Market Cool On Arad Investment & Industrial Development Ltd.'s (TLV:ARAD) Revenues Pushing Shares 83% Lower

Arad Investment & Industrial Development Ltd. (TLV:ARAD) shareholders that were waiting for something to happen have been dealt a blow with a 83% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

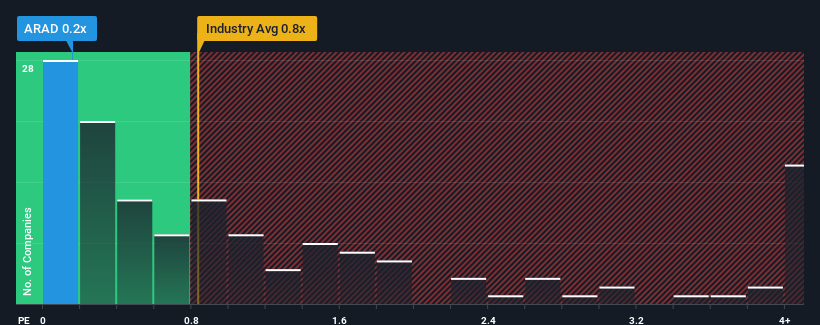

Following the heavy fall in price, it would be understandable if you think Arad Investment & Industrial Development is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Israel's Industrials industry have P/S ratios above 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Arad Investment & Industrial Development

What Does Arad Investment & Industrial Development's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Arad Investment & Industrial Development, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Arad Investment & Industrial Development will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Arad Investment & Industrial Development's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Arad Investment & Industrial Development?

The only time you'd be truly comfortable seeing a P/S as low as Arad Investment & Industrial Development's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.2%. Revenue has also lifted 30% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

When compared to the industry's one-year growth forecast of 4.3%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Arad Investment & Industrial Development's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Arad Investment & Industrial Development's P/S Mean For Investors?

Arad Investment & Industrial Development's recently weak share price has pulled its P/S back below other Industrials companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Arad Investment & Industrial Development revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Arad Investment & Industrial Development (at least 2 which shouldn't be ignored), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MLTH

Malam-Team Holdings

Provides computer services in the field of information technology in Israel.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026