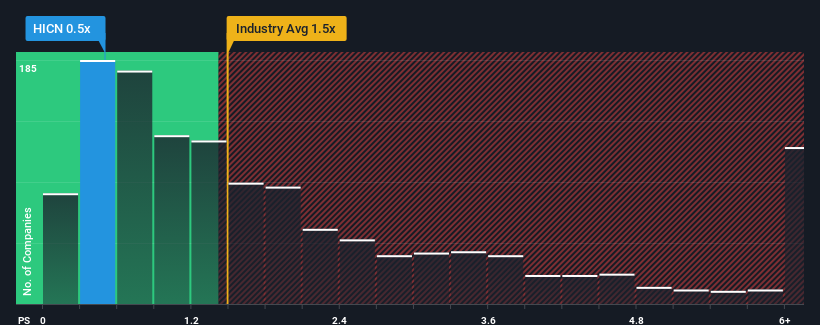

Highcon Systems Ltd.'s (TLV:HICN) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Machinery industry in Israel have P/S ratios greater than 1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Highcon Systems

How Has Highcon Systems Performed Recently?

For example, consider that Highcon Systems' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Highcon Systems will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Highcon Systems, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Highcon Systems' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Highcon Systems' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 113% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 16%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Highcon Systems' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Highcon Systems currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Highcon Systems you should know about.

If these risks are making you reconsider your opinion on Highcon Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Highcon Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:HICN

Highcon Systems

Engages in the provision of a proprietary technology for digital cutting and creasing solutions for post print processes in the folding carton and corrugated carton industry.

Moderate and slightly overvalued.

Market Insights

Community Narratives