A Look at Mizrahi Tefahot Bank (TASE:MZTF) Valuation After Strong Q3 Earnings and Business Credit Growth

Reviewed by Simply Wall St

Mizrahi Tefahot Bank (TASE:MZTF) just released its third quarter results, announcing higher net income and a plan to distribute half of its quarterly profit. The bank also reported impressive business credit growth.

See our latest analysis for Mizrahi Tefahot Bank.

Mizrahi Tefahot Bank’s latest earnings beat is fueling market enthusiasm, with the stock notching a 41% year-to-date share price return and a stellar 48% total shareholder return over the past year. Momentum has been solid in recent months, reflecting confidence in the bank’s robust growth strategy and improving outlook.

If this kind of steady performance sparks your curiosity, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares reaching a new high on robust earnings and business growth, the key question is whether Mizrahi Tefahot Bank remains undervalued or if the market has fully priced in its future potential. Could there still be a buying opportunity?

Price-to-Earnings of 10.6x: Is it justified?

Mizrahi Tefahot Bank trades at a price-to-earnings ratio of 10.6x based on its last close of ₪225.4. This is slightly higher than both the peer average and industry benchmarks, raising the question of whether investors are paying a justified premium for its earnings power.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each shekel of the bank's earnings. For a major Israeli bank like Mizrahi Tefahot, it reflects sentiment about future profit growth, risk appetite, and the bank's competitive position within the sector.

Currently, the stock’s P/E is just under the Israeli market average of 15.9x, which could seem attractive at first glance. However, when compared to the Asian Banks industry average of 9.3x and Mizrahi Tefahot's close peer group at 10.2x, it appears somewhat elevated. This could indicate that the market is placing a modest premium on its growth trajectory or unique strengths, even though earnings have risen more slowly compared to the broader industry over the past year.

Given these figures, investors should consider whether Mizrahi Tefahot Bank's fundamentals support its higher-than-peer valuation or if there may be better relative value elsewhere.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.6x (OVERVALUED)

However, macroeconomic headwinds or a slowdown in revenue growth could challenge Mizrahi Tefahot Bank's ability to sustain its current valuation premium.

Find out about the key risks to this Mizrahi Tefahot Bank narrative.

Another View: Discounted Cash Flow Perspective

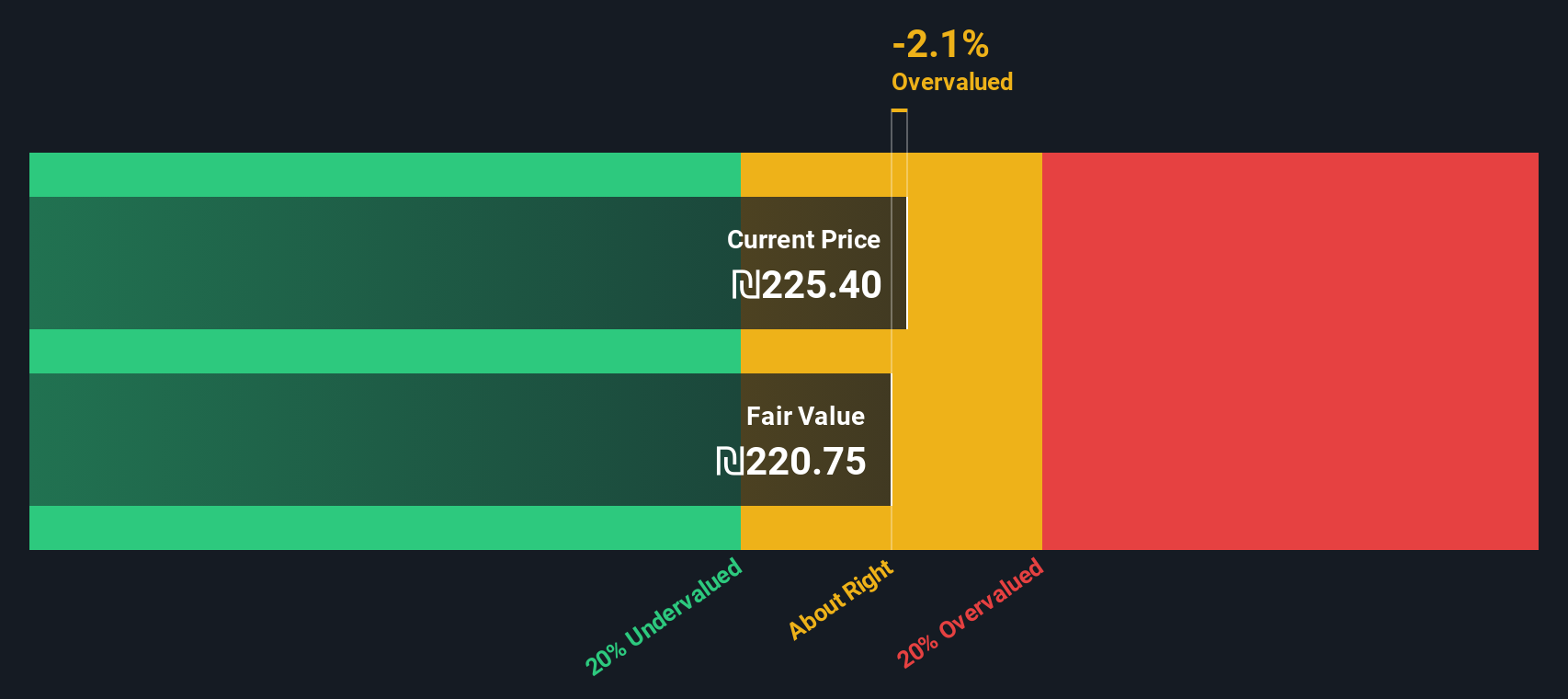

Switching gears from earnings multiples, the SWS DCF model offers a different angle. According to this approach, Mizrahi Tefahot Bank is currently trading above our estimated fair value of ₪220.75 per share. This suggests that, from a cash flow outlook, the stock may be slightly overvalued.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mizrahi Tefahot Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mizrahi Tefahot Bank Narrative

If you want a different perspective or wish to dig into the numbers yourself, you can craft your own take in just a few minutes, so why not Do it your way

A great starting point for your Mizrahi Tefahot Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity, and you shouldn’t either. Expand your watchlist with unique stocks that fit your goals and risk appetite using the powerful Simply Wall Street Screener.

- Turbocharge your search for high-potential opportunities by checking out these 3595 penny stocks with strong financials, which are poised for breakout performance and untapped growth.

- Boost your portfolio’s resilience by tapping into regular income streams with these 16 dividend stocks with yields > 3%, highlighting companies offering attractive dividend yields above 3%.

- Ride the wave of innovation and find tomorrow's leaders among these 25 AI penny stocks, featuring companies pushing boundaries with artificial intelligence and next-generation technology solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives