- Israel

- /

- Construction

- /

- TASE:ELTR

Electra (TASE:ELTR) Margin Compression Challenges Bullish Narrative Despite Revenue Growth

Reviewed by Simply Wall St

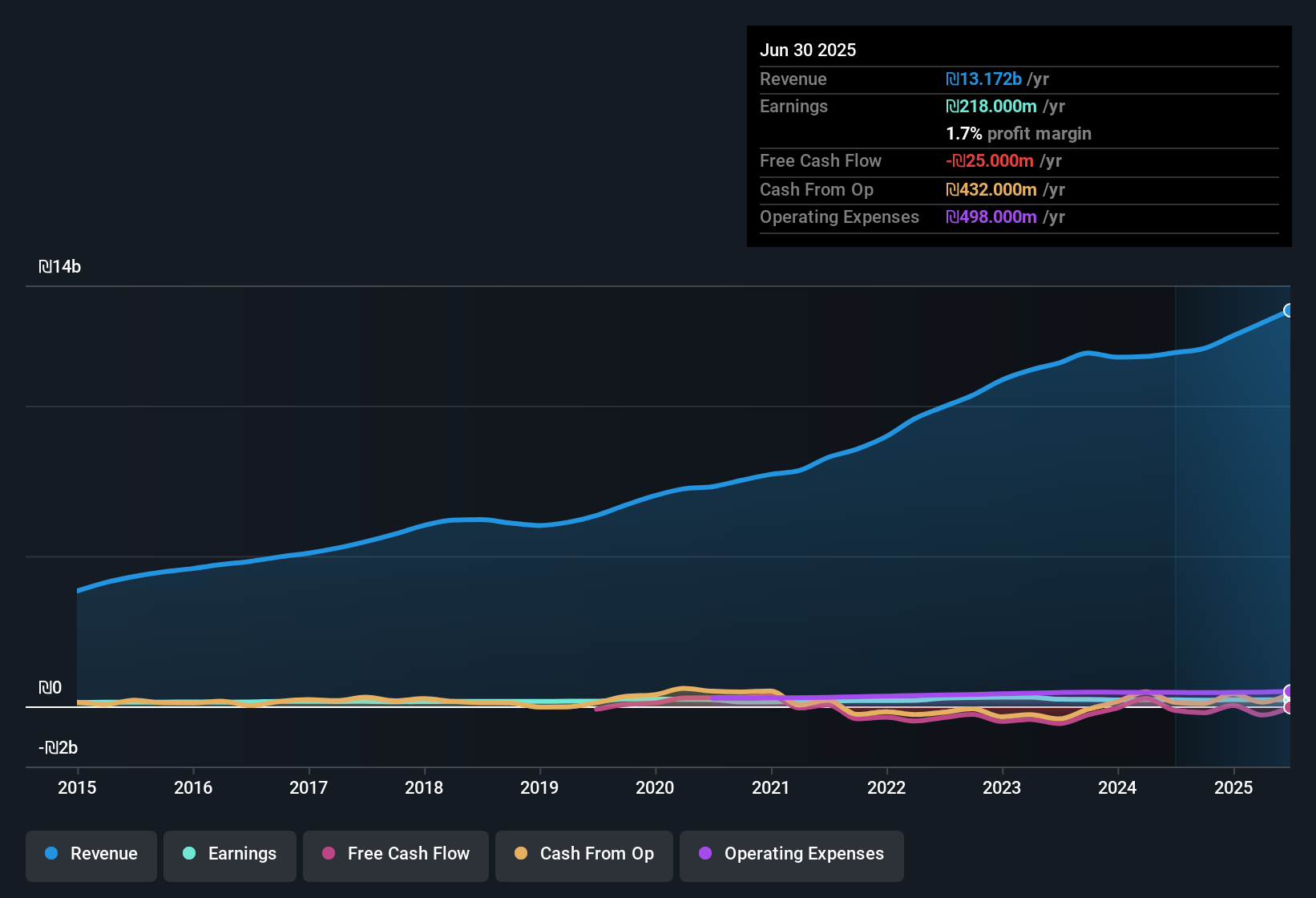

Electra (TASE:ELTR) has just released its Q3 2025 results, reporting revenue of ₪3.5 billion and net income of ₪23 million, with basic EPS at ₪0.30. Looking back, the company has seen revenue trend upward each quarter over the past year, moving from ₪3.1 billion in Q3 2024 to the latest figures. EPS has moved between ₪0.75 and ₪0.3 across the same span. As margins come under pressure, investors will be weighing the sustainability of recent profit trends against the broader market backdrop.

See our full analysis for Electra.Next up, we will see how these headline numbers measure up against popular market narratives and whether the latest figures confirm or challenge mainstream expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Stands Out

- Net profit margin slipped from 1.8% last year to 1.4% for the latest trailing twelve months, even though revenues rose to ₪13.5 billion ($13.5 billion).

- Bulls point to Electra's average annual earnings growth of 4% over the past five years as a sign of long-term strength. However, the drop in margin alongside negative earnings growth this year challenges the view that earnings quality is fully intact.

- Bulls highlight diversified business lines and resilience. Yet margin pressure and a fall in annual net income from ₪217 million to ₪183 million ($217 million to $183 million) make it harder to rely on this upswing continuing.

- Consensus narrative notes positive investor sentiment around infrastructure businesses. It also warns that sector-specific issues could test this stability if margins do not recover soon.

Valuation: Premium Price versus Discounted Value

- Electra is currently priced at a Price-to-Earnings ratio of 41.8x, notably higher than the peer average of 41.1x and much steeper than the Asian Construction industry at 14.6x. The stock trades at about 17% below its DCF fair value estimate of ₪120.27 per share.

- Bulls see the current valuation discount as an opportunity, citing quality of earnings. However, with the share price at ₪100 and negative profit growth, it remains a debate whether the multiple is justified.

- While bulls may favor the “discount” to fair value, the above-average P/E and falling profits force investors to weigh near-term challenges against longer-term growth.

- Consensus narrative adds that such a pricing setup reflects both optimism for infrastructure demand and skepticism about maintaining past earnings levels.

Debt Coverage: Key Risk on the Radar

- Electra’s debt is flagged as not well covered by operating cash flow, raising the risk profile for investors keeping a close eye on leverage and financial flexibility.

- AI-driven market analysis notes that despite a record of “high quality earnings” in the trailing twelve months, concerns about debt coverage and declining profit margins could prevent bullish momentum from taking over.

- Macro pressures on construction and infrastructure are mentioned as ongoing background risks for similar companies. Electra’s cash coverage challenge is specifically highlighted as a notable issue from the data.

- Any positive shifts on this front could bolster confidence in the balance sheet, while ongoing weak cash coverage may continue to cloud the upside case.

Investor sentiment is finely balanced between longer-term stability and the warning signs in margin pressure and debt service.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Electra's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite revenue growth, Electra faces pressure from shrinking profit margins and insufficient cash coverage of debt. This raises doubts about financial resilience.

If robust financial footing matters most, use our solid balance sheet and fundamentals stocks screener (1924 results) to focus on companies with stronger balance sheets and lower debt risks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success