Is Now The Time To Put Kingspan Group (ISE:KRX) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kingspan Group (ISE:KRX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kingspan Group with the means to add long-term value to shareholders.

How Fast Is Kingspan Group Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. Kingspan Group has grown its trailing twelve month EPS from €3.43 to €3.73, in the last year. That amounts to a small improvement of 8.9%.

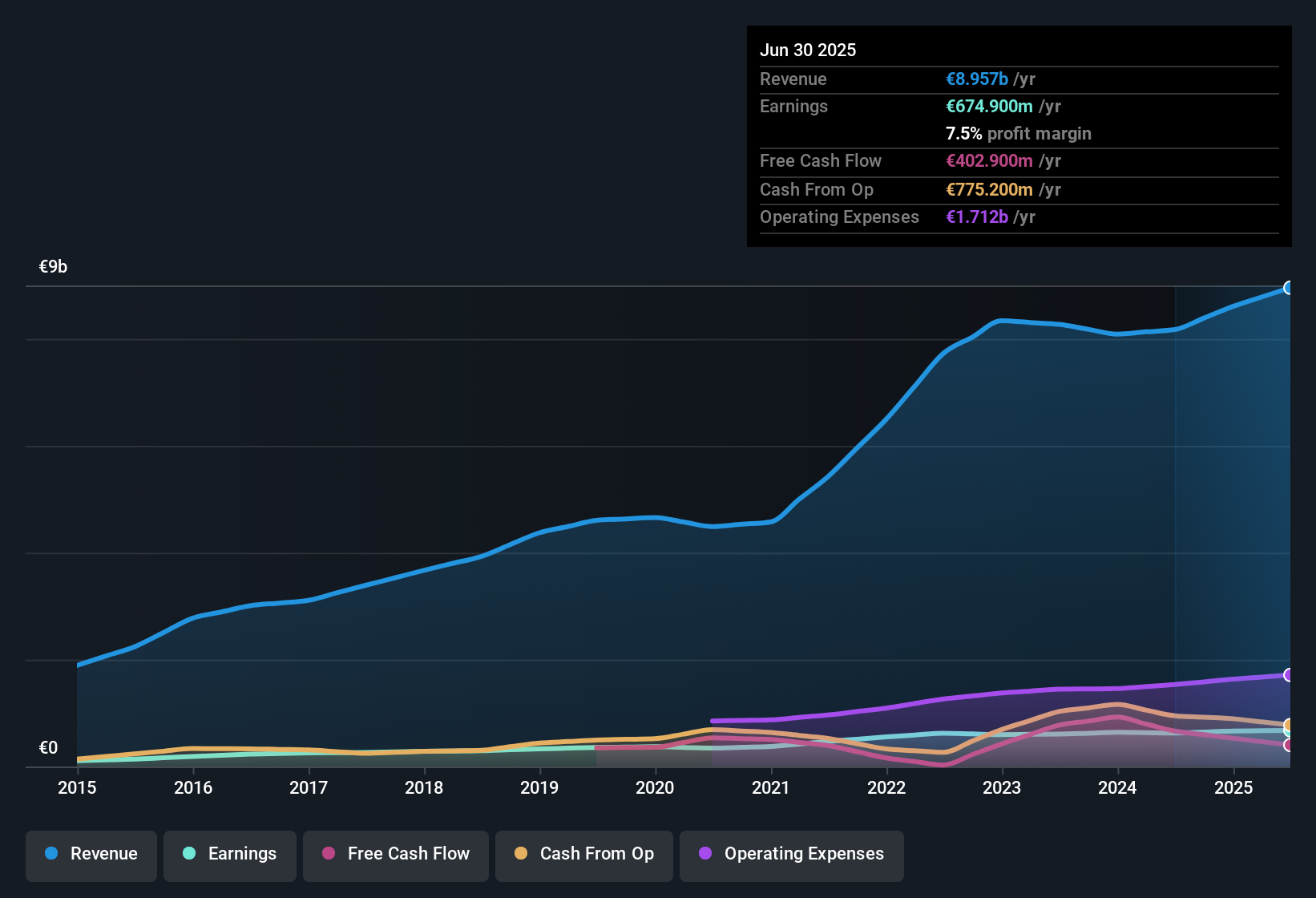

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Kingspan Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.6% to €9.0b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Kingspan Group

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Kingspan Group?

Are Kingspan Group Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations over €6.9b, like Kingspan Group, the median CEO pay is around €4.1m.

Kingspan Group's CEO took home a total compensation package worth €2.5m in the year leading up to December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Kingspan Group Worth Keeping An Eye On?

One important encouraging feature of Kingspan Group is that it is growing profits. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So based on its merits, the stock deserves further research, if not an addition to your watchlist. You still need to take note of risks, for example - Kingspan Group has 2 warning signs we think you should be aware of.

Although Kingspan Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Irish companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kingspan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:KRX

Kingspan Group

Provides insulation and building envelope solutions in Western and Southern Europe, Central and Northern Europe, the Americas, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives