Bank Leumi (TASE:LUMI) Valuation in Focus After First-Mover Market Maker Appointment

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 9.2x: Is it justified?

Bank Leumi le-Israel B.M is currently valued at a price-to-earnings ratio of 9.2x, which suggests the stock is trading at a slight discount compared to both the Asian Banks industry average of 9.5x and its peer average of 9.3x. This positions the stock as a relatively attractive value proposition based on earnings compared to comparable institutions.

The price-to-earnings (P/E) ratio is a widely used metric that compares a company's share price to its per-share earnings. For banks, the P/E ratio is particularly important because it reflects investor expectations around profitability and growth while allowing for direct comparisons across the industry.

The fact that Bank Leumi is priced below both industry and peer averages may indicate that the market is not fully recognizing the company’s recent profit growth and improving financials. This could imply a potential opportunity for investors seeking value within the banking sector.

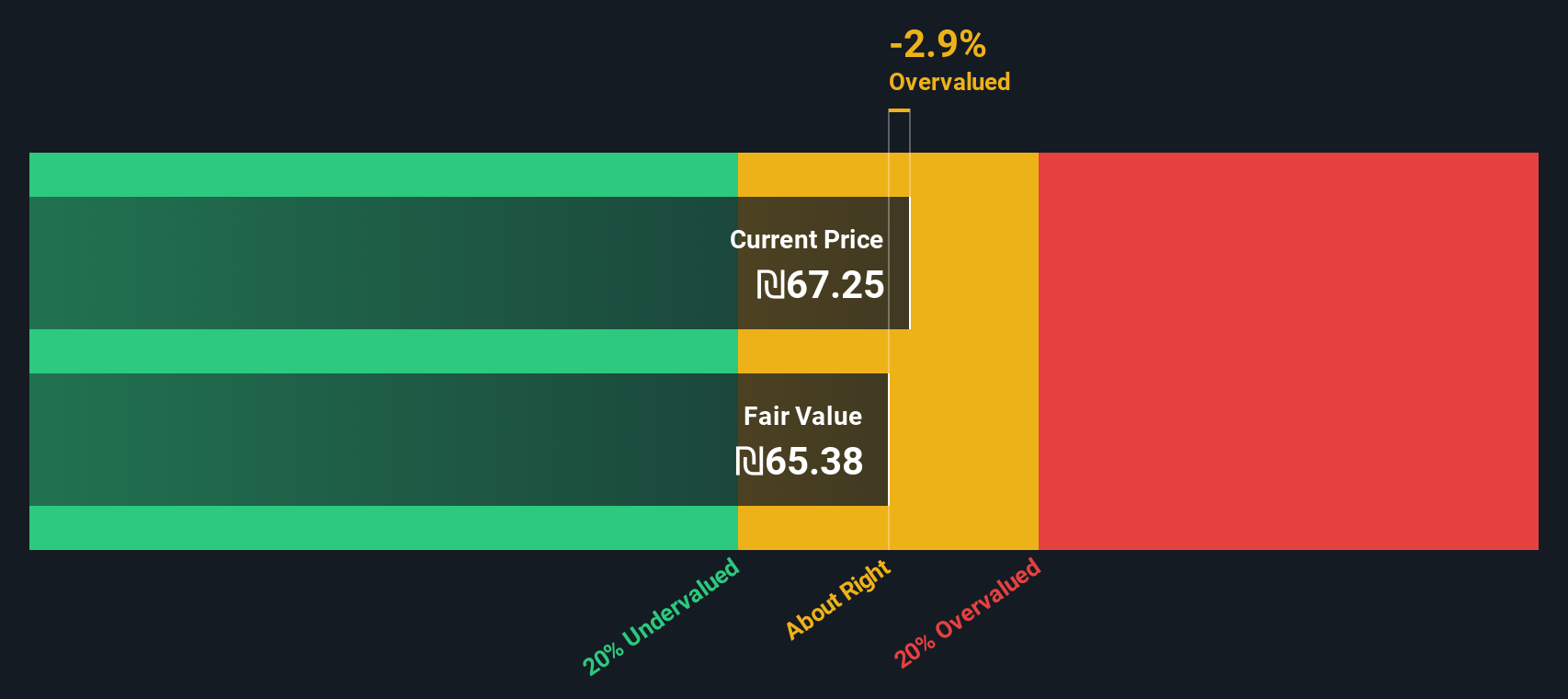

Result: Fair Value of ₪62.77 (UNDERVALUED)

See our latest analysis for Bank Leumi le-Israel B.M.However, a recent pullback and possible shifts in investor sentiment could challenge further upside, particularly if earnings or sector expectations disappoint.

Find out about the key risks to this Bank Leumi le-Israel B.M narrative.Another View: A DCF Model Angle

Looking through the lens of our SWS DCF model, a different perspective on Bank Leumi le-Israel B.M's valuation emerges. This approach once again signals the stock may be undervalued, but can both signals be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bank Leumi le-Israel B.M Narrative

Ultimately, if you have a different view or want to dig deeper into the numbers, you can analyze the data and build your own narrative in just a few minutes. Do it your way

A great starting point for your Bank Leumi le-Israel B.M research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to uncover fresh opportunities beyond Bank Leumi le-Israel B.M. The market is brimming with stocks you could be missing by not taking a closer look at what’s out there.

- Tap into high-potential companies transforming healthcare with advanced machine learning by using our healthcare AI stocks.

- Seek out income-generating opportunities from established businesses offering robust yields via the dividend stocks with yields > 3%.

- Catch the next wave of gains by targeting shares trading below their true value with the help of the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Leumi le-Israel B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LUMI

Bank Leumi le-Israel B.M

Provides banking and financial services for households, small and medium enterprises, and corporations in Israel, the United Kingdom, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives