- Turkey

- /

- Residential REITs

- /

- IBSE:SNGYO

Discovering Undiscovered Gems in the Middle East for November 2025

Reviewed by Simply Wall St

In recent months, most Gulf markets have eased due to weak oil prices and lackluster earnings, reflecting a cautious sentiment among investors. Despite these challenges, the Middle East remains a region ripe with potential for uncovering lesser-known stocks that could offer unique opportunities in the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 21.47% | 16.40% | 50.84% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.57% | -36.80% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gulf Pharmaceutical Industries P.S.C., also known as Julphar, is engaged in the manufacturing and sale of pharmaceutical, cosmetic, and medical compounds across the UAE, GCC countries, and internationally, with a market capitalization of AED1.39 billion.

Operations: Julphar generates revenue primarily from its manufacturing segment, which reported AED640.80 million. The company's financials indicate a segment adjustment of AED1.03 billion, impacting overall revenue figures.

Gulf Pharmaceutical Industries, known as Julphar, has shown a promising turnaround with its recent profitability. The company's net debt to equity ratio stands at a satisfactory 2.1%, reflecting improved financial health over the past five years from 128.5% to 39.9%. Despite interest payments not being well covered by EBIT at 2.1 times, Julphar's high-quality earnings and positive free cash flow signal robust operations. Recent inclusion in the S&P Global BMI Index highlights its growing market presence, with sales reaching AED 348 million in Q2 and net income of AED 17 million compared to a previous loss of AED 3.3 million.

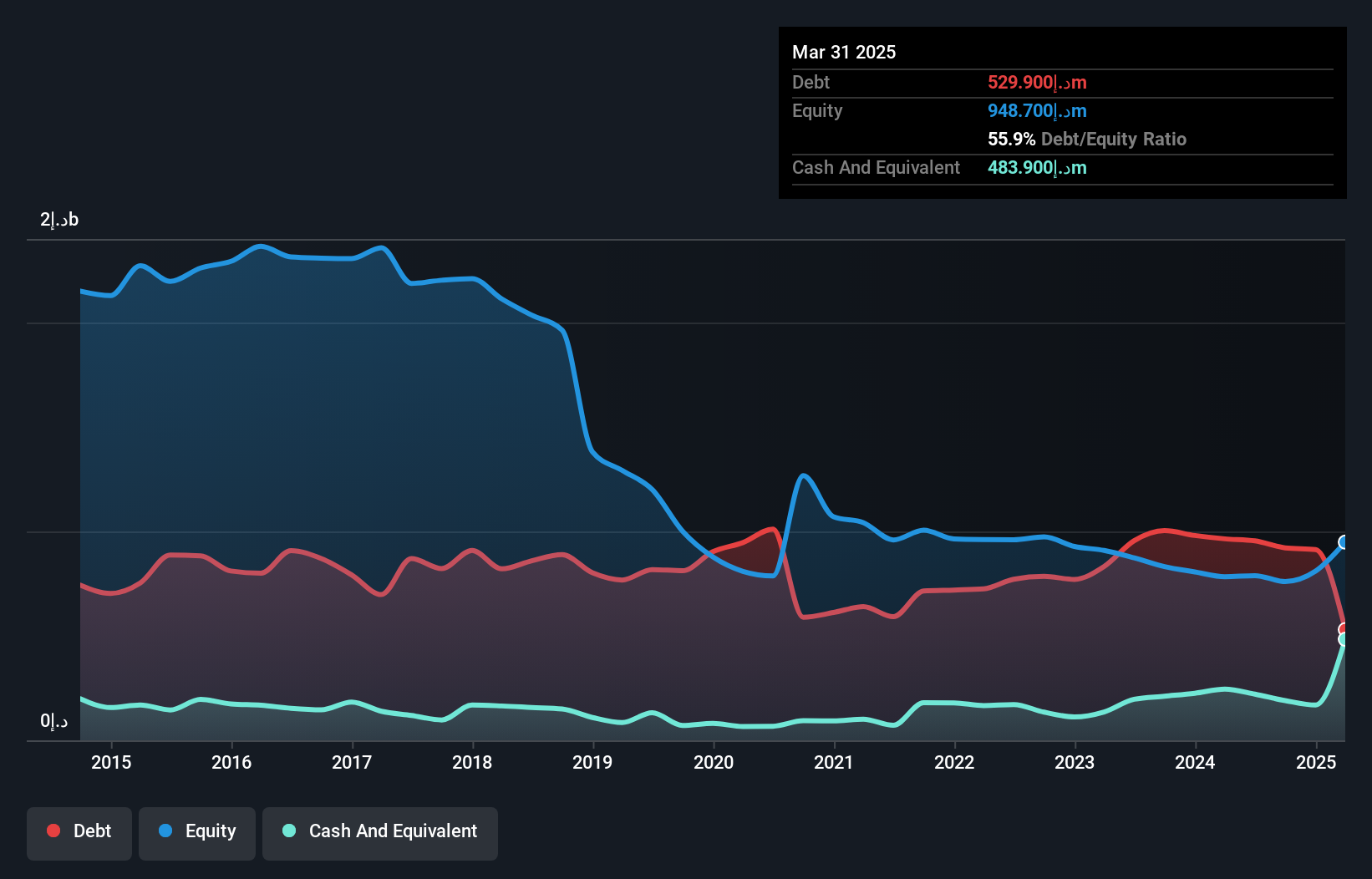

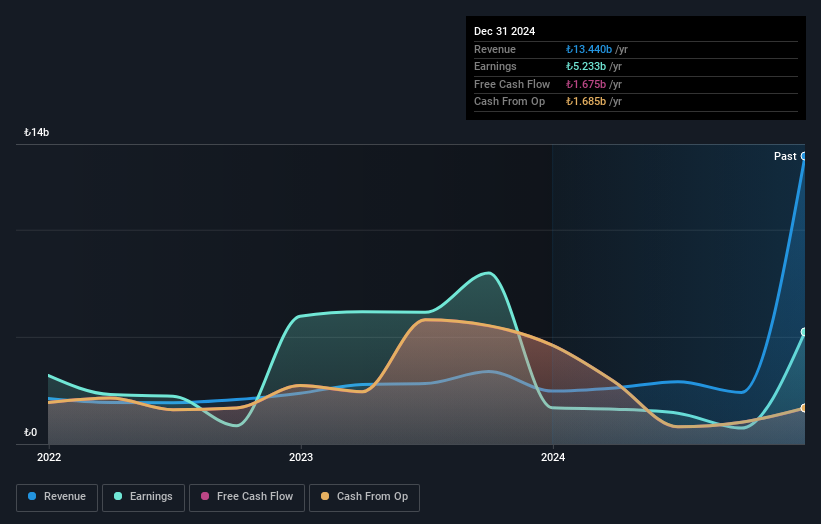

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi A.S., a Turkish real estate investment trust established in 2006, focuses on residential real estate developments and has a market cap of TRY19.56 billion.

Operations: SNGYO generates revenue primarily from residential real estate developments, amounting to TRY13.33 billion. The company's financial performance can be evaluated by examining its net profit margin, which provides insight into profitability relative to total revenue.

Sinpas Gayrimenkul Yatirim Ortakligi, a dynamic player in the real estate sector, has shown impressive earnings growth of 140.9% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 12.9%, reflecting prudent financial management as it significantly reduced from 3622.5% over five years. Despite reporting a TRY13.4 million net loss for Q3 2025, its nine-month performance shows resilience with TRY860 million in net income compared to TRY840 million previously. A notable one-off gain of TRY5.3 billion has skewed recent results, yet Sinpas remains free cash flow positive and offers an attractive P/E ratio of 3.8x against the Turkish market average of 20.5x.

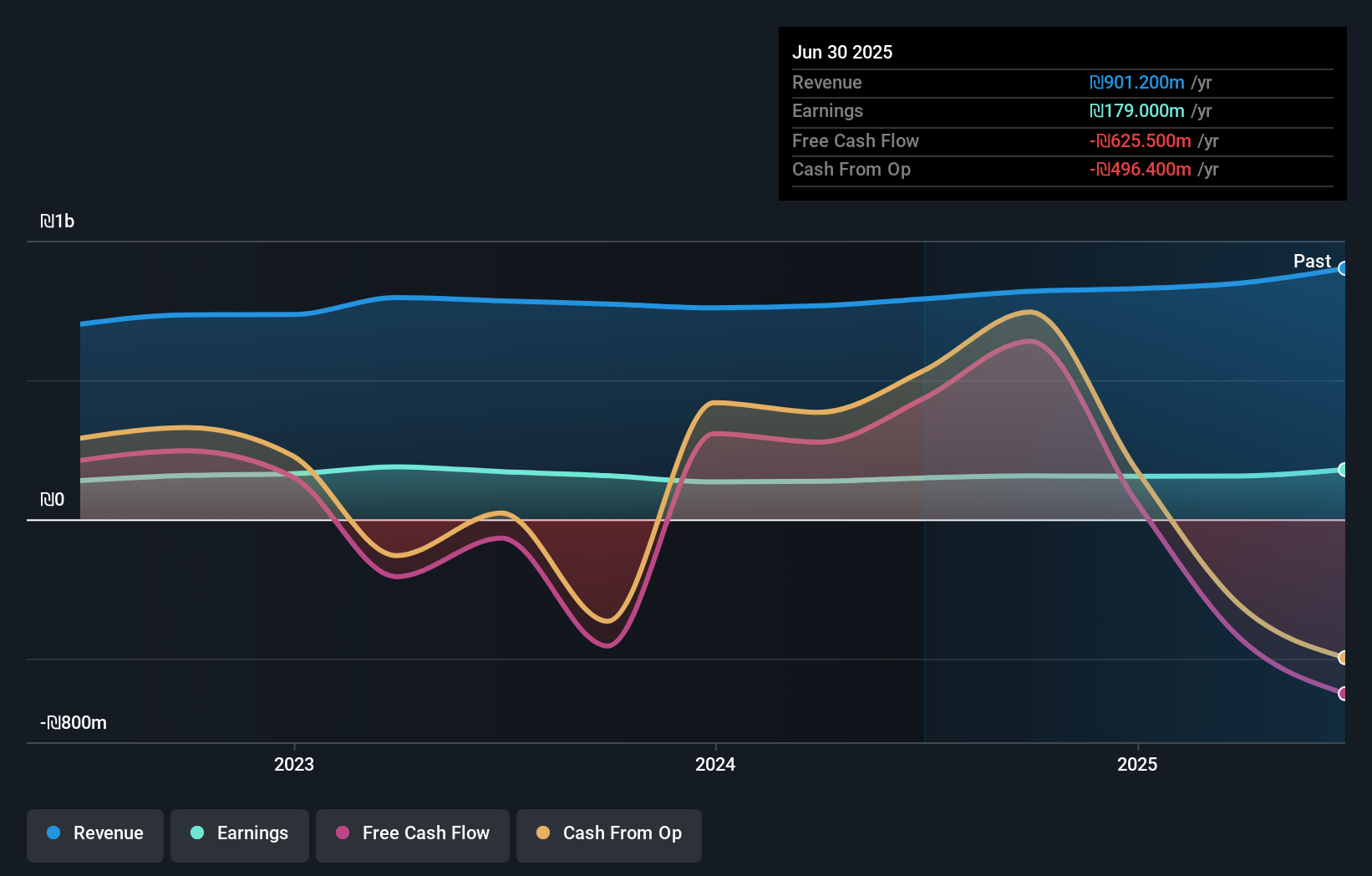

Bank of Jerusalem (TASE:JBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank of Jerusalem Ltd. is a commercial bank operating in Israel, with a market capitalization of ₪1.60 billion.

Operations: The bank generates revenue primarily through housing loans (₪212 million) and household-related services (₪261.8 million), supplemented by private banking (₪26.9 million) and services to institutional investors (₪6.7 million).

With total assets of ₪21.9 billion and equity at ₪1.6 billion, Bank of Jerusalem stands out with a robust financial base. Total deposits are at ₪17.3 billion, while loans reach ₪15.8 billion, indicating a solid loan-to-deposit ratio that suggests efficient capital utilization. The bank's earnings growth over the past year hit 20.2%, surpassing the industry average of 12.6%, reflecting its competitive edge in the market. Primarily funded through low-risk customer deposits, which make up 85% of liabilities, it seems to offer stability in funding sources amidst uncertain economic conditions in the region.

Key Takeaways

- Access the full spectrum of 207 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SNGYO

Sinpas Gayrimenkul Yatirim Ortakligi

Sinpas Gayrimenkul Yatirim Ortakligi A.S., formerly Sinpas Insaat, is a Turkish real estate investment trust (REIT) established in 2006 and transformed into a REIT in 2007.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives