The Middle Eastern stock markets have recently shown a mix of performance, with Dubai's index rising for two consecutive sessions and Abu Dhabi also experiencing gains, while Saudi Arabia saw a slight dip. For investors exploring beyond the mainstream stocks, penny stocks—often representing smaller or newer companies—remain an intriguing option. Despite being considered an outdated term by some, these stocks continue to offer potential opportunities for those who seek out companies with solid financials and growth potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.70 | TRY1.83B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.94 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.557 | ₪179.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Terminal X Online (TASE:TRX) | ₪4.314 | ₪547.9M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.311 | ₪171.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.725 | AED440.98M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.13 | AED361.51M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.18 | AED2.34B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.29B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ege Seramik Sanayi ve Ticaret (IBSE:EGSER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ege Seramik Sanayi ve Ticaret A.S. is engaged in the production and sale of ceramic floor and wall tiles globally, with a market capitalization of TRY2.18 billion.

Operations: The company generates revenue of TRY2.69 billion from its Building Products segment.

Market Cap: TRY2.18B

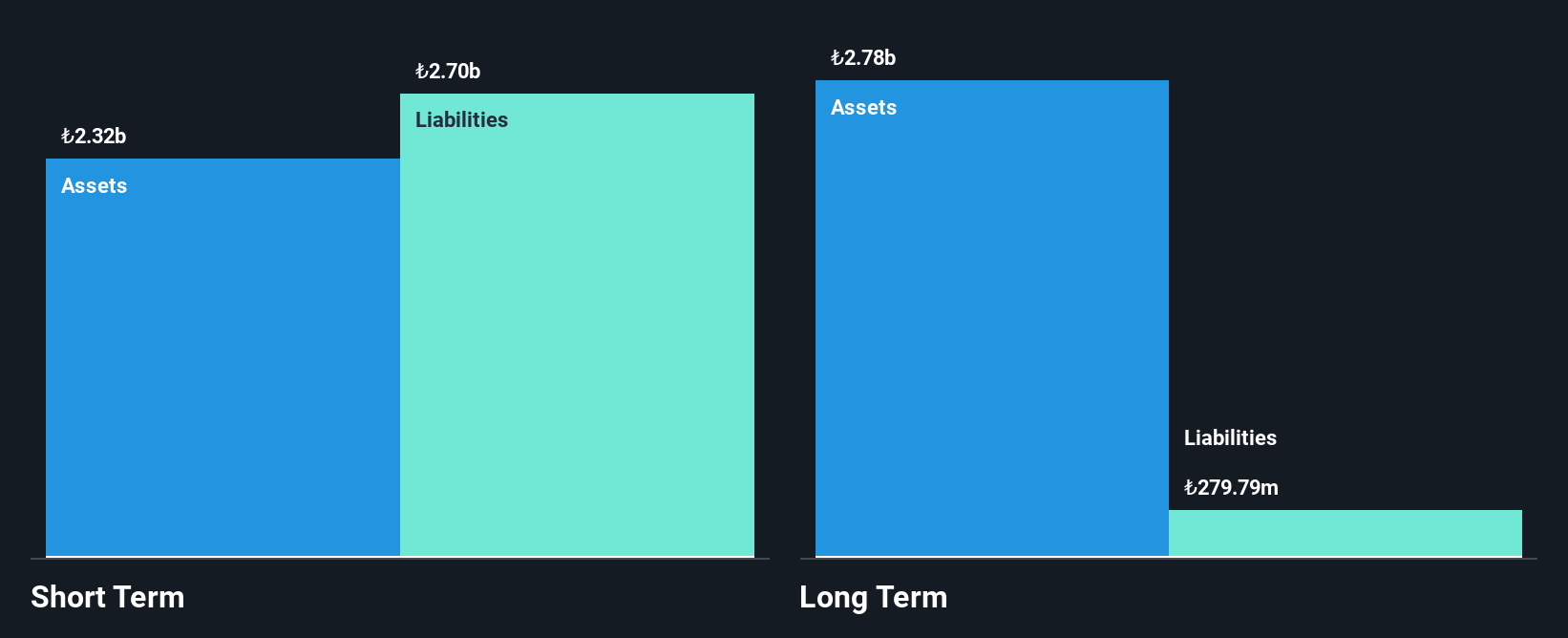

Ege Seramik Sanayi ve Ticaret A.S., with a market capitalization of TRY2.18 billion, is navigating the challenges typical of penny stocks. Despite generating TRY2.69 billion in revenue from its Building Products segment, the company remains unprofitable and has seen an increase in losses over the past five years. Its short-term assets comfortably cover both short- and long-term liabilities, indicating sound liquidity management. The company's debt level is satisfactory, supported by operating cash flow coverage. However, volatility remains stable at 6%, and shareholders have not faced significant dilution recently, providing some stability amidst financial challenges.

- Click here to discover the nuances of Ege Seramik Sanayi ve Ticaret with our detailed analytical financial health report.

- Examine Ege Seramik Sanayi ve Ticaret's past performance report to understand how it has performed in prior years.

Aerodrome Group (TASE:ARDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aerodrome Group Ltd specializes in offering UAV-based solutions for data collection, processing, and analysis using advanced software and AI for civil and security sectors, with a market cap of ₪38.09 million.

Operations: The company generates revenue through two primary segments: Air Intelligence, contributing ₪11.61 million, and Know-How Sharing, which accounts for ₪2.84 million.

