Investors Met With Slowing Returns on Capital At Arad Investment & Industrial Development (TLV:ARAD)

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Arad Investment & Industrial Development (TLV:ARAD) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Arad Investment & Industrial Development, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.058 = ₪564m ÷ (₪11b - ₪1.6b) (Based on the trailing twelve months to September 2023).

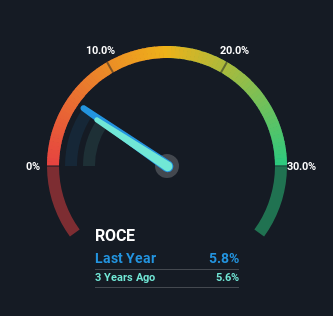

Thus, Arad Investment & Industrial Development has an ROCE of 5.8%. Even though it's in line with the industry average of 6.2%, it's still a low return by itself.

See our latest analysis for Arad Investment & Industrial Development

Historical performance is a great place to start when researching a stock so above you can see the gauge for Arad Investment & Industrial Development's ROCE against it's prior returns. If you're interested in investigating Arad Investment & Industrial Development's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Arad Investment & Industrial Development's ROCE Trending?

In terms of Arad Investment & Industrial Development's historical ROCE trend, it doesn't exactly demand attention. Over the past five years, ROCE has remained relatively flat at around 5.8% and the business has deployed 51% more capital into its operations. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

The Bottom Line On Arad Investment & Industrial Development's ROCE

In summary, Arad Investment & Industrial Development has simply been reinvesting capital and generating the same low rate of return as before. Yet to long term shareholders the stock has gifted them an incredible 180% return in the last five years, so the market appears to be rosy about its future. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

On a final note, we found 3 warning signs for Arad Investment & Industrial Development (1 makes us a bit uncomfortable) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MLTH

Malam-Team Holdings

Provides computer services in the field of information technology in Israel.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success