- Israel

- /

- Construction

- /

- TASE:ELTR

Electra (TASE:ELTR): Assessing Valuation After Strategic Moves in Cobalt Refining and U.S. Supply Chain Expansion

Reviewed by Simply Wall St

Electra (TASE:ELTR) is drawing attention after announcing a new program focused on advancing mineral deposit modelling at its Idaho project and integrating more North American feedstocks into its cobalt refinery.

See our latest analysis for Electra.

Electra’s renewed focus on North American cobalt refining and recent financing milestones have clearly grabbed investor attention, reflected in its sizable 21.8% one-month share price return. Over the past year, however, the total shareholder return stands out even more impressively at nearly 34%. This suggests momentum is building as the company positions itself as a critical player in the region’s mineral supply chain.

If Electra’s strategic moves have you thinking broader, now is a great moment to explore new ideas and discover fast growing stocks with high insider ownership

Given Electra’s recent surge and ambitious expansion plans, the key question now is whether the stock’s strong run already reflects all this future potential or if there is a genuine buying opportunity that the market has yet to price in.

Price-to-Earnings of 36.6x: Is it justified?

Electra’s stock currently trades at a price-to-earnings (P/E) ratio of 36.6x, notably lower than its peer average of 51.3x, yet significantly higher than the Asian Construction industry’s average of 15.4x. This positions Electra between broader peer optimism and industry caution, making its valuation stand out in the regional landscape.

The price-to-earnings ratio highlights how much investors are willing to pay for each shekel of the company’s earnings. For Electra, a high P/E multiple signals that the market expects meaningful growth, stronger future profitability, or both. However, the stock’s valuation could also reflect other factors such as brand reputation, perceived execution risk, or industry leadership status.

Compared to its peers, Electra appears attractively valued, but when matched against the industry average, the stock looks expensive. This disparity suggests that while investors recognize potential above sector norms, they remain somewhat cautious relative to the company’s closest comparables. If a fair ratio assessment were available, it would reveal whether the current multiple aligns with long-term underlying fundamentals or presents an aspirational valuation level that the market could adjust toward.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 36.6x (ABOUT RIGHT)

However, persistent share price volatility and unknown revenue growth rates could challenge Electra’s upbeat momentum if the underlying fundamentals fail to improve meaningfully.

Find out about the key risks to this Electra narrative.

Another View: What Does the SWS DCF Model Say?

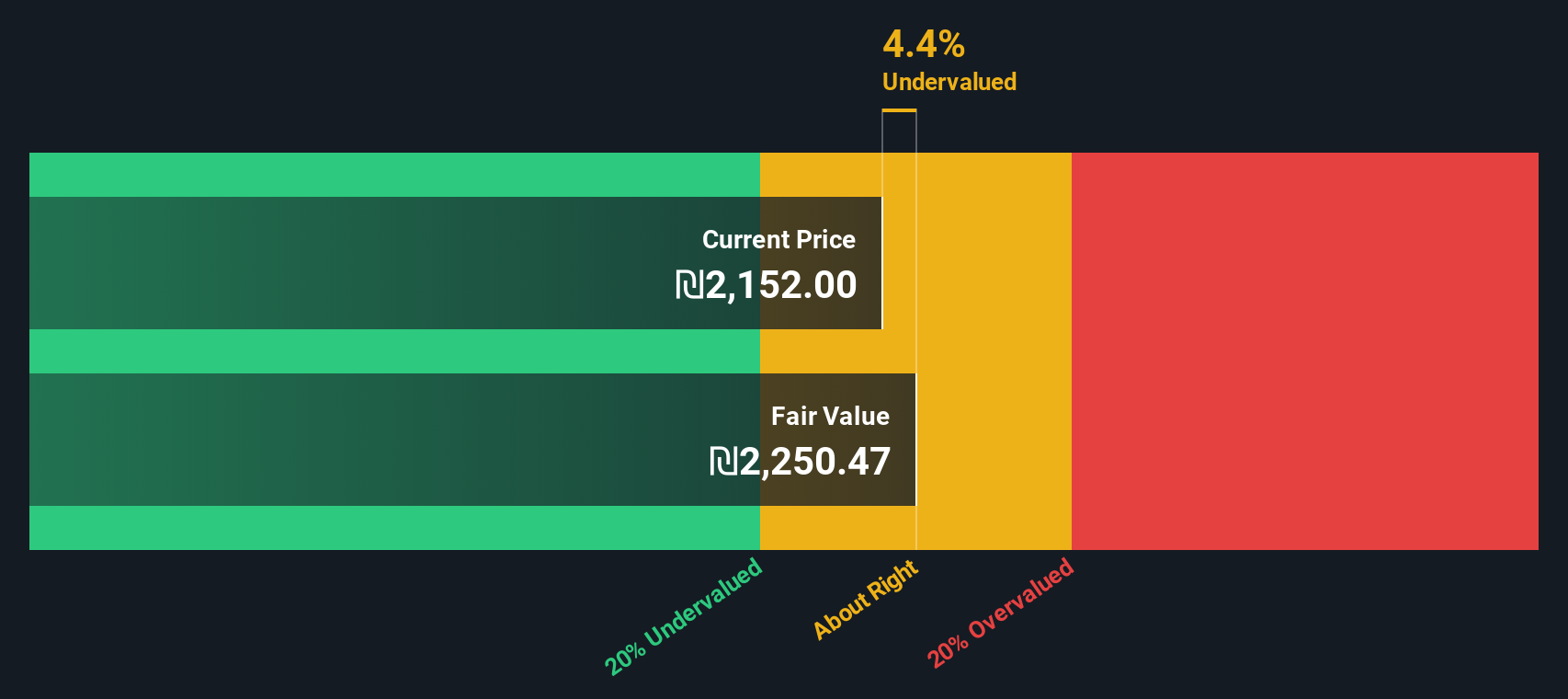

Looking at Electra from another angle, our DCF model estimates the shares to be trading about 5% below fair value. The current price is ₪104.1 and the fair value is ₪109.71. This suggests the stock could be undervalued, but does this align with market sentiment or mask deeper risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electra Narrative

If you’re looking to draw your own conclusions or dig deeper into the numbers, you can craft a personalized analysis in just a few minutes. Do it your way.

A great starting point for your Electra research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines when the next breakout opportunity is waiting. The right tools can help you uncover stocks primed for big moves today.

- Capitalize on untapped potential by scanning these 28 quantum computing stocks at the forefront of quantum innovation and industry disruption.

- Maximize your income potential with these 19 dividend stocks with yields > 3% offering strong yield and reliable returns in fluctuating markets.

- Step ahead of market trends with these 27 AI penny stocks leading advancements in artificial intelligence and redefining tomorrow’s technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives