- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

Uniphar plc's (ISE:UPR) 25% Jump Shows Its Popularity With Investors

Uniphar plc (ISE:UPR) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

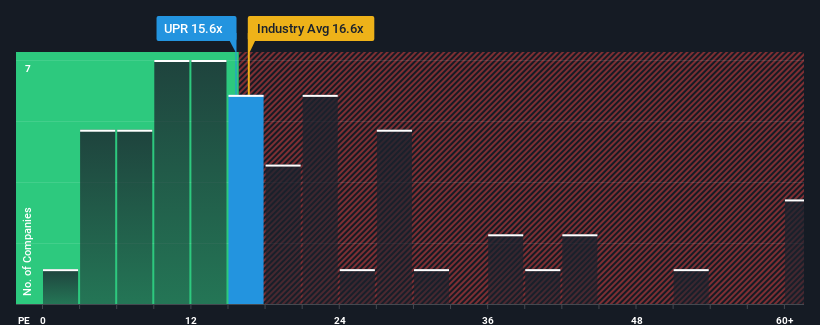

Following the firm bounce in price, Uniphar may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.6x, since almost half of all companies in Ireland have P/E ratios under 10x and even P/E's lower than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

While the market has experienced earnings growth lately, Uniphar's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Uniphar

How Is Uniphar's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Uniphar's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.9%. Even so, admirably EPS has lifted 67% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 6.0% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Uniphar is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Uniphar's P/E?

Uniphar shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Uniphar's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Uniphar (1 is concerning) you should be aware of.

If these risks are making you reconsider your opinion on Uniphar, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, the Netherlands, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives