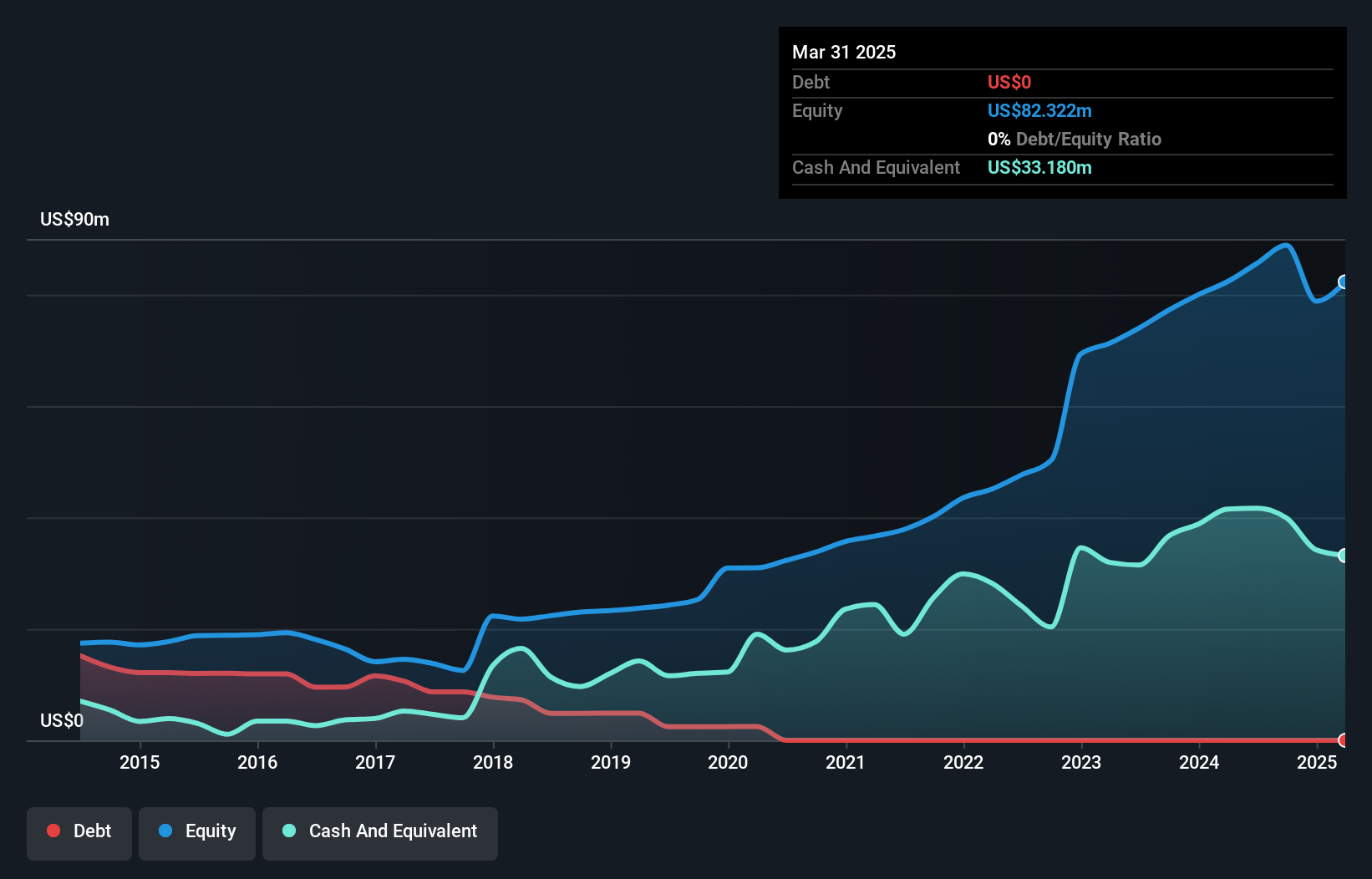

Overview: Orbit Technologies Ltd is a global company that develops, manufactures, and sells communication products with a market cap of ₪939.15 million.

Operations: Orbit Technologies generates revenue primarily from the development, marketing, and creation of advanced communication systems, amounting to $73.28 million.

Orbit Technologies, a nimble player in the Aerospace & Defense sector, showcases strong financial health with zero debt and impressive earnings growth of 24.7% annually over five years. Its recent quarterly sales hit US$18.36 million, up from US$15.13 million the previous year, while net income rose to US$3.26 million from US$2.19 million. The company’s price-to-earnings ratio stands at 20.9x, offering better value compared to the industry average of 26.9x despite not outpacing its peers' growth rates last year (24.2% versus 45.6%). Orbit's high-quality earnings and robust cash flow position it as a promising investment prospect in its field.

Key Takeaways

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 219 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ANLT

Analyst I.M.S. Investment Management Services

A publicly owned investment manager.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives