Valuing Bank of Ireland (ISE:BIRG) After Leadership Change in SME and Corporate Banking

Reviewed by Simply Wall St

If you’re tracking Bank of Ireland Group (ISE:BIRG), the recent announcement might have caught your eye. The company has brought June Butler, former CEO of the Strategic Banking Corporation of Ireland, on board as the new Head of Corporate and SME Banking. With her track record of innovative funding solutions for Irish SMEs and a strong leadership background, her appointment could be seen as a serious step to sharpen Bank of Ireland Group’s competitive edge within the corporate and SME banking space.

This move comes after a year where Bank of Ireland Group has posted solid momentum, with the stock up 41% over the past year and making substantial gains since January. Short-term swings have been mixed, but the broader trend shows significant progress compared to industry peers. Coupled with annual growth in both revenue and net income, these developments set the stage for management to capitalize on improving fundamentals and may justify the stock’s recent run.

With this leadership shakeup and a strong upward trend in place, the big question remains: Is Bank of Ireland Group offering investors a genuine buying opportunity right now, or is the market already baking in future growth potential?

Most Popular Narrative: 4.8% Undervalued

According to the most widely followed narrative, Bank of Ireland Group is seen as slightly undervalued, with analysts projecting a modest upside based on strong recent trends and operational improvements.

Continued investment in digital innovations and a new customer lending platform for small businesses and agricultural customers are expected to enhance revenue and customer satisfaction. This may also reduce operational costs and support higher net margins.

Curious about the financial engine powering this view? There is a bold prediction here as analysts are incorporating ambitious margin expansion and operational improvements to justify the premium. Want to discover exactly which future business levers and profit drivers they believe will push this valuation into the “undervalued” camp? Dive into the full narrative to uncover the numbers and assumptions shaping this outlook.

Result: Fair Value of €13.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing uncertainty in the Irish economy or industry competition could challenge the upbeat outlook and put Bank of Ireland’s growth story to the test.

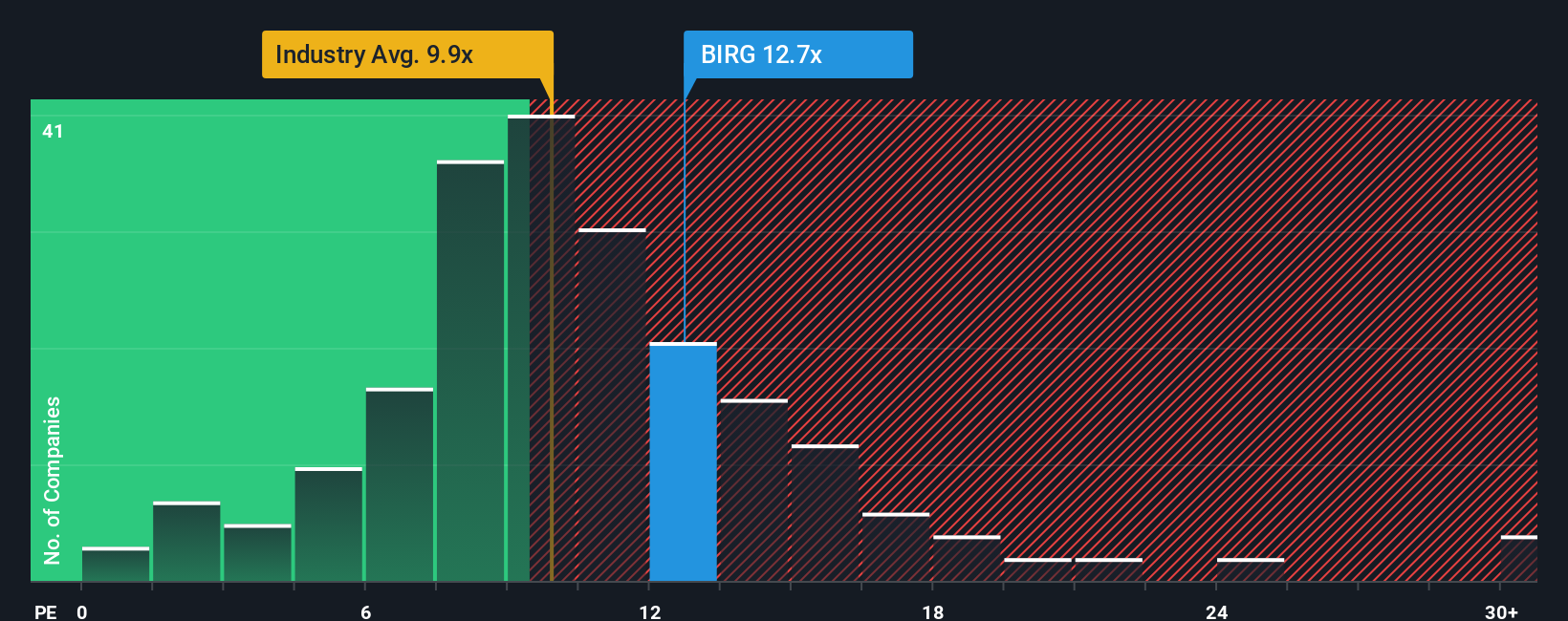

Find out about the key risks to this Bank of Ireland Group narrative.Another View: What Do Market Multiples Say?

While one approach suggests Bank of Ireland Group is modestly undervalued, a look at the current price-to-earnings ratio compared to the industry average tells a different story. This comparison hints that the shares may actually be priced at a premium. Which lens gives the truer picture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Bank of Ireland Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Bank of Ireland Group Narrative

If you’d like to challenge these views or dig deeper on your own, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Bank of Ireland Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait on the sidelines while others uncover tomorrow’s winning stocks. Use these curated ideas to spot fresh opportunities and gain an edge with your next move.

- Boost your search for income and long-term growth by tapping into stocks offering attractive yields using dividend stocks with yields > 3%.

- Ride the wave of advanced medicine and technology by exploring cutting-edge innovators in health with healthcare AI stocks.

- Jump into the front lines of artificial intelligence breakthroughs and discover standout companies shaping the future with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Ireland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:BIRG

Bank of Ireland Group

Provides banking and other financial services in the Republic of Ireland, the United Kingdom, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives