Bank Hapoalim (TASE:POLI) Valuation After Strong Earnings Growth and Major Buyback Announcement

Reviewed by Simply Wall St

Bank Hapoalim B.M. (TASE:POLI) just announced earnings showing marked growth in both net interest income and net income for the quarter. In addition, the bank unveiled a ILS 1,000 million share repurchase program.

See our latest analysis for Bank Hapoalim B.M.

After these upbeat earnings and buyback news, Bank Hapoalim B.M. has seen momentum build, with a 6.8% one-month share price return helping to boost its gains for the year. The stock’s 1-year total shareholder return now sits at a remarkable 69%, and its five-year total return is over 288%, a testament to sustained outperformance and renewed confidence as management continues to reward shareholders.

If a bank’s surge on strong results caught your attention, now’s the perfect moment to broaden your investing radar and discover fast growing stocks with high insider ownership

With shares climbing on strong financials and a major buyback, the key question now is whether Bank Hapoalim B.M. remains undervalued or if the market has already accounted for the bank’s continued growth potential.

Most Popular Narrative: 3.2% Undervalued

With Bank Hapoalim B.M's fair value in the most popular narrative sitting just above its last close price, the market appears to be pricing in stable growth but not the full upside. The recent earnings release and strong track record fuel optimism, setting the stage for a deeper look at the factors driving this fair value.

Robust investment in digital banking capabilities and cost discipline have driven a best-in-class cost-income ratio (33.8%) and positive operating leverage. This suggests operational efficiency gains will further enhance net margins over time.

Curious what lies beneath this valuation? The narrative leans on ambitious projections for profitability, efficiency, and the future earnings multiple. Want to see which bold numbers support this scenario? Dive in to discover the quantitative leaps and pivotal forecasts that drive the fair value above today's market price.

Result: Fair Value of ₪71.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued strong performance is not guaranteed, since one-off profit boosts and potential weakness in the mortgage market could challenge future growth.

Find out about the key risks to this Bank Hapoalim B.M narrative.

Another View: Market Ratios Paint a Different Picture

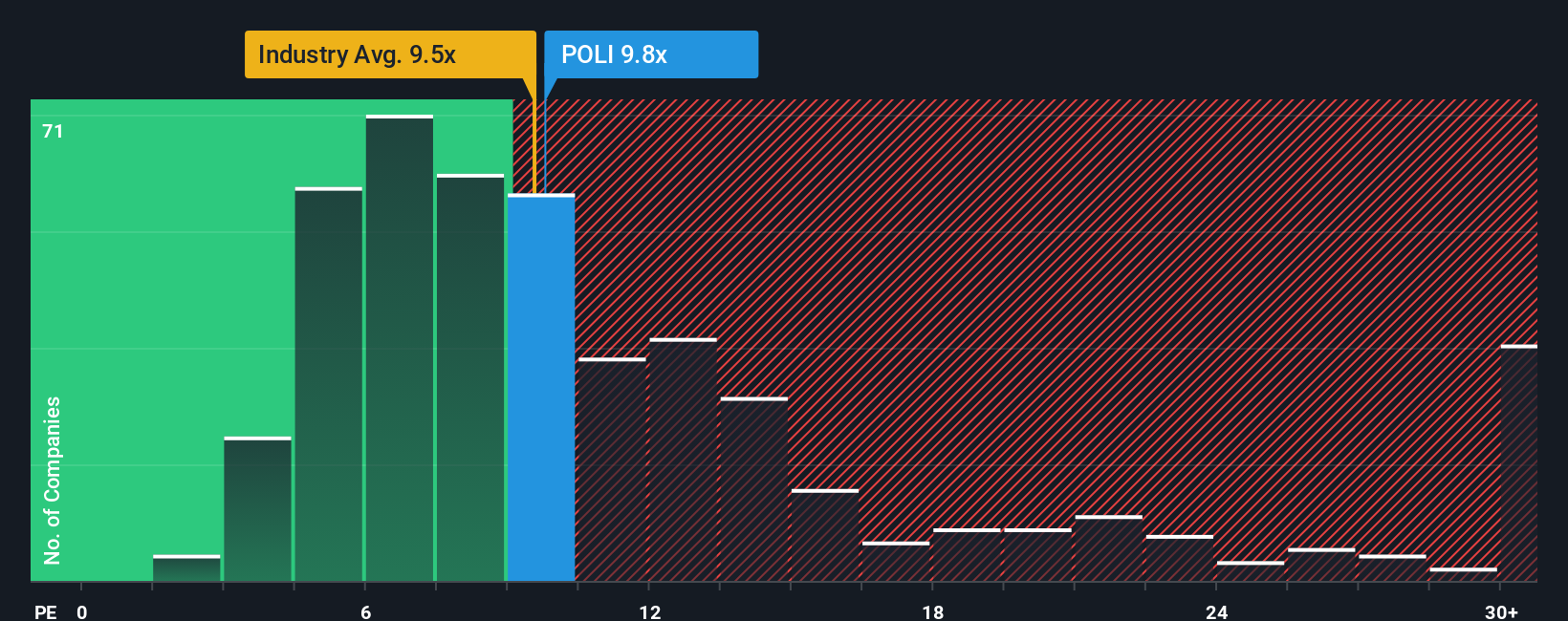

Taking a look at Bank Hapoalim B.M using earnings multiples, its price-to-earnings ratio of 9.8x sits below the Israeli market average of 15.2x, but is slightly above both the Asian Banks industry average (9.3x) and what our model suggests is a fair ratio (9.4x). This narrow gap means the current valuation leaves little room for error or disappointment, as investors may face risks if earnings growth slows or expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank Hapoalim B.M Narrative

Prefer your own approach or see things differently? Take a few minutes to explore the data and craft your own view. Do it your way

A great starting point for your Bank Hapoalim B.M research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your strategy and stay ahead of the crowd by checking out cutting-edge stocks you won’t want to overlook. Don’t miss these unique opportunities for your watchlist:

- Supercharge your portfolio with passive income and security by evaluating these 14 dividend stocks with yields > 3% offering yields above 3% for reliable cash flow.

- Catch the AI-driven surge and stay on the pulse by following these 26 AI penny stocks with transformative potential in automation, analytics, and next-generation tech.

- Capitalize on rapid innovation by reviewing these 26 quantum computing stocks, where breakthroughs are unlocking entirely new growth frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Hapoalim B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:POLI

Bank Hapoalim B.M

Provides various banking and financial services in Israel and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success