Market Cap: ₪38.09M

Aerodrome Group Ltd, with a market cap of ₪38.09 million, faces challenges typical of penny stocks in the Middle East. The company reported sales of ₪14.45 million for 2024 but remains unprofitable with a net loss of ₪22.8 million, reflecting an increasing trend in losses over five years at 20.2% per year. Despite having more cash than total debt and short-term assets exceeding liabilities, Aerodrome has less than a year of cash runway and high share price volatility at 10%. Management is experienced, but earnings have declined significantly compared to the previous year’s performance.

- Jump into the full analysis health report here for a deeper understanding of Aerodrome Group.

- Explore historical data to track Aerodrome Group's performance over time in our past results report.

HomeBiogas (TASE:HMGS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HomeBiogas LTD develops, produces, and markets biogas systems that convert organic waste into clean energy for various users worldwide, with a market cap of ₪28.54 million.

Operations: The company's revenue of $2.63 million is generated from the development, production, and marketing of biogas systems.

Market Cap: ₪28.54M

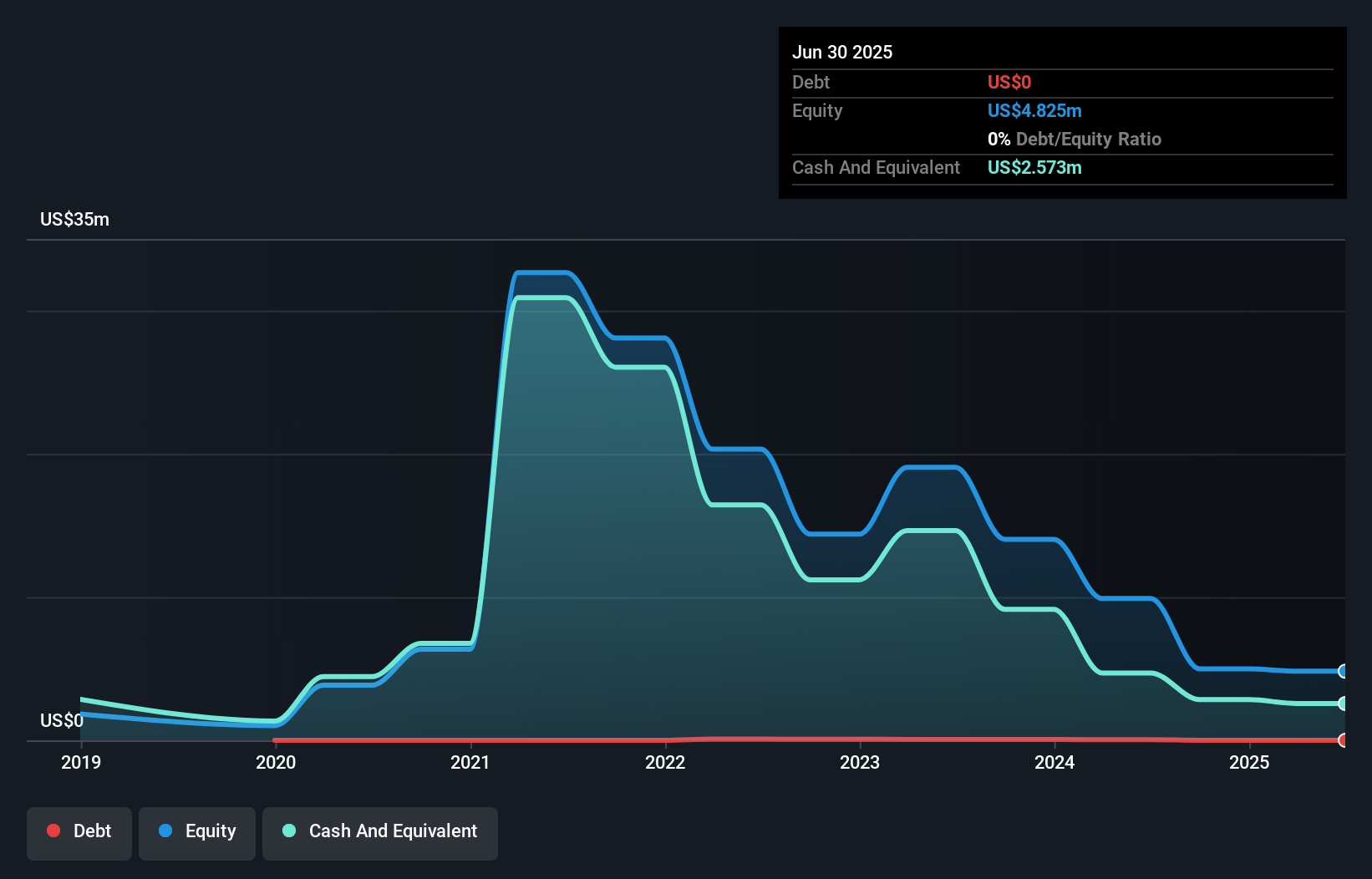

HomeBiogas Ltd, with a market cap of ₪28.54 million, embodies the volatility and financial challenges often seen in penny stocks. The company reported 2024 sales of US$2.63 million but remains unprofitable with a net loss of US$9.42 million. Despite experienced management and board members, HomeBiogas faces significant hurdles including less than a year of cash runway and high share price volatility at 13%. Auditor concerns regarding its ability to continue as a going concern further highlight its precarious position, although short-term assets do exceed both short- and long-term liabilities.

- Click to explore a detailed breakdown of our findings in HomeBiogas' financial health report.

- Assess HomeBiogas' previous results with our detailed historical performance reports.

Make It Happen

- Explore the 94 names from our Middle Eastern Penny Stocks screener here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Seramik Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGSER

Ege Seramik Sanayi ve Ticaret

Produces and sells floor and wall tiles worldwide.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026