- Israel

- /

- Semiconductors

- /

- TASE:QLTU

Undiscovered Gems In Middle East Stocks To Watch June 2025

Reviewed by Simply Wall St

As most Gulf markets continue their upward trajectory, with Dubai's main index hitting a 17-year high and Abu Dhabi following suit, the Middle East is drawing increased attention from investors looking to capitalize on the region's economic momentum. In this dynamic environment, identifying promising stocks involves considering factors such as market positioning and growth potential within sectors benefiting from steady oil prices and regional developments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 0.14% | 25.61% | 36.34% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 20.07% | 44.84% | 6.75% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aryt Industries Ltd. operates through its subsidiaries to develop, produce, and market electronic thunderbolt for the defense market in Israel with a market cap of ₪2.26 billion.

Operations: Aryt Industries generates revenue primarily from detonators, amounting to ₪126.54 million. The company's market cap stands at approximately ₪2.26 billion.

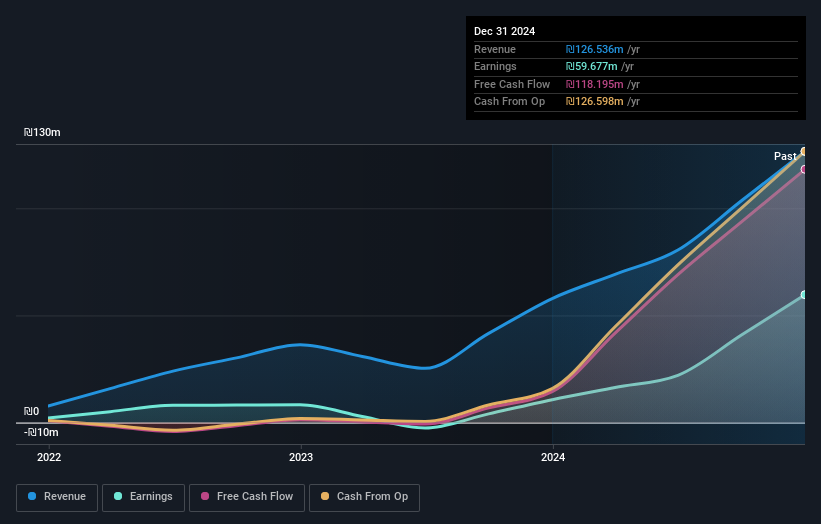

Aryt Industries, a dynamic player in the Aerospace & Defense sector, has captured attention with its impressive earnings growth of 458.5% over the past year, outpacing the industry average of 46.1%. Despite a volatile share price recently, Aryt's financials remain robust with net income soaring to ILS 59.68 million from ILS 10.69 million last year and basic earnings per share climbing to ILS 0.616 from ILS 0.111. The company is trading at an attractive valuation, approximately 87% below estimated fair value, while maintaining more cash than total debt and covering interest payments comfortably without concerns about cash runway due to profitability.

- Navigate through the intricacies of Aryt Industries with our comprehensive health report here.

Examine Aryt Industries' past performance report to understand how it has performed in the past.

Aura Investments (TASE:AURA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aura Investments Ltd. is involved in the identification, initiation, planning, and construction of residential real estate projects both in Israel and internationally, with a market capitalization of approximately ₪4.99 billion.

Operations: Aura Investments generates revenue primarily from residential construction, amounting to approximately ₪1.54 billion. The net profit margin is a key financial metric for the company, reflecting its profitability after accounting for all expenses and taxes.

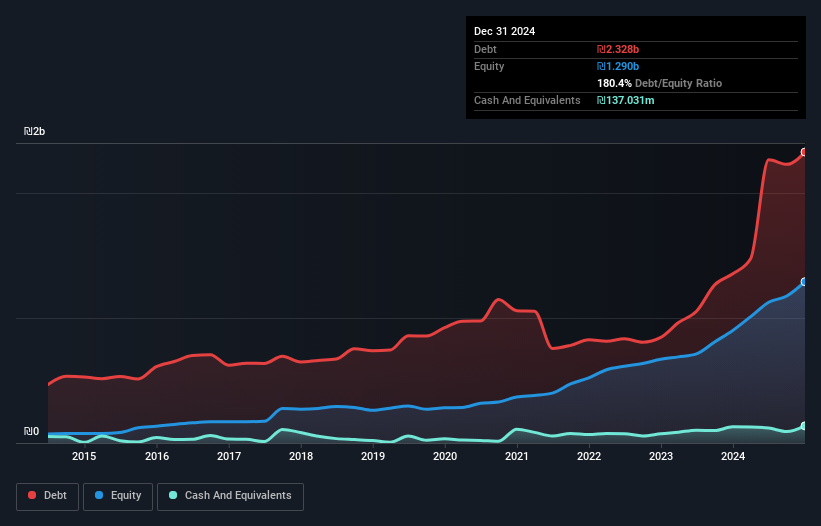

Aura Investments, a nimble player in the real estate sector, has shown impressive earnings growth of 99.6% over the past year, outpacing its industry peers at 30.6%. Despite a high net debt to equity ratio of 188.7%, Aura's interest payments are comfortably covered by EBIT at 7.4 times, suggesting solid financial management. The company reported first-quarter revenue of ILS 370.7 million and net income of ILS 73.82 million, reflecting a slight dip from last year's figures but maintaining robust performance overall. With high-quality non-cash earnings and profitability intact, Aura remains an intriguing prospect despite challenges with free cash flow positivity.

Qualitau (TASE:QLTU)

Simply Wall St Value Rating: ★★★★★★

Overview: Qualitau Ltd develops, manufactures, and sells test equipment and services for the semiconductor industry targeting European and Far-Eastern markets, with a market cap of ₪1.45 billion.

Operations: Qualitau generates revenue primarily through its electronic components and parts segment, which accounts for $46.25 million. The company's market capitalization stands at approximately ₪1.45 billion.

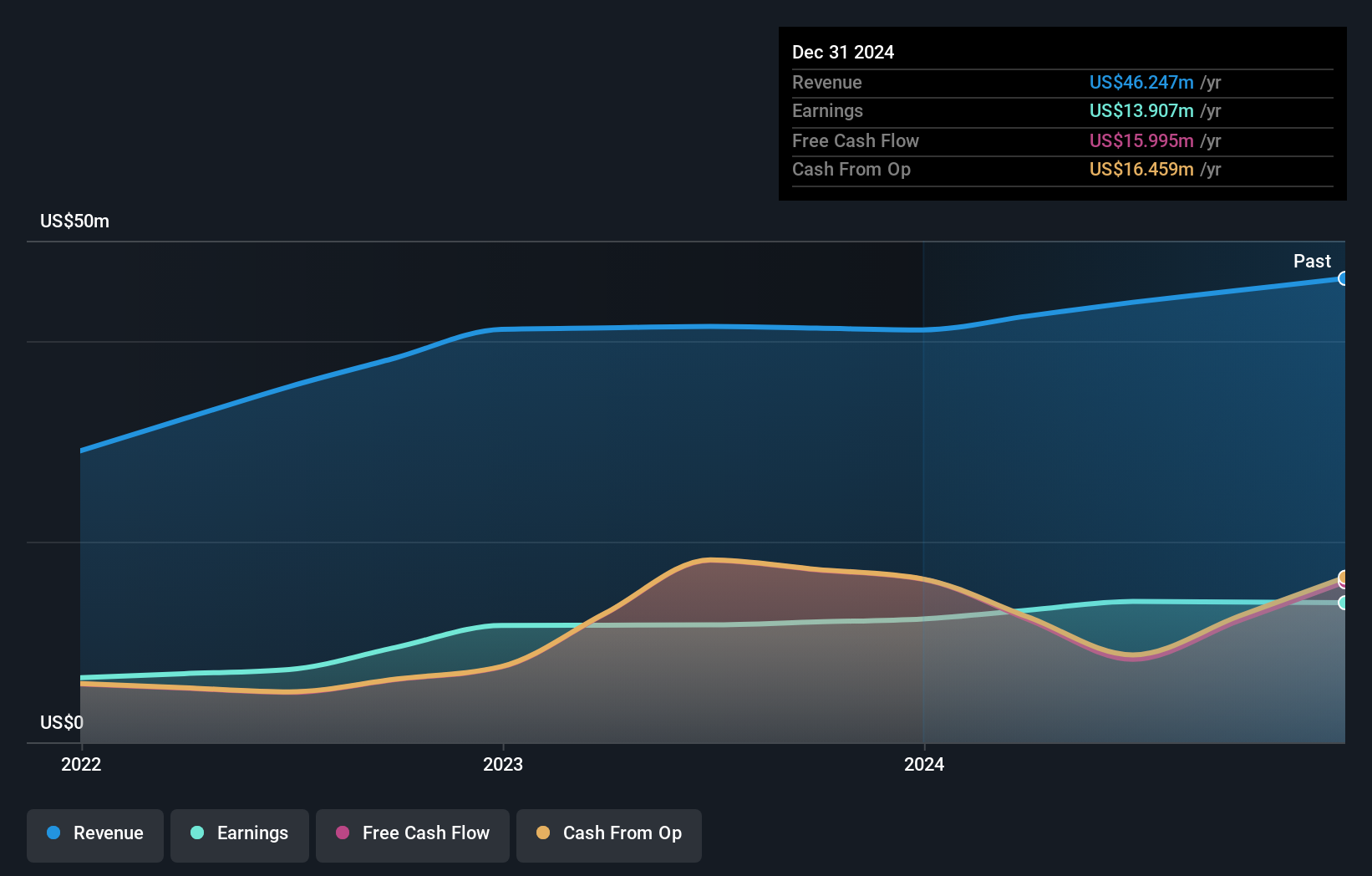

Qualitau, a nimble player in the semiconductor industry, has shown promising growth with earnings climbing 13.1% over the past year, outpacing the sector's 12.2%. The company is debt-free, eliminating concerns about interest coverage and highlighting its robust financial health. Recent earnings reported a net income of US$13.91 million for 2024, up from US$12.3 million in 2023, alongside basic EPS rising to US$3.192 from US$2.841 previously. Furthermore, Qualitau announced a share repurchase program worth ILS7.37 million which underscores management's confidence in its future prospects amid recent stock volatility.

- Delve into the full analysis health report here for a deeper understanding of Qualitau.

Evaluate Qualitau's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 228 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qualitau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:QLTU

Qualitau

Engages in the development, manufacture, and sale of test equipment and services for use in the semiconductor industry for European and Far-Eastern markets.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives