- Israel

- /

- Auto Components

- /

- TASE:SHNP

E. Schnapp & Co. Works Ltd (TLV:SHNP) Soars 30% But It's A Story Of Risk Vs Reward

E. Schnapp & Co. Works Ltd (TLV:SHNP) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

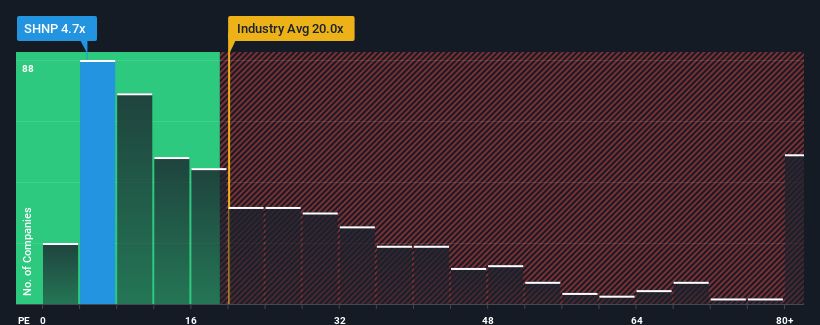

In spite of the firm bounce in price, given about half the companies in Israel have price-to-earnings ratios (or "P/E's") above 11x, you may still consider E. Schnapp Works as a highly attractive investment with its 4.7x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

E. Schnapp Works certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for E. Schnapp Works

How Is E. Schnapp Works' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as E. Schnapp Works' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 156%. The strong recent performance means it was also able to grow EPS by 81% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that E. Schnapp Works' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From E. Schnapp Works' P/E?

Even after such a strong price move, E. Schnapp Works' P/E still trails the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that E. Schnapp Works currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for E. Schnapp Works you should be aware of.

Of course, you might also be able to find a better stock than E. Schnapp Works. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if E. Schnapp Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SHNP

E. Schnapp Works

Manufactures and sells batteries for vehicles in Israel and internationally.

Flawless balance sheet with moderate risk and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion