As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. Amidst this backdrop of fluctuating indices and economic signals, dividend stocks offer a potential avenue for stable income, providing investors with regular payouts that can help mitigate market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

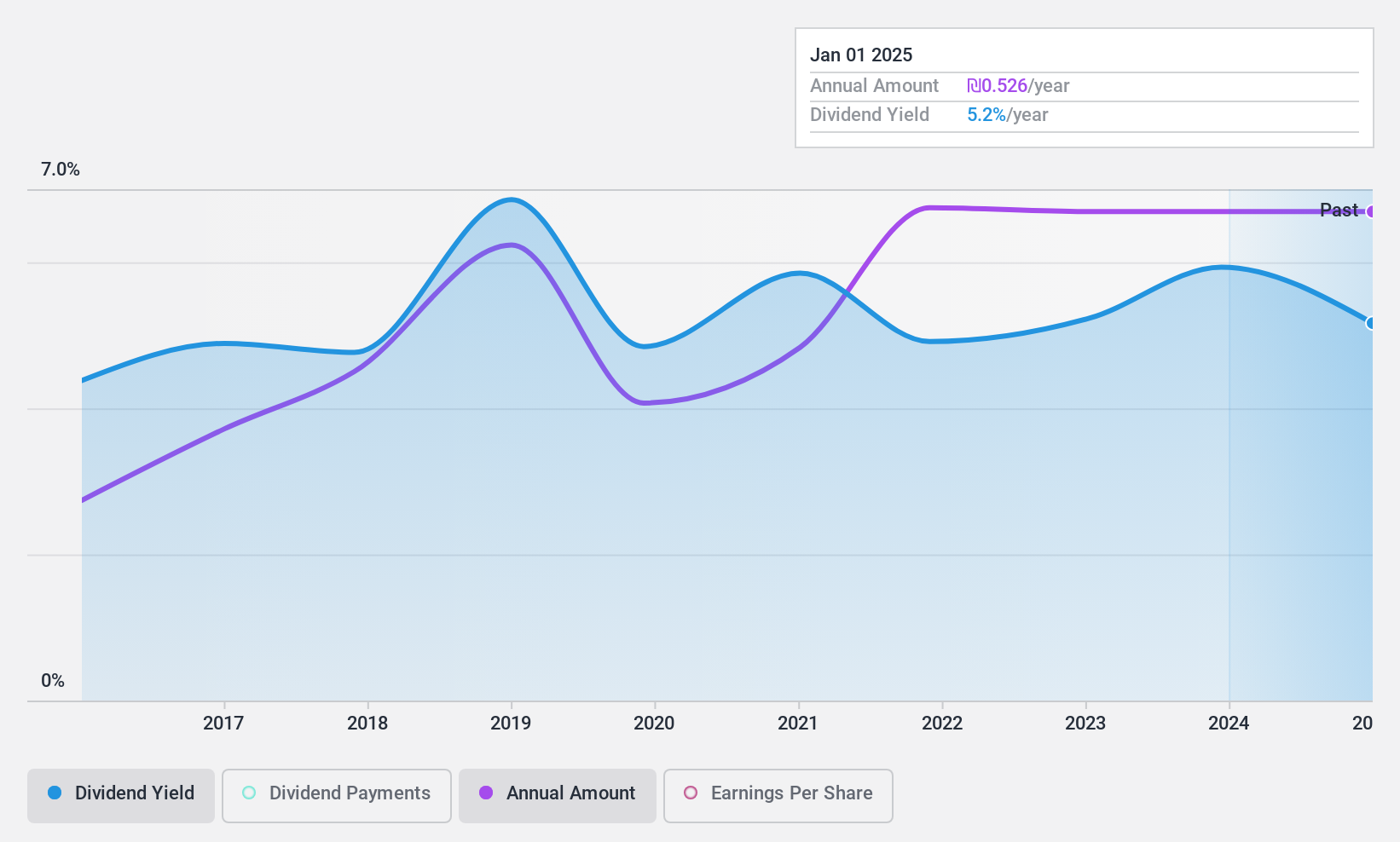

Golan Renewable Industries (TASE:GRIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Golan Renewable Industries Ltd specializes in the development, production, distribution, and sale of cross-linked polyethylene PEX piping systems across various global markets including Israel, Europe, Scandinavia, Asia, North America, and South America; the company has a market cap of ₪374.15 million.

Operations: Golan Renewable Industries Ltd generates revenue of ₪387.86 million from its Plastics & Rubber segment.

Dividend Yield: 4.8%

Golan Renewable Industries faces challenges for dividend investors due to its volatile and unreliable dividend history over the past decade, despite an increase in payments. The dividends are covered by earnings and cash flows with payout ratios around 76.6% and 77%, respectively, yet the yield is lower than top-tier IL market payers. Recent financial results show a decline in sales and net income, potentially impacting future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Golan Renewable Industries.

- Our valuation report unveils the possibility Golan Renewable Industries' shares may be trading at a discount.

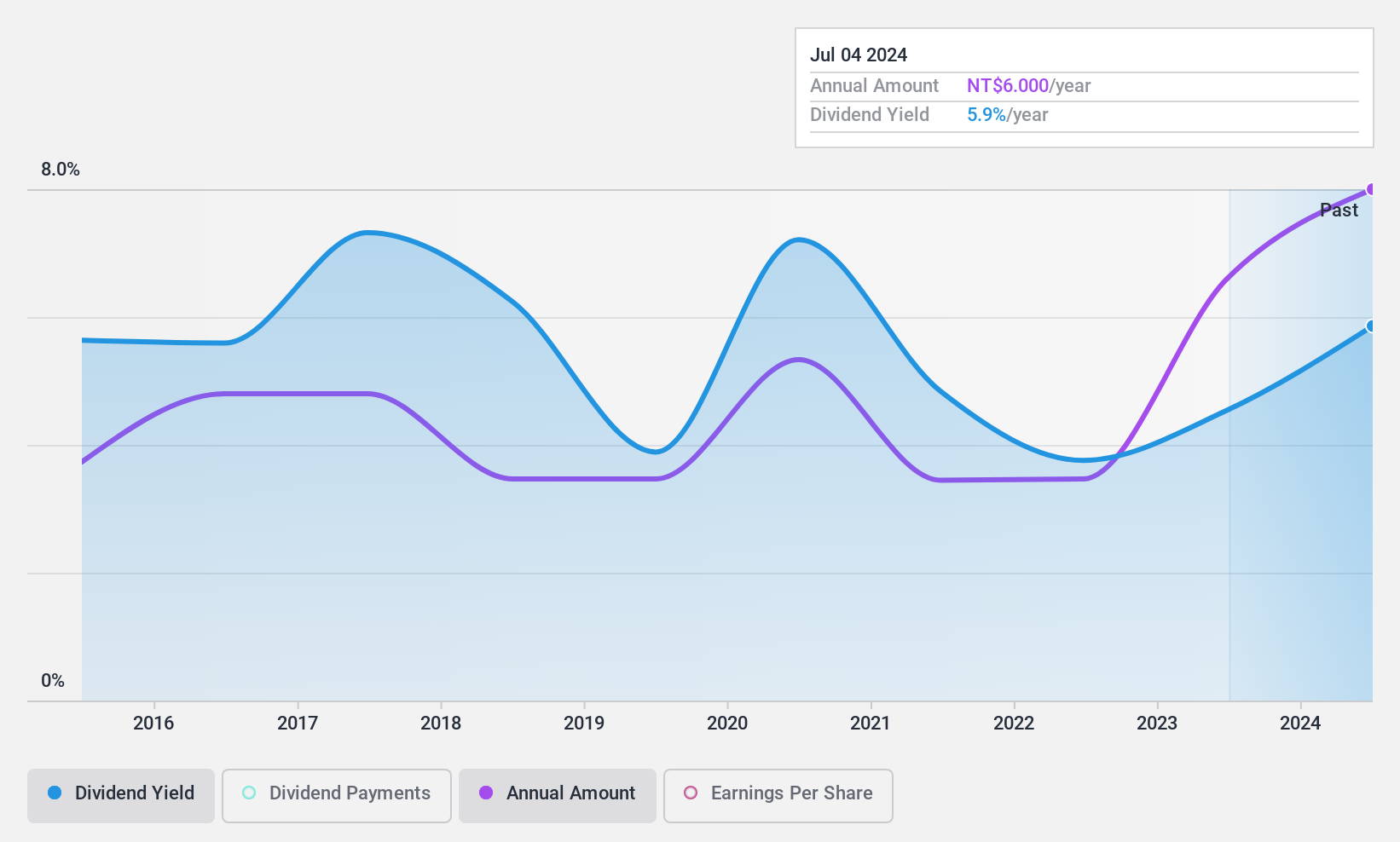

Avalue Technology Incorporation (TPEX:3479)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avalue Technology Incorporation is involved in the production, processing, and sale of industrial computers across Taiwan, the Americas, Europe, Asia, and internationally with a market cap of NT$7.10 billion.

Operations: Avalue Technology Incorporation generates revenue through its operations in the industrial computer sector, serving diverse markets including Taiwan, the Americas, Europe, and Asia.

Dividend Yield: 6.1%

Avalue Technology Incorporation's dividend yield of 6.14% ranks in the top 25% in Taiwan, but its sustainability is questionable due to a high cash payout ratio of 126.7%. Despite being covered by earnings with an 87.4% payout ratio, the dividends are not well supported by free cash flows and have experienced volatility over the past decade. Recent financial results show declines in sales and net income, which may further affect dividend reliability and growth prospects.

- Click here to discover the nuances of Avalue Technology Incorporation with our detailed analytical dividend report.

- According our valuation report, there's an indication that Avalue Technology Incorporation's share price might be on the cheaper side.

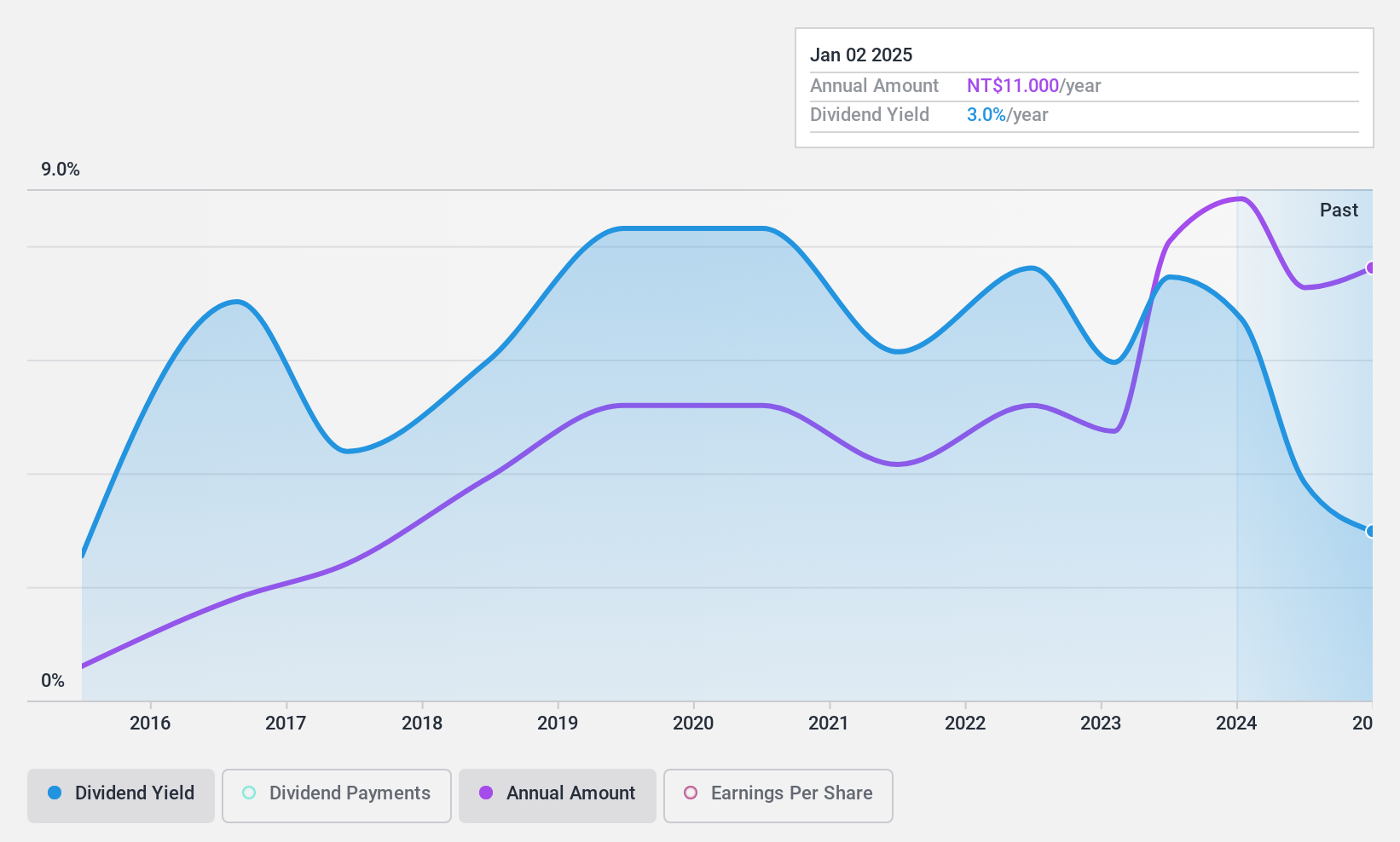

Acter Group (TPEX:5536)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market cap of NT$40.39 billion.

Operations: Acter Group Corporation Limited generates revenue from engineering services with NT$11.97 billion in Taiwan, NT$12.95 billion in Mainland China, and NT$3.09 billion across other Asian countries.

Dividend Yield: 3.4%

Acter Group's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 61.6% and 39.8%, respectively, indicating sustainability. However, the company has a volatile dividend history over the past decade despite recent increases. Its current yield of 3.38% is below Taiwan's top quartile for dividends. Recent financial results show strong growth in sales and net income, supporting its ability to maintain dividends in the near term.

- Dive into the specifics of Acter Group here with our thorough dividend report.

- The valuation report we've compiled suggests that Acter Group's current price could be inflated.

Summing It All Up

- Investigate our full lineup of 1965 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:GRIN

Golan Renewable Industries

Develops, manufactures, sells, and distributes cross-linked polyethylene pipe systems in Israel, Europe, Latin America, Scandinavia, North and South America, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives