- Israel

- /

- Construction

- /

- TASE:ELTR

Electra (TASE:ELTR): Assessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Electra (TASE:ELTR) has caught the interest of investors lately, thanks to its consistent performance and recent share price increase. The company’s stock is up nearly 8% over the past week, and this adds to the gains seen so far this year.

See our latest analysis for Electra.

Electra’s latest surge builds on a solid upward trend this year. Its 1-year total shareholder return now reaches nearly 29%. The recent momentum suggests optimism is returning as investors reassess the company’s long-term potential and risk profile.

If strong momentum stories like Electra’s inspire your next move, it may be a good time to broaden your search and discover fast growing stocks with high insider ownership

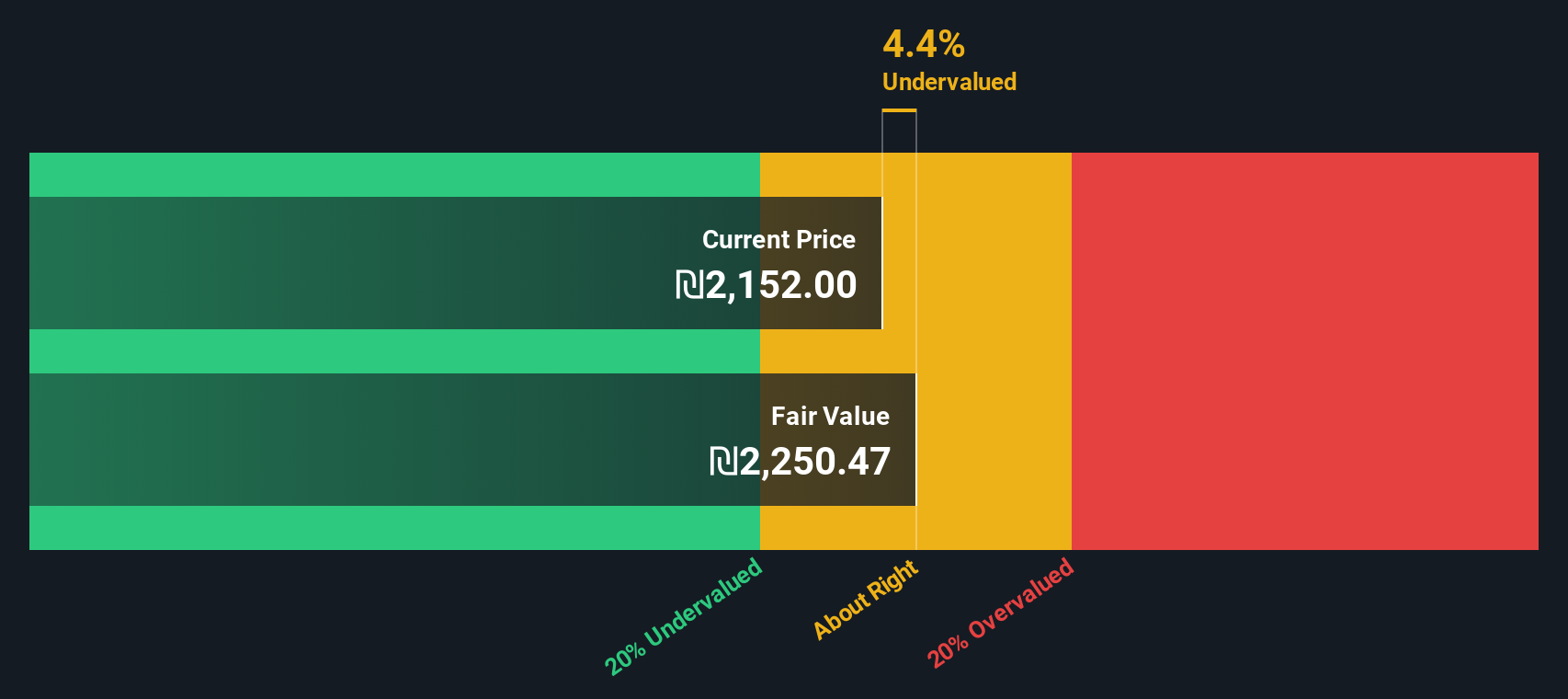

Yet with shares near recent highs, the real question facing investors is whether Electra is still undervalued, or if the current price already reflects all its expected future growth. Is there still a true buying opportunity here?

Price-to-Earnings of 38.7x: Is it justified?

Electra’s recent performance comes with a high price tag in valuation terms, as the stock trades at a Price-to-Earnings (P/E) ratio of 38.7. This is significantly above average levels among its industry peers and puts the spotlight on expectations for future growth.

The Price-to-Earnings ratio represents how much investors are willing to pay today for each unit of current earnings. In the construction sector, this multiple can signal market confidence in a company’s profit growth, but it can also significantly overstate prospects if earnings stall.

With Electra’s P/E of 38.7, the market is pricing in a future that goes well beyond the current growth pace. The industry average stands at just 15.1, so buyers of Electra are paying more than double compared to the broader sector. Despite slightly higher profit growth than the industry, this premium is difficult to justify without a clear catalyst for accelerating earnings going forward.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 38.7 (OVERVALUED)

However, risks remain, such as potential changes in market demand or unexpected profit slowdowns. These factors could challenge today’s optimistic outlook.

Find out about the key risks to this Electra narrative.

Another Perspective: Discounted Cash Flow Estimate

Taking a different view, our DCF model suggests Electra shares, trading at ₪110, are only marginally above the estimated fair value of ₪109.56. In other words, on a cash flow basis, the stock appears roughly fairly valued rather than dramatically overpriced or discounted.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electra Narrative

If you see the numbers differently or want to dig deeper into Electra’s story, creating your own analysis is quick and straightforward. Do it your way

A great starting point for your Electra research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your investment opportunities with handpicked stock lists that could give you a major advantage. Don’t let potential winners pass you by. Take action now.

- Secure reliable income streams by targeting strong yields with these 16 dividend stocks with yields > 3% for the latest companies delivering dividends above 3%.

- Tap into the energy of high-growth tech by checking out these 25 AI penny stocks featuring early movers making waves in artificial intelligence and automation.

- Catalyze your portfolio with fresh value plays by seeking out these 877 undervalued stocks based on cash flows to discover hidden gems trading below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELTR

Electra

Through its subsidiaries, engages in the contracting, construction, infrastructure, and electromechanical system businesses in Israel and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives