Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Lesico Ltd (TLV:LSCO) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Lesico

How Much Debt Does Lesico Carry?

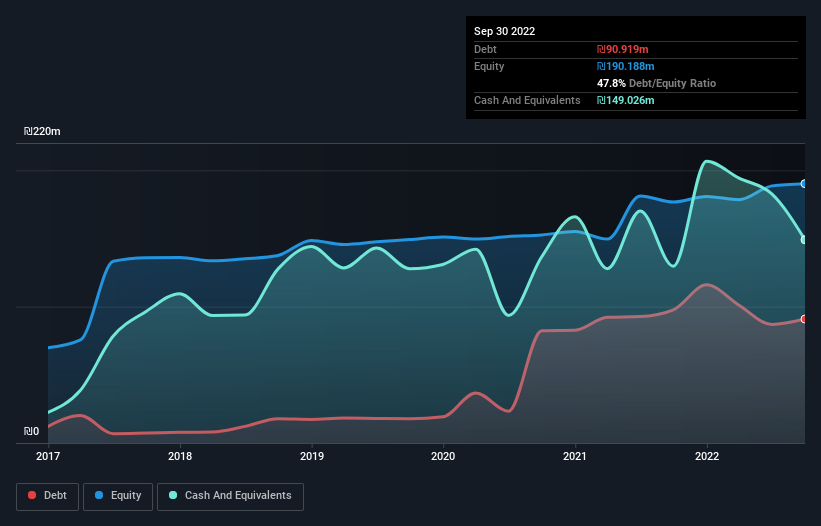

You can click the graphic below for the historical numbers, but it shows that Lesico had ₪90.9m of debt in September 2022, down from ₪97.6m, one year before. But it also has ₪149.0m in cash to offset that, meaning it has ₪58.1m net cash.

A Look At Lesico's Liabilities

Zooming in on the latest balance sheet data, we can see that Lesico had liabilities of ₪338.3m due within 12 months and liabilities of ₪72.4m due beyond that. On the other hand, it had cash of ₪149.0m and ₪319.0m worth of receivables due within a year. So it actually has ₪57.4m more liquid assets than total liabilities.

This surplus strongly suggests that Lesico has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, Lesico boasts net cash, so it's fair to say it does not have a heavy debt load!

We also note that Lesico improved its EBIT from a last year's loss to a positive ₪7.2m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Lesico's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Lesico may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Lesico actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Lesico has net cash of ₪58.1m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of ₪44m, being 608% of its EBIT. So we don't think Lesico's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Lesico (of which 1 is concerning!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:LSCO

Lesico

Engages in the construction of various infrastructure projects in Israel and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives